What does Bear not understand about the market's current situation?

The economy seems to be in a deep recession, and the market is almost back where it was a few months ago pre-COVID. Some people are still scratching their heads about it, but I’m not. Actually, I profited from this crisis. My performance and equity line have skyrocketed. Let me explain why it wasn’t that hard to predict the direction of the market and take advantage of it, by limiting the risk with OTM options.

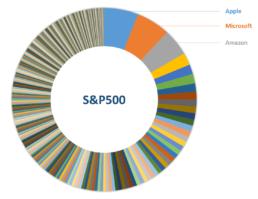

The S&P500 is our reference index in the market, and how the index is currently weighted, big Tech companies are an essential part of its portfolio. Amazon, which is now one of the most significant components of the S&P500, is up almost 50% as I am writing this.

COVID has accelerated the progress of digital society. Cloud firms, digital communication enterprises, and all the companies for which mass adoption of technology would probably have taken many more years have now reached impressive levels due to people staying home during the pandemic.

Technology is sticky; great tech companies have historically had a low churn rate. Still, when people discover and use these technologies, they get attached to them because they fall in love with the benefits. Adoption is the key to the valuation of tech companies. Its compound effect on the network is the hidden secret of those that apparently have a lousy multiple but know that once on a growing path, it can go far.

What does increased adoption mean for the network? Exponential or at least logarithmic growth. If all the assets are “just” a matter of calculating the Net Present Value (well, “just” is a euphemism), then even if there is an apparent disruption of earnings for a couple of quarters, the valuation of the company will be higher.

What else can you have if higher earnings are at the horizon due to adoption increase, and the hurdle rate is going virtually to zero? What else would you expect? Your Net Present Value now will be a result of a more significant number on top and much lower denominator for a higher valuation.

Forget about all that negativity and moaning of the street economy from your friend’s bakery or your cousin’s restaurant. The bankrupt has little or nothing to do with those tech giants with market caps of trillions of dollars that are benefiting from the digital life and their moat in this arena.

Your poor bankrupted friend who lost his job or small business, he has no access to the capital market or the Fed Power, he could probably be in deep trouble, but that has nothing to little to do, at least for now, with the best and most powerful market in the world.

Many of us were fortunate enough to profit from the last crisis in 2009. I made 20 times my money and became wealthier by using the Fed’s Quantitative Easing paradigm to invest in assets that, at the time, nobody wanted. However, a few years later, thanks to the expansive monetary policy, my real estate was available to be bought from the same bankrupted people that could not keep up before because of their credit. The same people that lost their single-family homes ten years ago, which I paid 70k for, are buying back the same property from me at 300k with the bank’s money again.

Equity, and in particular Tech, did even better. Look at Apple, Facebook, and Amazon’s stock price a few years ago and compare it to the current rate. I have some friends who kept gold and were preaching against money printing, evoking inflation and the Financial Armageddon. Gold is now returning at a price similar to that of ten years ago, while my Tech’s stock value is ten times what it was. Those friends that used to hang out with me are now not much better off than a decade ago.

This time it has been even easier to make money. It was not difficult to understand which paradigm we were under and what would happen with such a strong and motivated Fed. Trump and Powell (the Chairman of the Federal Reserve) were the certainties that the USA would do anything to bring the market up. They and their language, speech, and willingness to take care of the market were the assurance that the cheap option premium, which was indeed very cheap, would produce amazing results. OTM option premium in March and April on Tech did 7x to 10x.

It’s funny when people find an excuse not to invest because they worry about the Fed’s balance sheet. I don’t get what they think, like if having cash would help them, what damaging fear can be to even the smartest!

Cash is trash, Ray Dalio mentioned recently. The worse place you can be when there is such accommodating monetary policy is cash. Assets, in particular stocks, are the most efficient protection you can have for inflation. Intuitively people think about gold and real estate. But, the best place to be is quality equity, low debt, big moat, and resiliency to the pandemic. In other words, top tech companies.

On the flip side, I’m not worried about the debasement of the currency, and after keeping Bitcoin for so many years, I believe it currently isn’t an alternative to the dollar, and probably won’t be for the next few years. In another article, I will explain my view of Bitcoin which is, for the short term, at least, only a function of the liquidity on the market.

