Portfolio diversification and hedging under the new paradigm

Portfolio diversification and hedging under the new paradigm

Understanding the current situation in the market can give you an edge on where to invest, what type of long-term investment goals you could have, and how to organize and diversify your portfolio. Fed is starting to show that their power is limited and fiscal stimulus is needed in order to solve the coronavirus damages to the economy. So, now the Government needs to implement a new policy that changes the view of the deficit. Indeed, a new modern view of the deficit is urgently required.

If debt keeps piling, selling debt (Treasury) may become an issue. In the long-term, the reserve currency status of the US dollar can be threatened. Fortunately for the USA, the other three reserve currencies are all facing the same problem. Therefore, Gold, Equity, and other assets are attracting money flow.

Based on the piling of debts, it’s not attractive to invest in the Treasury because you would have a negative real yield. On the other side, the Treasury is losing its diversification purpose. This could cause a spiral in which eventually a sell-off would be strong and could potentially lead to an increased interest rate that could be catastrophic for the economy.

Being long is the wiser thing to do. However, you cannot forget to be fully diversified by asset class and country but also to ensure your portfolio against what many call a “tail risk.” Tail risk is an event that can create a dramatic sell-off, which is not like a simple market correction because it can have profound consequences furthermore. Taleb Nassim says that if you don’t have a tail risk insurance, you don’t have a portfolio.

Tail risk can be insured in multiple ways by shorting some asset classes as a percentage of the portfolio via ETF or the use of options. Also, choosing to invest in a portion of the portfolio which is inversely proportional to the market. Tail risk protection is not free, but it will impact a small percentage of your performance. However, like most insurances, if materialized, you would be happy you had it.

Being greedy and not accepting to spend money on protection would be like buying a beautiful house with no insurance. Imagine if a fire burns the house down, you would have lost it all forever. You can never be entirely sure; rare events sometimes happen, so better be assured!

Hedging in other currencies and countries, especially for the US market, is vital. Bitcoin could also be a way to find exposure to a hedge against the reserve currencies’ status. People sometimes go too far and place all their wealth or a significant portion of it in such instruments, losing sight of what is risk and how to manage it.

Assuring tail risk has a cost, but if the diversification is appropriately done by calculating the correlation between assets, it doesn’t cost anything. You can diversify, lowering volatility without reducing the expected returns.

So there are two types of hedging. The first one comes down to hedging against tail risk through a specific strategy. For example, shorting an index with a percentage of the portfolio to offset long positions in Equity or taking a position in derivatives to cover your portfolio in case of a strong sell-off in the market. The other hedging type is done by organizing a diversification and decorrelation of the portfolio without lowering the expected returns.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Before COVID, decorrelation in the portfolio could be achieved by having Treasury or Bond. So the demand for Treasury had sense also in a diversification process. Now it doesn’t, and this represents a problem for portfolio managers. The issue with a low-interest rate is not only about the return but about not having the demand for the Treasury as a proper uncorrelated instrument to insert in a portfolio.

The covariance of the Treasury changes against Equity as the interest rate approaches zero. This is my perception: monitoring the correlation between the Treasury and Equity will give us a hint on the perception of inflation and could eventually help us to spot an Equity bubble in the market.

The decorrelation has not always been as it was in the last decade. When we analyze the covariance (for covariance, I mean how an asset moves in relation to another asset) between Equity and Bond, a positive covariance is negative for portfolio diversification because it does not create any benefit. In contrast, a negative covariance will be positive for the portfolio because, through diversification, those negative covariance assets can reduce the risk without affecting the expected returns (a value investor would probably kill me).

Zero covariance does not really provide any benefit to the portfolio. There are many debates about this, but this is not the time to dig deeper into that. Bitcoin, for instance, does not show a decorrelation from the market in the short term. In the past few months, it has been quite correlated to the NASDAQ, and it does not provide, at least in the short-term, any hedge for the portfolio.

My problem with Bitcoin in the short-term was indeed not being able to optimize my portfolio by creating an inverse correlation with my Equity. By adding Bitcoin, I increased my overall volatility without benefiting from the negative covariance because it has recently been quite correlated to the market.

However, correlation within assets is not always linear, and macroeconomics changes can modify the covariance between them. This means that Bitcoin, instead of a threat to the US dollar as a reserve currency, could even start to decorrelate from other Equity behaviors, creating, therefore, diversification.

