Value Investing Analysis: Park Hotels & Resorts (PK)

Value Investing Analysis: Park Hotels & Resorts (PK)

Many of my friends, employees, and followers ask me how I analyze companies before investing. My answer is usually “that depends on my investment approach for that particular asset”. Park Hotels & Resorts (PK) has been one of my last moves in value investing, so I would like to share with you, in a simplified way, how I analyzed this particular stock at this particular time.

Park Hotels & Resorts is a USA Hotel REIT that initially was a spin-off of Hilton (HLT). Most of its real estate assets are in a public REIT whose portfolio consists of 60 premium-branded hotels and resorts, all currently located in the USA. Their mission is “to be the preeminent lodging REIT, focused on consistently delivering superior, risk-adjusted returns for stockholders through active asset management and a thoughtful external growth strategy while maintaining a strong and flexible balance sheet.”

PK, being among the top 30 in the USA, is a large REIT. It currently has 60 Branded Hotels with 33k+ rooms. A significant acquisition was made in 2019: PK purchased Chesapeake Lodging Trust for $2.5B, diversifying its assets locations and expanding its exposure to Marriot and Hyatt brands. Management has been able to dispose of and acquire Hotels effectively.

Since the spin-off, PK’s management has disposed of 24 hotels and acquired another 18 changing the hotel adjusted EBITDA from $97M to $181M. In 2018 13 hotels were sold for $519M, 10 of them belonged to its international division. In 2019 other 8 hotels were sold for $497M, and they acquired Chesapeake. Finally, in 2020 they sold their last two foreign hotels for $208M getting out of the international market.

Pk's Portfolio

Its geographical distribution is impressive, from the San Francisco Union square to the Hilton New York midtown. More than 85% of PK’s properties are in the luxury or upper-upscale segment.

Insights analysis

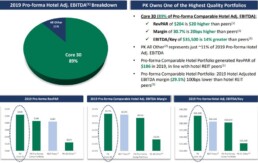

As a Hotel owner and investor, the first thing that pops to my eyes is that almost 90% of PK EBITDA comes from its core 30 Hotels. More importantly, its REVPAR is 20% higher than its peers at $204. EBIDTA/key is roughly $35,500 (pre-COVID19), which was 14% higher when compared to its peers.

REVPAR is the hotel industry metric that indicates the revenue per available room. Higher revenue per room would mean, in the Hotel industry, that there is a moat or client captivity due to the location of the hotels or/and superior management.

As a value investor, I always try to proceed with a proper value investment analysis, Santos/Greenwald’s style. In essence, I would calculate the Asset Value with appropriate adjustment for depreciation, the Earnings Power Value with proper adjustment to the income statement for sustainable earnings, and then compare them.

Once I have found superior management and EV higher than AV, only at that point, I would assess the entry barriers and calculate the franchisee value. However, I don’t want to annoy you with my classical valuation methodology because, in this case, being a REIT, I would value it as an asset play and use different reasoning, mostly objectively focused.

Investment Thesis

My investment thesis is that we are buying superior-location and well-managed big-brand hotels strategically distributed all over the USA for the price to tangible book of around 0.41x.

Price to Tangible Book is a metric that could be useless in some sectors. However, I consider it particularly useful in real estate. This company has been affected dramatically by the COVID19 pandemic, as several PK hotels have been temporarily closed. Nevertheless, my line of argument is that PK strong Balance Sheet and liquidity make PK a winning bet for a quick recovery when the fear of the disease disappears, and the occupancy rate gets back to pre COVID19 levels.

About cash-burning, the management has estimated 73 million, of which 23 million are for corporate expenditures and the remaining 50 million for hotel operating expenses.

Let me give you a quick look at the most recent Balance Sheet

The balance sheet does not hold any Goodwill because it has already been impaired. Also, from the liquidity side, we have some extra good news because all the covenant has been amended.

Amended covenants overview

Exercise of Extension Options:

- revolver maturity extended to December 2021.

- Covenant Waiver.

- Suspend compliance with all existing financial covenants tested through and including 3/31/21.

- Pledge equity in certain subsidiaries to secure the facilities (eight high-quality hotels— a mix of urban, resort, and suburban).

- Adjust levels of particular financial covenants after such a period.

- Minimum liquidity covenant of $200M.

These and other amendments have been set in place to reduce the impact of the current pandemic impact.

PK has Hotel properties for $9,627M (again without Goodwill, which has all been impaired). Its cash position is $1,304M, and total debt would be around $5,095M without considering leasing.

