Portfolio diversification and hedging under the new paradigm

Understanding the current situation in the market can give you an edge on where to invest, what type of long-term investment goals you could have, and how to organize and diversify your portfolio. Fed is starting to show that their power is limited and fiscal stimulus is needed in order to solve the coronavirus damages to the economy. So, now the Government needs to implement a new policy that changes the view of the deficit. Indeed, a new modern view of the deficit is urgently required.

If debt keeps piling, selling debt (Treasury) may become an issue. In the long-term, the reserve currency status of the US dollar can be threatened. Fortunately for the USA, the other three reserve currencies are all facing the same problem. Therefore, Gold, Equity, and other assets are attracting money flow.

Based on the piling of debts, it’s not attractive to invest in the Treasury because you would have a negative real yield. On the other side, the Treasury is losing its diversification purpose. This could cause a spiral in which eventually a sell-off would be strong and could potentially lead to an increased interest rate that could be catastrophic for the economy.

Being long is the wiser thing to do. However, you cannot forget to be fully diversified by asset class and country but also to ensure your portfolio against what many call a “tail risk.” Tail risk is an event that can create a dramatic sell-off, which is not like a simple market correction because it can have profound consequences furthermore. Taleb Nassim says that if you don’t have a tail risk insurance, you don’t have a portfolio.

Tail risk can be insured in multiple ways by shorting some asset classes as a percentage of the portfolio via ETF or the use of options. Also, choosing to invest in a portion of the portfolio which is inversely proportional to the market. Tail risk protection is not free, but it will impact a small percentage of your performance. However, like most insurances, if materialized, you would be happy you had it.

Being greedy and not accepting to spend money on protection would be like buying a beautiful house with no insurance. Imagine if a fire burns the house down, you would have lost it all forever. You can never be entirely sure; rare events sometimes happen, so better be assured!

Hedging in other currencies and countries, especially for the US market, is vital. Bitcoin could also be a way to find exposure to a hedge against the reserve currencies’ status. People sometimes go too far and place all their wealth or a significant portion of it in such instruments, losing sight of what is risk and how to manage it.

Assuring tail risk has a cost, but if the diversification is appropriately done by calculating the correlation between assets, it doesn’t cost anything. You can diversify, lowering volatility without reducing the expected returns.

So there are two types of hedging. The first one comes down to hedging against tail risk through a specific strategy. For example, shorting an index with a percentage of the portfolio to offset long positions in Equity or taking a position in derivatives to cover your portfolio in case of a strong sell-off in the market. The other hedging type is done by organizing a diversification and decorrelation of the portfolio without lowering the expected returns.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

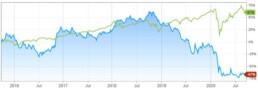

Before COVID, decorrelation in the portfolio could be achieved by having Treasury or Bond. So the demand for Treasury had sense also in a diversification process. Now it doesn’t, and this represents a problem for portfolio managers. The issue with a low-interest rate is not only about the return but about not having the demand for the Treasury as a proper uncorrelated instrument to insert in a portfolio.

The covariance of the Treasury changes against Equity as the interest rate approaches zero. This is my perception: monitoring the correlation between the Treasury and Equity will give us a hint on the perception of inflation and could eventually help us to spot an Equity bubble in the market.

The decorrelation has not always been as it was in the last decade. When we analyze the covariance (for covariance, I mean how an asset moves in relation to another asset) between Equity and Bond, a positive covariance is negative for portfolio diversification because it does not create any benefit. In contrast, a negative covariance will be positive for the portfolio because, through diversification, those negative covariance assets can reduce the risk without affecting the expected returns (a value investor would probably kill me).

Zero covariance does not really provide any benefit to the portfolio. There are many debates about this, but this is not the time to dig deeper into that. Bitcoin, for instance, does not show a decorrelation from the market in the short term. In the past few months, it has been quite correlated to the NASDAQ, and it does not provide, at least in the short-term, any hedge for the portfolio.

My problem with Bitcoin in the short-term was indeed not being able to optimize my portfolio by creating an inverse correlation with my Equity. By adding Bitcoin, I increased my overall volatility without benefiting from the negative covariance because it has recently been quite correlated to the market.

However, correlation within assets is not always linear, and macroeconomics changes can modify the covariance between them. This means that Bitcoin, instead of a threat to the US dollar as a reserve currency, could even start to decorrelate from other Equity behaviors, creating, therefore, diversification.

My issue getting back to the Treasury is that any asset class is moved by the demand towards it. If the negative covariance with Treasury will change as Treasury approaches Zero and debt will pile up even further going towards MMT dynamics, what would be the reason to have such an asset in the portfolio?

How would that affect the currency reserve status of the US dollar? If the crypto market could become more useful than Gold in shorting the US dollar, as macroeconomics change to a new paradigm under which portfolio immunization can be obtained, the demand of crypto could be driven by the necessity of decorrelation from the Equity. Until now, however, crypto does not have these characteristics, and the expected inflation and the relation Bond/Equity may provide us a guide in the future for when the paradigm might switch.