My issue getting back to the Treasury is that any asset class is moved by the demand towards it. If the negative covariance with Treasury will change as Treasury approaches Zero and debt will pile up even further going towards MMT dynamics, what would be the reason to have such an asset in the portfolio?

How would that affect the currency reserve status of the US dollar? If the crypto market could become more useful than Gold in shorting the US dollar, as macroeconomics change to a new paradigm under which portfolio immunization can be obtained, the demand of crypto could be driven by the necessity of decorrelation from the Equity. Until now, however, crypto does not have these characteristics, and the expected inflation and the relation Bond/Equity may provide us a guide in the future for when the paradigm might switch.

Bitcoin's scalability problem

One of the most important things when it comes to Bitcoin and scalability is the “Scalability Trilemma.” This refers to the most suitable strategy or better to say the best balance between scalability, security, and decentralization. Usually, this issue relates to each type of cryptocurrency because, necessarily, the increase in efficiency in one of the three would produce as tradeoff an effect on the other two. For instance, a protocol with a faster consensus model would enhance scalability at the expense of security or decentralization.

Due to the Bitcoin POW consensus, security and centralization seem to be covered. However, the latter is becoming an issue, especially with the Lighting Network. Segwit was the reason that caused the hard fork with Bitcoin Cash, but to be able to aboard this concisely, let’s leave it on the side for now.

From the other side, the ability to scale is the most pressure matter that has been facing bitcoin for a while. For scalability, we intent the ability for the network to grow without impacting the speed of the transactions.

Because the miners need to approve the transactions in the block and each block is 1 MB of data, each block should take 10 minutes to get approved. Although in a period of massive queues it takes longer, Bitcoin now has an average of 4 to 7 transactions per second against 1,700 of Visa. In order to solve this issue, we are going to discuss two of the most known approaches.

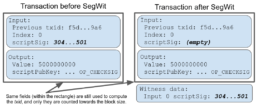

The first one is Segwit, which is a soft fork of Bitcoin that allowed a change in the block structure to solve the transaction malleability problem. We know that the block is formed by data of the receiver output, the digital signature, and the sender output. The way the digital signature is written with the Legacy block allows a malicious actor to change the transaction id.

The information of the witness data, which is encrypted, is called “transaction ID,” and it can be changed maliciously without changing the transaction. Simply because the digital signature can be modified in a way that the mathematical computational check its still valid according to the network even though the hash will be different.

In this way, in the Legacy block (the block prior to the Segwit change), transaction ID can be changed and causes what is called the malleability issue.

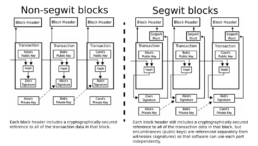

This creates many problems, firstly because it can be exploited by people to cheat others that don’t wait for the confirmation of the block. Secondly, without such significant change, the lightning network could have never been developed. The reason why Segwit was implemented without a hard fork was to change the structure of the block. Contrary to popular opinion, Segwit is an increase in block size but in a different way than it was done with the hard fork of Bitcoin Cash.

What Segwit did was to move in the signature data from outside the base box. They added an extended block in which the digital signature was included but is not part of the base block. This created two main advantages: by not being anymore part of the base box, the transaction ID would not be affected even if the digital signature is modified. And also, it has increased the available space for the witness data, so the block now has 4 MB in total, and therefore can contain more information.

So the main pros are first the elimination of the malleability issue. And that it shrinks the base box leaving more space for data to fit in the block, therefore increasing the speed of the transactions in the network. I would probably add that transactions now could be cheaper.

Thanks to this system, the Lightning Network was able to be implemented. Indeed because the second layer (Lightning Network) relies on the first layer (Bitcoin’s blockchain), then if the malleability issue was not solved, it directly couldn’t work.

It is essential to mention that we could not have increased the block size because, according to Bitcoin’s protocol, it would need to be 1 MB. So, developers had to find a solution to accept Segwit without a hard fork (as Bitcoin Cash did) to make sure that both blocks were allowed while the network was updated.

Again, another advantage of creating faster transactions is that Segwit would see the operation as a weight. What I mean by that is that miners would perceive Legacy’s block as size and Segwit’s block as what is in the witness data compared to its base. Because of the extended block, so miners can select lighter blocks to make faster transactions, and this would also reduce the fee.

Of course, this reduced fee is seen as a con for the miner because profitability could decrease. As a matter of fact, not many miners were happy with Segwit’s solution. The work of the miners can be affected in other ways, especially for mining pools. All of this has created a big debate in the bitcoin community.