Equity valuation

My valuation delivers an equity value of $3,8bn vs a market cap at the moment of writing of around $2,1bn. (235m shares net of treasures for the price of almost $9).

Normalized earnings

The first consideration is that PK has a REIT status. In the Risk session, we will obviously cover this part. However, the REIT status allows it not to pay any tax. To be more precise, the company has to pay them, but it will be entitled to a refund. Indeed, in the normalized earning analysis, we will take the 2017 and notice that there was a refund for $2,346M.

In order to calculate the sustainable earnings, I have taken the average revenue of $2,704M for the past 20 quarters and calculated the average margin profit of 14.90% for an earning of 403M. The average margin profit is calculated on five years average to adjust for the business cycle.

I have assumed the necessary SGA costs I would incur if I would have to run the hotel and sustain the current earnings. However, I thought that in this case a 25% could be considered as part to grow the business, so I have adjusted the earnings adding back 25% of the average SGA expenses.

Therefore, 25% of SGA costs would be $16.45M. Hence $403M plus $16.45M would be equal to $419.5M that, adding the excessive depreciation I have estimated as being $284M would be $703.5M in total.

In a “typical” non RIET company, I would have subtracted taxes from both earnings and excessive depreciation. However, since we are in a REIT model and we are assuming PK will keep the REIT status, I am not doing so.

PK is now trading at three times normalized earnings. If we consider the interest around $205M, then its TEV/EBIT is equal to $5,906M/$908.5M =6.5 times. The FFO average pre-COVID19 has always been around to $550M.

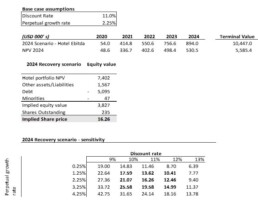

Discounted Cash Flow Analysis

I usually don’t use discount cash flow analysis for value investing strategy. Still, being the current circumstances different, as I described above, I thought that this approach would be useful to have another perspective on PK’s asset value once cash flow is normalized.

I have worked a discounted cash flow analysis considering a minimum perpetual growth and a recovery scenario in 2024.

I’ve assumed a gradual recovery in EBITDA to reach pre-COVID levels in 2024. My underlying assumptions in the DCF model are 11% discount WACC (which looks very conservative as current debt represents around 60% of total sources factoring equity at market value) and 2,25% perpetual growth rate.

Under these assumptions, my conservative target price could be in the region of $16.5 per share leaving above 60% potential upside at current prices. I’ve also made a quick sensitivity to check to which extent the equity value is sensitive to WACC and perpetual growth rate.

To justify the current price, you should either assume inflation minus perpetual growth rate or two digits WACC. Both are not reasonable considering the nature of the business and PK capital structure.

Catalyst

It isn’t necessary to dig deeper into more metrics to explain the value of such assets in the case that COVID19 fades away, and earnings eventually get back to normal. If we take a look from the other side to the pre-COVID19 profit and loss, we will understand the potential of the revenue generation outside the pandemic environment.

I am confident that due to the strength of the Balance Sheet and the available liquidity for over 24 months, that PK is a great card to play. A COVID Vaccine and consequentially a return to traveling will significantly increase the PK valuation rapidly

Risks

Risks are directly connected to the extended COVID situation. The time frame that takes to return to sustainable earnings is what instantly impacts the valuation. I believe that in case of need, the strong balance sheet and the low leverage scenario would allow the company to pull another 1 Billion credit line easily.

Another possible Risk is if the company loses its REIT status, this itself due to tax saving can be worth $6 – $7 per share.

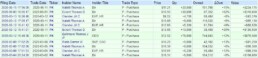

Insiders

It’s useful to add that in recent months, insiders have been purchasing shares at a price on average much higher than today’s price.

I would like to repeat the disclaimer that this is not financial advice. This article is just an analysis of a company that I decided to share because it is an example of how the current situation has affected the stock market and how I analyze firms under a Value Investing approach. You can read my article about “Investing under the new paradigm” if you would like to have a more holistic idea of my investing perspective during and after COVID-19.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Investing under the new paradigm

Investing under the new paradigm

Why are you so scared and worried about the budget deficit?

How many trillions of budget deficit can the government sustain? An infinite number of trillions if we speak about the USA government and the dollar. However, not without consequences, but let’s go by order and understand how to take advantage of the new paradigm we are living under.

If the government spends $100 into the economy, and it taxes $30, then the remaining 70 dollars are on someone else’s book and pocket. The deficit is always good for someone, that is for the people that did not have money, and it’s, on the other side, terrible for the savers in that currency.

