Why are you so scared and worried about the budget deficit?

How many trillions of budget deficit can the government sustain? An infinite number of trillions if we speak about the USA government and the dollar. However, not without consequences, but let’s go by order and understand how to take advantage of the new paradigm we are living under.

If the government spends $100 into the economy, and it taxes $30, then the remaining 70 dollars are on someone else’s book and pocket. The deficit is always good for someone, that is for the people that did not have money, and it’s, on the other side, terrible for the savers in that currency.

A great investor in today’s paradigm is someone that finds an opportunity to short the dollar. Your real job today as an active investor is to follow the Fed wind, check where it goes, and take advantage of their policy. How you do that? You short the dollar. You find all possible ways to trade a fiat currency with asset or medium of exchange that would produce future cash flow or will be recognized as a better store of wealth.

Businesses producing future cash flow most likely means that inflation will be dealt with. In 20 years, the new iPhone would, for sure, cost more numerically speaking that the one today. Businesses are a way to short the dollar because their cash flow will adjust for inflation. Gold, from the other end, is just perceived as a better store of value than the worthless dollars, but gold will not produce cash flow.

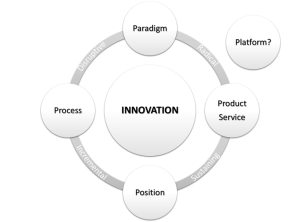

What did we say above? The deficit for the government is just money in someone else’s pocket. So, why don’t you take advantage of that extra money in the economy? It will go somewhere, and they will be spending so to produce more cash flow, increase sales, and promote innovation.

Investors fail to understand the nature of the deficit budget, its consequences on the economy, and how to take advantage of it regarding your asset allocation. MMT clarify that, in a simple sentence, “USA Government does not have financial constrain, it can print as much as it wants, and should just replace its artificial constrains, with a real constrain which is inflation.”

Can printing go too far?

Absolutely, to the point of creating real inflation, but the Fed “should not monitor the inflation.” At least according to their expectation inflation model (that frankly is not even a proper model), but through a full-employment policy. To be fair to the MMT people, the Fed does not have an appropriate model of working of inflation, and fiscal policy could monitor inflation by draining money supply with taxes or setting a new system in place to avoid bubbles in particular sectors.

Even if the government “disagrees” with the MMT policy or ideas, the Fed agenda and the government fiscal stimulus are effectively following them. What else could they do? I don’t disagree with that. I don’t blame the Fed, I just follow the wind and short the fiat currency in the smartest way possible. I invest by keeping in mind that my first objective is shorting the dollar. The consequences of money printing will be two, weaker dollars and money flying in the pocket of the smarter and younger, who will spend in technology and luxury products.

Investing in companies providing such services will guarantee that the future cash flow will be considering inflation. Let’s look at diversification and the world economy. Where geographically allocate my wealth? While USD is a reserve currency, the USA can manage to print trillions to crate stimulus, and eventually later manage the inflation efficiently. That is not possible for other countries in emerging markets and particularly South America.

Hyperinflation based on inflation expectation, contrary to the USA, is highly possible in South America. Most countries there tend to fight economic depression with money printing. Those are hard spots that I would consider shorting at any chance I have. Because, unless they don’t find political leadership able to guide through the crisis, they will be in trouble for many many years.

If you, as a country, have debt in a foreign currency and do not have the means to produce and sell products that attract dollars, you will be in serious trouble.

Investment thesis

My investment thesis for the next years is:

- Invest in USA equity, in particular, tech companies.

- Take debt in USD and Euro to finance businesses and Real estate. Fiat currency will be cheaper and will create, with time, a significant spread between its cash flow that will adapt to inflation. Its intrinsic value will be lower every year.

- Not hold bonds in my portfolio. Those will not be a hedge anymore versus my equity. I would only own junk bonds that I genuinely believe will not face bankruptcy and will be recovering.

- Have a small amount of crypto and very little gold.

If you would like to go deeper into this and have a broader view, I recommend one of my last articles called “What does Bear not understand about the market’s current situation?”

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.