Anyways, Segwit does not entirely solve the scalability issue. It just improves it a bit. Scalability is a problem that would always remain and would eventually be tied to milestones. At every stage of Bitcoin’s adoption and usage, new scalability concerns will arise.

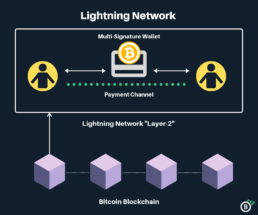

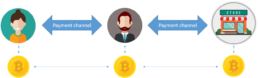

The second method to solve the scalability issue is the Lightning Network or LN. This is an open protocol built on top of Bitcoin’s network, and its central idea is that small transactions don’t have to be recorded directly on the blockchain but rather off-chain on a second layer.

LN is a way to create payment channels among two or more people to do multiple transactions and keep a ledger between them. Then, once reached the desired number of operations, report on the main blockchain only the final balance.

In this case, once the payment channel is opened, both users will choose the initial amount, which will be the maximum amount they can use in the circuit. The transactions will be signed in an off-chain and then reported on the blockchain only when the involved parties confirm it.

The LN has a sort of fraud mechanism in case one of the users tries to cheat the system. The deposit will be used to punish the cheater and sent it to the other party. The beauty of the system relies on its interconnect ability. If you don’t have to have a direct payment channel with somebody, you still can use the power of the network to reach that person through a preferred payment rout.

The payment channels work like an IOU sort of agreement, and when the channel is closed, the IOU is redeemed. Direct Channels would be free from fees, and fees would be paid only when the ledger would be brought back on the chain to settle the balance. This allows much faster speed on the transactions within the payment channel and frees up a lot of space on the blockchain, which will be used theoretically only for more critical payments.

It appears evident as Pro that speed is the first the most important of all. Even minimal payment can be made, and fees and transaction fees will be much cheaper. The transactions are secured and encrypted, and therefore This adds an extra layer of security to transactions made on the LN

The main Cons are very debatable but mostly reside in the fact that because you have to preload the channel with the upper spending of the Bitcoin, you would use instead user route in which you know you have enough BTC. Therefore this makes a debate on centralization of the network from a big institution or even banks that want to provide liquidity to the system. I would probably also argue since all the nodes are hot wallets that security could be in the same case an issue, and nodes could be targeted by hackers and malicious players.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

The 5th P of Innovation and its existential crisis

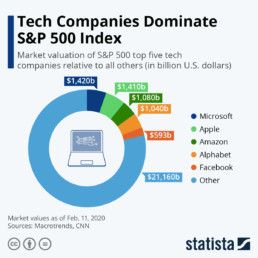

The secret behind the growth of the majority of disruptive companies is their platform’s ability to create value for other businesses. That is the main shared element of Facebook, Apple, Google, Amazon, and almost all big and not-so-big tech enterprises. By building up the principles of innovation, they have created an ecosystem where many other projects can thrive, and that is one of the main reasons for their economic success.

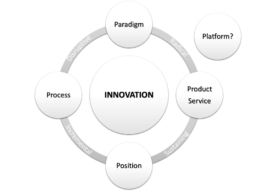

Some innovators called “platform” the “5th P” of the “4 P’s of innovation” described by Tidd and Bessan).

In particular, the paradigm is meant to be the frame with which the organization does what it does, its business model and innovation in paradigm it’s referred to the ability to propose its services under a different model, that differentiation would create value.

Apparently, some were not happy with this definition when referring to the platform and added the fifth “P” to evoke an ecosystem that creates moat and mutual value between the business itself and its associates.

If we think of Amazon, the IOs of Apple, or even, more recently, in the success of Ethereum and Smart Contracts, we quickly realize that many innovations are the result of a change of paradigm. In particular, the business models that are disruptive in the way they are presented. Bringing value by producing an environment in which other businesses can thrive while using its creativity with the support of the same ecosystem. If we recall how much Apple IOS has created creativity and value or how many businesses were able to scale and increase their sales thanks to Amazon, we would be amazed by the power of those platforms.

What should be the way an investor would analyze the weaknesses and the strength of new businesses that leverage on those platforms? How should you evaluate a new DApps or service that will scale amazingly on Ethereum blockchain? And, from the other side, can a disruptive business that has implemented a new paradigm creating value for itself by allowing others to use its platform and scale, be disrupted? How much value the platform can create for itself and others, and what risks it faces?