A great investor in today’s paradigm is someone that finds an opportunity to short the dollar. Your real job today as an active investor is to follow the Fed wind, check where it goes, and take advantage of their policy. How you do that? You short the dollar. You find all possible ways to trade a fiat currency with asset or medium of exchange that would produce future cash flow or will be recognized as a better store of wealth.

Businesses producing future cash flow most likely means that inflation will be dealt with. In 20 years, the new iPhone would, for sure, cost more numerically speaking that the one today. Businesses are a way to short the dollar because their cash flow will adjust for inflation. Gold, from the other end, is just perceived as a better store of value than the worthless dollars, but gold will not produce cash flow.

What did we say above? The deficit for the government is just money in someone else’s pocket. So, why don’t you take advantage of that extra money in the economy? It will go somewhere, and they will be spending so to produce more cash flow, increase sales, and promote innovation.

Investors fail to understand the nature of the deficit budget, its consequences on the economy, and how to take advantage of it regarding your asset allocation. MMT clarify that, in a simple sentence, “USA Government does not have financial constrain, it can print as much as it wants, and should just replace its artificial constrains, with a real constrain which is inflation.”

Can printing go too far?

Absolutely, to the point of creating real inflation, but the Fed “should not monitor the inflation.” At least according to their expectation inflation model (that frankly is not even a proper model), but through a full-employment policy. To be fair to the MMT people, the Fed does not have an appropriate model of working of inflation, and fiscal policy could monitor inflation by draining money supply with taxes or setting a new system in place to avoid bubbles in particular sectors.

Even if the government “disagrees” with the MMT policy or ideas, the Fed agenda and the government fiscal stimulus are effectively following them. What else could they do? I don’t disagree with that. I don’t blame the Fed, I just follow the wind and short the fiat currency in the smartest way possible. I invest by keeping in mind that my first objective is shorting the dollar. The consequences of money printing will be two, weaker dollars and money flying in the pocket of the smarter and younger, who will spend in technology and luxury products.

Investing in companies providing such services will guarantee that the future cash flow will be considering inflation. Let’s look at diversification and the world economy. Where geographically allocate my wealth? While USD is a reserve currency, the USA can manage to print trillions to crate stimulus, and eventually later manage the inflation efficiently. That is not possible for other countries in emerging markets and particularly South America.

Hyperinflation based on inflation expectation, contrary to the USA, is highly possible in South America. Most countries there tend to fight economic depression with money printing. Those are hard spots that I would consider shorting at any chance I have. Because, unless they don’t find political leadership able to guide through the crisis, they will be in trouble for many many years.

If you, as a country, have debt in a foreign currency and do not have the means to produce and sell products that attract dollars, you will be in serious trouble.

Investment thesis

My investment thesis for the next years is:

- Invest in USA equity, in particular, tech companies.

- Take debt in USD and Euro to finance businesses and Real estate. Fiat currency will be cheaper and will create, with time, a significant spread between its cash flow that will adapt to inflation. Its intrinsic value will be lower every year.

- Not hold bonds in my portfolio. Those will not be a hedge anymore versus my equity. I would only own junk bonds that I genuinely believe will not face bankruptcy and will be recovering.

- Have a small amount of crypto and very little gold.

If you would like to go deeper into this and have a broader view, I recommend one of my last articles called “What does Bear not understand about the market’s current situation?”

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

European banking system set to collapse after coronavirus black swan?

European banking system set to collapse after coronavirus black swan?

I’m just looking at Europe in search of potential business opportunities. My radar is always switched on and completely proof of any political issue. I’m on a trip to Europe, and I was deeply impacted by empty airports, empty stores and restaurants, and desolate downtowns, in particular in my native Italy.

Europe is facing, like the rest of the world, an economic recession, probably the worst after II world war with significant pressure on stock markets and a collapse in consumer spending.

The main question I’m asking myself is how all of this is impacting the European banking system and whether there is any business opportunity around. Is it better to invest in the US, in Europe, or any emerging market?

The consensus is pointing at around a 10% decline in the European economy, with Italy probably exceeding 12%. Bad credits are set to explode in Europe because of deteriorating assets.

Is this enough to foresee a credit crunch with a snowball effect implying bank defaults and a financial meltdown with global ramifications?

Honestly, I think there are still some issues that need to be assessed to answer this question. We don’t know how long the coronavirus impact will last and how deep it will jeopardize the real economy.

My guess is that the worst still has to come because European banks and Italian, in particular, still had to recover from the last financial crisis, which began in late 2008 with toxic real estate debt, spread to eurozone sovereign debt, and lasted for more than seven years.