The US will find a way to deal with inflation, and when it happens, which I am quite sure will be in a few years, taxes will increase and drain the extra inflation away. However, I will be offshore and won’t be touched by it. Bonds and cash will be a dead beat, and your fear will become your worst enemy. If you have some savings, a medium two-to-four year horizon and plan to retire, buy stocks with leaps option, quality stock, or index if you are able to spot the right one. And buy your residency in an incredible lovely tax paradise, I am sure it will work just fine.

All this generosity by the Fed will eventually finish when the dollar is threatened as a reserve currency. Right now, they are doing all it takes to keep the economy up, but fiscal and monetary policy will drain the money away from the economy in the near future.

The wealth gap will be huge, much bigger than now. All of us that have benefited from the asset bubble towards which we are flying will be 100 times richer than those with no savings. And will, eventually, live another paradigm in which the wealthy would ultimately be hit. However, my retirement will be offshore, and my money safe from taxes.

Now please be careful, I am only advocating to go long on the top class companies in the USA. Your hedge should be being short on the countries and companies that don’t have the benefit of having a reserve currency.

I think you can be an Alpha creator if you can pick not only the winners but also the losers of the market. This market created an enormous differentiation, and now it hasn’t been effective in discriminating, so here it comes the new strategy to hedge your position.

To be more precise, the current crisis is different than the boom and bust cycle that usually leads to a financial crisis. In a typical economic cycle, the interest gets pushed up when things are going great to avoid inflation. Economic contraction starts to happen, the debt crisis will show up, and then again, monetary policy will start the expansion period to accommodate the economy.

The normal debt cycle, the way we know it, will result in credit falling, monetary policy tightening, and only after, the income will be hit before a new accommodating monetary policy kick in. However, because of the virus, we had income falling before, in a scenario where the interest rate was already zero. Credit expansion now cannot be exercised by merely cutting interest rates, so the Fed needs to adopt other policies to be effective.

Once that happens, the way out has been Quantitative Easing, but that weapon has also been used. So now the Fed is moving to something that has never happened before. More and more economies are embracing Modern Monetary Theory or MMT.

MMT has different layers and approaches, but basically it is the idea that a country could and should always run at a constant deficit. Instead of going deeper into theory, let’s focus on the paradigm’s consequences and how to structure your strategy.

Economies that have reserve currencies like the USD will be able to “print their way out” without creating hyperinflation, at least for the next few years. But all those countries that don’t have that ability will face more significant issues and a hyperinflation scenario.

Fiscal policy will be used in combination with monetary policy to send money to support the economy. Now “support the economy” does not mean the market goes up, it means that the Fed will do all it takes to promote full employment, and that is their mandate.

At a certain point, all those companies affected by COVID will eventually be picked up, to generate jobs. I would not be surprised if, in the next few months, the affected sectors receive an extra stimulus. At the end of the day, the Fed knows that the only way to reach full employment is to send money and support the old economy businesses. To incentivize jobs to the less skilled people, who are the ones suffering, that necessarily needs to be done with fiscal stimulus.

The difference between the countries without this ability, like the emerging markets in Latin America and the USA or Europe, will be enormous. The gap will increase with time, and if not dealt with, conflicts and riots will be a daily issue in those countries. Shorting Latin America, their banks, and debts would be your hedge while long on the USA market.

What will happen in the long term? Well, I recall a lesson at university in which when studying MMT, my professor was speaking about the colonies, and how they were operating their monetary policy.

Dutch colonies; for example, were printing to pay their local workers (the slaves). Printing paper currency and plenty of it, with the queen or king’s head on it, to pay to the slaves. Where was this leading? You would be thinking “inflation,” well, those colonies were obligated to pay a lot of taxes. And do you know what the Dutch army was doing with it? They were burning piles of money to drain the inflation. That was a way to get the useless paper out of the system and, at the same time, to make it less worthless.

So, we are moving into a scenario in which we will see asset pricing inflating. Those who have access to credit and assets will become more prosperous, while others will be much poorer. One day, far in the future, this large gap will have a repercussion in politics. Taxes will be the way for the poor to take back some wealth, and it will be the only way for the governments to avoid the debasement of the whole system.

If the strategy is not clear: long USA equity and short emerging markets, especially South America. Look for assets and businesses that target the rich, not the poor. Start to look for a place to run to when taxes hit hard, escaping from taxes could be an issue if you don’t prepare for it, and take all your money back. Becoming wealthy will be that easy.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Well expressed Antonio!