Well, I would start by saying that things go great until they don’t. And some premises are riskier than others. Do you recall Zynga? Zynga was an American social game that grew symbolically with Facebook, exactly taking advantage of the paradigm mentioned above. The ability to scale throughout the platform was handy to Znynga’s growth, but it lost a big chunk of its value when Facebook changed the rules. How many businesses scale and rely on the ability to sell their products on Amazon? What about all those ICO and DApps entirely relying on EOS or Ethereum?

All those companies have what is called a big existential risk. They put the key to their success on the platform on which they operate; their growth depends on a centralized platform. Funny enough, even in a decentralized ecosystem, it’s the same.

Sometimes interest can change, or conflict of interest could arise. Regulations, economics, or political reasons for which the platform is not able to let the business run anymore with the same rules, and those changes can destroy a business. Many things, for many reasons, can change from one day to another.

When you analyze the business potential and business threats, innovation should act as a competitive advantage, and the ability to capture and keep its moat to capture the value should not be in the hands of an external centralized organization.

It’s a paradox to be in a decentralized ecosystem, like cryptocurrency, and have a business model that only allows growth on other’s platforms. Is this meant to be a decentralized economy? What is decentralized in a business that its livelihood depends on a single company, platform, or project? Are Ethereum and Bitcoin genuinely decentralized? Some movements have started to fight against this.

The ecosystem needs to produce freedom from the platform, not incentivize the growth of businesses that are born with such an existential threat. They are a click’s distance of being kicked off, and it can happen anytime without previous notice.

The key to innovative businesses is working on the paradigm of innovation and free up from preconstructed systems that have their own interests and, undoubtedly, not the ones of every single business within the ecosystem.

By the way, I think the threats go from both sides. The Companies founded on the idea of being a central institution that “allows its affiliates to grow” might be disrupted. They have the risk that businesses will, one day, be able to grow independently without relying on such a fragile symbiotic paradigm. Companies that have captured this idea and are working on creating something unique, a new path that allows them to own their future.

Somehow, in the way we are operating today, especially when it comes to marketing, we are rowing back from the “free world” we wanted to create with the internet and relying again on centralized corporations that have their own agenda. We found ourselves tirelessly trying to find out and work around their algorithms that are specifically created on the base of conflict of interest and seek to keep us tied to them forever.

For instance, I was thinking about Booking.com’s platform and its relation with Google. As a hotel owner and investor, I know the value that platforms like Booking or Airbnb can create for those who know how to leverage those platforms. However, as we have discussed, those platforms can change their rules or implement new ones that are not convenient for some businesses within the ecosystem and therefore put them in serious crisis. Imagine now that they are themselves in a similar situation with platforms like google. Many companies are at the end of a chain of centralized platforms that, in a matter of seconds, could fall apart like dominoes.

Nonetheless, the effort and the capital investment needed to bypass those platforms in order to grow are too big and often not convenient. They have reached significant traffic and user captivity that leave little or no space to alternative channels of distribution and sales.

As mentioned before, paradoxically, a portal like Booking.com itself is vulnerable to Google. Booking is one of Google’s best clients, spending billions of dollars a year, but, at the same time, Google represents Booking’s biggest threat. Google could use its data to become more efficient, copy, and improve Booking’s business model. Have you heard of “Google Hotels” and “Google Hotel Ads”? Well, Booking should be worried. There are several examples of other businesses being eaten by these big tech platforms, and, as we know, if they cannot successfully copy you, they will end up acquiring you.

Those channels or platforms that allow others to grow could become the reason for a business’s surrender. But why disrupted businesses do not tend to respond? “Often, the challenger is actually invisible because she misdirects attention. ” The Disruption FAQ – Q7

As an investor, I need to invest or create businesses that do not rely on a centralized platform that could stab me in the back anytime by completely disrupt or destroying me. It’s a Damocles sword that would limit my growth and compress my multiple due to an existential risk that could materialize anytime, and I will never overcome.

In the blockchain industry, I have spotted a company called Dfinity that is already thinking about how to disrupt centralized platforms by creating an internet computer with an advanced decentralized protocol that is run by independent data centers. The new internet computer will create internet services under a completely new paradigm protecting users’ data and disrupting the monopolistic nature of the relationship that Big Tech it’s establishing by owing and controlling all on their platforms.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.