If I look at Deutsche Bank in Frankfurt or Santander in Spain or even the plethora of popular banks in Italy, they are all facing poor profitability, an inefficient scale of operations, and the continuing cost of cleaning up old bad credits. This is crazy to me! If I believe at the potential value disruption for shareholders, I can’t figure out how most of them are still stuck to their junk shares.

Let’s look at some figures, and let’s try to be serious! The European economy relies on the banking system to a much greater extent when compared to the US. European companies are much more exposed to the banking system than US peers. More than 2/3 of European companies’ debt is represented by bank loans, while American firms tend to diversify their source of finance by placing bond. Less than 30% of American firms’ source of funding is represented by bank debt.

All of this means that sooner or later, bad credits will destroy the assets of the banking system despite the efforts of the European Central Bank to continue flooding the financial system with cash.

Someone may argue that a mega-merger trend might save the sector. It worked in the past for other mature industries, but it doesn’t work this way for the banking system. When the entire system has deteriorated, it fails in being the pivot of the economic system. And this is not recoverable by simply merging banks and scaling up dimensionally.

The European Central Bank is called to make all possible efforts to sustain sovereign debts (see Italy) on top of the banking system. I foresee a turmoil future ahead for the European economy, the European banking system, and I would definitely be scared if I had shares of any European bank in my portfolio.

I prefer to remain invested in the US, prefer digital assets, and continue to firmly believe that the US economy will come out of the crisis at a much faster pace than Europe.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

What does Bear not understand about the market's current situation?

What does Bear not understand about the market's current situation?

The economy seems to be in a deep recession, and the market is almost back where it was a few months ago pre-COVID. Some people are still scratching their heads about it, but I’m not. Actually, I profited from this crisis. My performance and equity line have skyrocketed. Let me explain why it wasn’t that hard to predict the direction of the market and take advantage of it, by limiting the risk with OTM options.

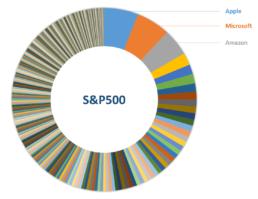

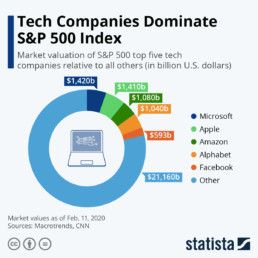

The S&P500 is our reference index in the market, and how the index is currently weighted, big Tech companies are an essential part of its portfolio. Amazon, which is now one of the most significant components of the S&P500, is up almost 50% as I am writing this.

COVID has accelerated the progress of digital society. Cloud firms, digital communication enterprises, and all the companies for which mass adoption of technology would probably have taken many more years have now reached impressive levels due to people staying home during the pandemic.

Technology is sticky; great tech companies have historically had a low churn rate. Still, when people discover and use these technologies, they get attached to them because they fall in love with the benefits. Adoption is the key to the valuation of tech companies. Its compound effect on the network is the hidden secret of those that apparently have a lousy multiple but know that once on a growing path, it can go far.

What does increased adoption mean for the network? Exponential or at least logarithmic growth. If all the assets are “just” a matter of calculating the Net Present Value (well, “just” is a euphemism), then even if there is an apparent disruption of earnings for a couple of quarters, the valuation of the company will be higher.

What else can you have if higher earnings are at the horizon due to adoption increase, and the hurdle rate is going virtually to zero? What else would you expect? Your Net Present Value now will be a result of a more significant number on top and much lower denominator for a higher valuation.

Forget about all that negativity and moaning of the street economy from your friend’s bakery or your cousin’s restaurant. The bankrupt has little or nothing to do with those tech giants with market caps of trillions of dollars that are benefiting from the digital life and their moat in this arena.

Your poor bankrupted friend who lost his job or small business, he has no access to the capital market or the Fed Power, he could probably be in deep trouble, but that has nothing to little to do, at least for now, with the best and most powerful market in the world.

Many of us were fortunate enough to profit from the last crisis in 2009. I made 20 times my money and became wealthier by using the Fed’s Quantitative Easing paradigm to invest in assets that, at the time, nobody wanted. However, a few years later, thanks to the expansive monetary policy, my real estate was available to be bought from the same bankrupted people that could not keep up before because of their credit. The same people that lost their single-family homes ten years ago, which I paid 70k for, are buying back the same property from me at 300k with the bank’s money again.

Equity, and in particular Tech, did even better. Look at Apple, Facebook, and Amazon’s stock price a few years ago and compare it to the current rate. I have some friends who kept gold and were preaching against money printing, evoking inflation and the Financial Armageddon. Gold is now returning at a price similar to that of ten years ago, while my Tech’s stock value is ten times what it was. Those friends that used to hang out with me are now not much better off than a decade ago.

This time it has been even easier to make money. It was not difficult to understand which paradigm we were under and what would happen with such a strong and motivated Fed. Trump and Powell (the Chairman of the Federal Reserve) were the certainties that the USA would do anything to bring the market up. They and their language, speech, and willingness to take care of the market were the assurance that the cheap option premium, which was indeed very cheap, would produce amazing results. OTM option premium in March and April on Tech did 7x to 10x.

It’s funny when people find an excuse not to invest because they worry about the Fed’s balance sheet. I don’t get what they think, like if having cash would help them, what damaging fear can be to even the smartest!

Cash is trash, Ray Dalio mentioned recently. The worse place you can be when there is such accommodating monetary policy is cash. Assets, in particular stocks, are the most efficient protection you can have for inflation. Intuitively people think about gold and real estate. But, the best place to be is quality equity, low debt, big moat, and resiliency to the pandemic. In other words, top tech companies.

On the flip side, I’m not worried about the debasement of the currency, and after keeping Bitcoin for so many years, I believe it currently isn’t an alternative to the dollar, and probably won’t be for the next few years. In another article, I will explain my view of Bitcoin which is, for the short term, at least, only a function of the liquidity on the market.

The US will find a way to deal with inflation, and when it happens, which I am quite sure will be in a few years, taxes will increase and drain the extra inflation away. However, I will be offshore and won’t be touched by it. Bonds and cash will be a dead beat, and your fear will become your worst enemy. If you have some savings, a medium two-to-four year horizon and plan to retire, buy stocks with leaps option, quality stock, or index if you are able to spot the right one. And buy your residency in an incredible lovely tax paradise, I am sure it will work just fine.

All this generosity by the Fed will eventually finish when the dollar is threatened as a reserve currency. Right now, they are doing all it takes to keep the economy up, but fiscal and monetary policy will drain the money away from the economy in the near future.

The wealth gap will be huge, much bigger than now. All of us that have benefited from the asset bubble towards which we are flying will be 100 times richer than those with no savings. And will, eventually, live another paradigm in which the wealthy would ultimately be hit. However, my retirement will be offshore, and my money safe from taxes.

Now please be careful, I am only advocating to go long on the top class companies in the USA. Your hedge should be being short on the countries and companies that don’t have the benefit of having a reserve currency.

I think you can be an Alpha creator if you can pick not only the winners but also the losers of the market. This market created an enormous differentiation, and now it hasn’t been effective in discriminating, so here it comes the new strategy to hedge your position.

To be more precise, the current crisis is different than the boom and bust cycle that usually leads to a financial crisis. In a typical economic cycle, the interest gets pushed up when things are going great to avoid inflation. Economic contraction starts to happen, the debt crisis will show up, and then again, monetary policy will start the expansion period to accommodate the economy.

The normal debt cycle, the way we know it, will result in credit falling, monetary policy tightening, and only after, the income will be hit before a new accommodating monetary policy kick in. However, because of the virus, we had income falling before, in a scenario where the interest rate was already zero. Credit expansion now cannot be exercised by merely cutting interest rates, so the Fed needs to adopt other policies to be effective.

Once that happens, the way out has been Quantitative Easing, but that weapon has also been used. So now the Fed is moving to something that has never happened before. More and more economies are embracing Modern Monetary Theory or MMT.

MMT has different layers and approaches, but basically it is the idea that a country could and should always run at a constant deficit. Instead of going deeper into theory, let’s focus on the paradigm’s consequences and how to structure your strategy.

Economies that have reserve currencies like the USD will be able to “print their way out” without creating hyperinflation, at least for the next few years. But all those countries that don’t have that ability will face more significant issues and a hyperinflation scenario.

Fiscal policy will be used in combination with monetary policy to send money to support the economy. Now “support the economy” does not mean the market goes up, it means that the Fed will do all it takes to promote full employment, and that is their mandate.

At a certain point, all those companies affected by COVID will eventually be picked up, to generate jobs. I would not be surprised if, in the next few months, the affected sectors receive an extra stimulus. At the end of the day, the Fed knows that the only way to reach full employment is to send money and support the old economy businesses. To incentivize jobs to the less skilled people, who are the ones suffering, that necessarily needs to be done with fiscal stimulus.

The difference between the countries without this ability, like the emerging markets in Latin America and the USA or Europe, will be enormous. The gap will increase with time, and if not dealt with, conflicts and riots will be a daily issue in those countries. Shorting Latin America, their banks, and debts would be your hedge while long on the USA market.

What will happen in the long term? Well, I recall a lesson at university in which when studying MMT, my professor was speaking about the colonies, and how they were operating their monetary policy.

Dutch colonies; for example, were printing to pay their local workers (the slaves). Printing paper currency and plenty of it, with the queen or king’s head on it, to pay to the slaves. Where was this leading? You would be thinking “inflation,” well, those colonies were obligated to pay a lot of taxes. And do you know what the Dutch army was doing with it? They were burning piles of money to drain the inflation. That was a way to get the useless paper out of the system and, at the same time, to make it less worthless.

So, we are moving into a scenario in which we will see asset pricing inflating. Those who have access to credit and assets will become more prosperous, while others will be much poorer. One day, far in the future, this large gap will have a repercussion in politics. Taxes will be the way for the poor to take back some wealth, and it will be the only way for the governments to avoid the debasement of the whole system.

If the strategy is not clear: long USA equity and short emerging markets, especially South America. Look for assets and businesses that target the rich, not the poor. Start to look for a place to run to when taxes hit hard, escaping from taxes could be an issue if you don’t prepare for it, and take all your money back. Becoming wealthy will be that easy.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Bitcoin's scalability problem

One of the most important things when it comes to Bitcoin and scalability is the “Scalability Trilemma.” This refers to the most suitable strategy or better to say the best balance between scalability, security, and decentralization. Usually, this issue relates to each type of cryptocurrency because, necessarily, the increase in efficiency in one of the three would produce as tradeoff an effect on the other two. For instance, a protocol with a faster consensus model would enhance scalability at the expense of security or decentralization.

Due to the Bitcoin POW consensus, security and centralization seem to be covered. However, the latter is becoming an issue, especially with the Lighting Network. Segwit was the reason that caused the hard fork with Bitcoin Cash, but to be able to aboard this concisely, let’s leave it on the side for now.

From the other side, the ability to scale is the most pressure matter that has been facing bitcoin for a while. For scalability, we intent the ability for the network to grow without impacting the speed of the transactions.

Because the miners need to approve the transactions in the block and each block is 1 MB of data, each block should take 10 minutes to get approved. Although in a period of massive queues it takes longer, Bitcoin now has an average of 4 to 7 transactions per second against 1,700 of Visa. In order to solve this issue, we are going to discuss two of the most known approaches.

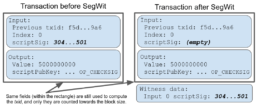

The first one is Segwit, which is a soft fork of Bitcoin that allowed a change in the block structure to solve the transaction malleability problem. We know that the block is formed by data of the receiver output, the digital signature, and the sender output. The way the digital signature is written with the Legacy block allows a malicious actor to change the transaction id.

The information of the witness data, which is encrypted, is called “transaction ID,” and it can be changed maliciously without changing the transaction. Simply because the digital signature can be modified in a way that the mathematical computational check its still valid according to the network even though the hash will be different.

In this way, in the Legacy block (the block prior to the Segwit change), transaction ID can be changed and causes what is called the malleability issue.

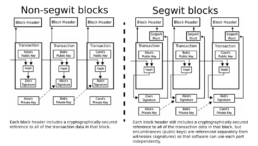

This creates many problems, firstly because it can be exploited by people to cheat others that don’t wait for the confirmation of the block. Secondly, without such significant change, the lightning network could have never been developed. The reason why Segwit was implemented without a hard fork was to change the structure of the block. Contrary to popular opinion, Segwit is an increase in block size but in a different way than it was done with the hard fork of Bitcoin Cash.

What Segwit did was to move in the signature data from outside the base box. They added an extended block in which the digital signature was included but is not part of the base block. This created two main advantages: by not being anymore part of the base box, the transaction ID would not be affected even if the digital signature is modified. And also, it has increased the available space for the witness data, so the block now has 4 MB in total, and therefore can contain more information.

So the main pros are first the elimination of the malleability issue. And that it shrinks the base box leaving more space for data to fit in the block, therefore increasing the speed of the transactions in the network. I would probably add that transactions now could be cheaper.

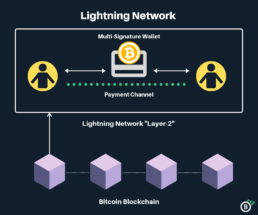

Thanks to this system, the Lightning Network was able to be implemented. Indeed because the second layer (Lightning Network) relies on the first layer (Bitcoin’s blockchain), then if the malleability issue was not solved, it directly couldn’t work.

It is essential to mention that we could not have increased the block size because, according to Bitcoin’s protocol, it would need to be 1 MB. So, developers had to find a solution to accept Segwit without a hard fork (as Bitcoin Cash did) to make sure that both blocks were allowed while the network was updated.

Again, another advantage of creating faster transactions is that Segwit would see the operation as a weight. What I mean by that is that miners would perceive Legacy’s block as size and Segwit’s block as what is in the witness data compared to its base. Because of the extended block, so miners can select lighter blocks to make faster transactions, and this would also reduce the fee.

Of course, this reduced fee is seen as a con for the miner because profitability could decrease. As a matter of fact, not many miners were happy with Segwit’s solution. The work of the miners can be affected in other ways, especially for mining pools. All of this has created a big debate in the bitcoin community.

Anyways, Segwit does not entirely solve the scalability issue. It just improves it a bit. Scalability is a problem that would always remain and would eventually be tied to milestones. At every stage of Bitcoin’s adoption and usage, new scalability concerns will arise.

The second method to solve the scalability issue is the Lightning Network or LN. This is an open protocol built on top of Bitcoin’s network, and its central idea is that small transactions don’t have to be recorded directly on the blockchain but rather off-chain on a second layer.

LN is a way to create payment channels among two or more people to do multiple transactions and keep a ledger between them. Then, once reached the desired number of operations, report on the main blockchain only the final balance.

In this case, once the payment channel is opened, both users will choose the initial amount, which will be the maximum amount they can use in the circuit. The transactions will be signed in an off-chain and then reported on the blockchain only when the involved parties confirm it.

The LN has a sort of fraud mechanism in case one of the users tries to cheat the system. The deposit will be used to punish the cheater and sent it to the other party. The beauty of the system relies on its interconnect ability. If you don’t have to have a direct payment channel with somebody, you still can use the power of the network to reach that person through a preferred payment rout.

The payment channels work like an IOU sort of agreement, and when the channel is closed, the IOU is redeemed. Direct Channels would be free from fees, and fees would be paid only when the ledger would be brought back on the chain to settle the balance. This allows much faster speed on the transactions within the payment channel and frees up a lot of space on the blockchain, which will be used theoretically only for more critical payments.

It appears evident as Pro that speed is the first the most important of all. Even minimal payment can be made, and fees and transaction fees will be much cheaper. The transactions are secured and encrypted, and therefore This adds an extra layer of security to transactions made on the LN

The main Cons are very debatable but mostly reside in the fact that because you have to preload the channel with the upper spending of the Bitcoin, you would use instead user route in which you know you have enough BTC. Therefore this makes a debate on centralization of the network from a big institution or even banks that want to provide liquidity to the system. I would probably also argue since all the nodes are hot wallets that security could be in the same case an issue, and nodes could be targeted by hackers and malicious players.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

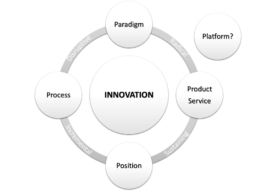

The 5th P of Innovation and its existential crisis

The secret behind the growth of the majority of disruptive companies is their platform’s ability to create value for other businesses. That is the main shared element of Facebook, Apple, Google, Amazon, and almost all big and not-so-big tech enterprises. By building up the principles of innovation, they have created an ecosystem where many other projects can thrive, and that is one of the main reasons for their economic success.

Some innovators called “platform” the “5th P” of the “4 P’s of innovation” described by Tidd and Bessan).

In particular, the paradigm is meant to be the frame with which the organization does what it does, its business model and innovation in paradigm it’s referred to the ability to propose its services under a different model, that differentiation would create value.

Apparently, some were not happy with this definition when referring to the platform and added the fifth “P” to evoke an ecosystem that creates moat and mutual value between the business itself and its associates.

If we think of Amazon, the IOs of Apple, or even, more recently, in the success of Ethereum and Smart Contracts, we quickly realize that many innovations are the result of a change of paradigm. In particular, the business models that are disruptive in the way they are presented. Bringing value by producing an environment in which other businesses can thrive while using its creativity with the support of the same ecosystem. If we recall how much Apple IOS has created creativity and value or how many businesses were able to scale and increase their sales thanks to Amazon, we would be amazed by the power of those platforms.

What should be the way an investor would analyze the weaknesses and the strength of new businesses that leverage on those platforms? How should you evaluate a new DApps or service that will scale amazingly on Ethereum blockchain? And, from the other side, can a disruptive business that has implemented a new paradigm creating value for itself by allowing others to use its platform and scale, be disrupted? How much value the platform can create for itself and others, and what risks it faces?

Well, I would start by saying that things go great until they don’t. And some premises are riskier than others. Do you recall Zynga? Zynga was an American social game that grew symbolically with Facebook, exactly taking advantage of the paradigm mentioned above. The ability to scale throughout the platform was handy to Znynga’s growth, but it lost a big chunk of its value when Facebook changed the rules. How many businesses scale and rely on the ability to sell their products on Amazon? What about all those ICO and DApps entirely relying on EOS or Ethereum?

All those companies have what is called a big existential risk. They put the key to their success on the platform on which they operate; their growth depends on a centralized platform. Funny enough, even in a decentralized ecosystem, it’s the same.

Sometimes interest can change, or conflict of interest could arise. Regulations, economics, or political reasons for which the platform is not able to let the business run anymore with the same rules, and those changes can destroy a business. Many things, for many reasons, can change from one day to another.

When you analyze the business potential and business threats, innovation should act as a competitive advantage, and the ability to capture and keep its moat to capture the value should not be in the hands of an external centralized organization.

It’s a paradox to be in a decentralized ecosystem, like cryptocurrency, and have a business model that only allows growth on other’s platforms. Is this meant to be a decentralized economy? What is decentralized in a business that its livelihood depends on a single company, platform, or project? Are Ethereum and Bitcoin genuinely decentralized? Some movements have started to fight against this.

The ecosystem needs to produce freedom from the platform, not incentivize the growth of businesses that are born with such an existential threat. They are a click’s distance of being kicked off, and it can happen anytime without previous notice.

The key to innovative businesses is working on the paradigm of innovation and free up from preconstructed systems that have their own interests and, undoubtedly, not the ones of every single business within the ecosystem.

By the way, I think the threats go from both sides. The Companies founded on the idea of being a central institution that “allows its affiliates to grow” might be disrupted. They have the risk that businesses will, one day, be able to grow independently without relying on such a fragile symbiotic paradigm. Companies that have captured this idea and are working on creating something unique, a new path that allows them to own their future.

Somehow, in the way we are operating today, especially when it comes to marketing, we are rowing back from the “free world” we wanted to create with the internet and relying again on centralized corporations that have their own agenda. We found ourselves tirelessly trying to find out and work around their algorithms that are specifically created on the base of conflict of interest and seek to keep us tied to them forever.

For instance, I was thinking about Booking.com’s platform and its relation with Google. As a hotel owner and investor, I know the value that platforms like Booking or Airbnb can create for those who know how to leverage those platforms. However, as we have discussed, those platforms can change their rules or implement new ones that are not convenient for some businesses within the ecosystem and therefore put them in serious crisis. Imagine now that they are themselves in a similar situation with platforms like google. Many companies are at the end of a chain of centralized platforms that, in a matter of seconds, could fall apart like dominoes.

Nonetheless, the effort and the capital investment needed to bypass those platforms in order to grow are too big and often not convenient. They have reached significant traffic and user captivity that leave little or no space to alternative channels of distribution and sales.

As mentioned before, paradoxically, a portal like Booking.com itself is vulnerable to Google. Booking is one of Google’s best clients, spending billions of dollars a year, but, at the same time, Google represents Booking’s biggest threat. Google could use its data to become more efficient, copy, and improve Booking’s business model. Have you heard of “Google Hotels” and “Google Hotel Ads”? Well, Booking should be worried. There are several examples of other businesses being eaten by these big tech platforms, and, as we know, if they cannot successfully copy you, they will end up acquiring you.

Those channels or platforms that allow others to grow could become the reason for a business’s surrender. But why disrupted businesses do not tend to respond? “Often, the challenger is actually invisible because she misdirects attention. ” The Disruption FAQ – Q7

As an investor, I need to invest or create businesses that do not rely on a centralized platform that could stab me in the back anytime by completely disrupt or destroying me. It’s a Damocles sword that would limit my growth and compress my multiple due to an existential risk that could materialize anytime, and I will never overcome.

In the blockchain industry, I have spotted a company called Dfinity that is already thinking about how to disrupt centralized platforms by creating an internet computer with an advanced decentralized protocol that is run by independent data centers. The new internet computer will create internet services under a completely new paradigm protecting users’ data and disrupting the monopolistic nature of the relationship that Big Tech it’s establishing by owing and controlling all on their platforms.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Interview with Dominican Economist Jordan De Los Santos

In this interview, we talk about the Dominican Market’s opportunities for investment growth, some hotel industry insights, and Real Capital Caribe’s competitive advantage.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

May 21, 2019