Welcome sell-off!

Welcome sell-off!

I have always loved the sell-offs. It makes a line between the fools that simply try to ride the momentum and the proper long-term investors that are not scared about the volatility. Still, they act on it, taking advantage of the volatility to gain a position that, with time down the line, will indeed make a difference.

If you don’t know why you bought a stock in the first place and just bought it thinking it will go up, you then will drop it when it does not, and you deserve to lose money. I don’t blink when I see my stock dropping but evaluate if the market is cheap enough to have another bite. As many would have told you, I only sell when the fundamentals have changed, or when the market is willing to overpay ridiculously. In that case, I might just let it go, but sometimes even that is not easy or right either.

For instance, I recently have trimmed my Apple’s position, and the split momentum added billions of market cap without any fundamental reason. The valuation was too rich, I had Apple from a price of $69 pre-split, so when I sold part of it at $510, people would think I did great. Well, I have learned that you never sell compounder. However, I have spotted some others with lower valuation, it was a tough decision to take, very hard to let part of my Apple shares go, but finally, I did it. If the market would drop a bit more, I would probably buyback.

Besides the diversion, let’s look deeper into what the market is telling us, what is happening, and what my move will be.

I was exploring some statistics and, while diving in numbers, got impressed by how the media is altering the information to satisfy their cheeky agenda, which is definitely not your financial freedom but the opposite. They need to scare you in order to get things cheaper. Wall Street and the media have an alliance, I think, which has the purpose of scaring mom and daddy’s money.

Please don’t trust the misinformation of those panic disseminators but instead look at the numbers by yourself, learn where to find them, and how to interpret them.

Congress hasn’t yet come to an agreement. The payroll tax has been suspended through an executive order, but if Trump is reelected, it will likely be tax forgiveness. Otherwise, double taxes would need to be paid, and this could create some small frictions on the market.

The fantastic best news was the monetary policy. Powell is telling us what to do, he is our guide, and is saying “don’t worry, right now we don’t care about inflation, we would allow inflation to rise above 2%.” In case it does, to keep up for some time, and also, Powell had many times in his interventions said that their model is not working correctly, they are not even sure that inflation would rise that quickly. They are much more worried about deflation than inflation. That’s the message we need to collect in order to invest.

We are going to experience a very bullish market in the next two quarters. After some corrections, in the next few months and for all 2021, we are going to see assets inflating, and we need to take advantage of those movements because we won’t see prices so low anymore in some of the equity.

This week the unemployment number dropped to single-digit. We are doing really well, 8.4%, which means that 2.8 million dropped in unemployment, which is a massive number. Many small businesses are bankrupting and restarting companies, so there is this new trend, and I think many young entrepreneurs are just reorganizing themselves, especially in the US. I am not concerned about how harmful bankruptcy could become for the economy at this stage.

Real estate prices are increasing in many parts of the USA. People are buying in the countryside and taking advantage of low-interest rates. They purchase real estate based on their mortgage payment, not based on prices. If their mortgage payment is convenient enough, real estate goes up in the USA, especially the RE related to the demand, which is personal and not motivated by investment reasons.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

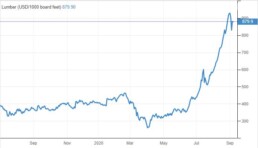

Indeed the price of lumber is high, and its continually increasing. Prices went from $300 to a pick of $934, and this makes a strong case for USA builders and demand for housing.

Even the ISM manufacture index is doing well.

Money is moving across asset classes, and the young entrepreneurs are making money at a pace never seen before. Once the election volatility is over, we will be, especially if Trump gets reelected, on a path toward the sky.

The big swap you might have already noticed is between the old type of stock and the new one. Older stocks that did not spend in innovation or made strategic acquisitions are suffering and are going to be destroyed by the new innovative and disruptive businesses.

There is a lot of rumor about how financials are cheap, how Well Fargo and Chase are cheap, but why don’t we try to listen to the market that is suggesting us to look at the disruption and how companies like Paypal or Square have changed the payment system? With all this activity on the DeFi market, I expect to see many more older-type of banks getting to the same place that the oil companies are now. Banks, if they don’t invest in innovation through acquisition, will not be able to survive or will shrink dramatically under the new FinTech disruption.

I am currently selling my Well Fargo shares, a small position, and take advantage of this sell-off to increment my position in Square.

Bonds are dead. Bonds are not even working as a hedge, and producing real negative returns, listen to what Powell has been telling you. If you want to survive and conquer your financial independence, you have to be able to swallow this volatility, and the only place where you can have returns is in equity. Change your frame of mind about risk; volatility is not risk. Risk is buying something you don’t understand, just hoping that it will go up.

I welcome this correction; it is there to eliminate all those short-term gamblers, the fools that believe the market only goes up and don’t know what they buy. Education and information is the only thing that can keep you alive in a volatile market. You need to have a thesis based on research and understand why you are holding that equity. Like Damodaran says, when the market drops intensely, you need to know why you are holding, and valuation is the only thing that can save you.

If you don’t know the value, at least try to understand the reasons behind your investments. For instance, you could invest in a disruptive company that you know is going to change the existing paradigm and therefore increase in value, as we spoke above about FinTech.

With the new monetary policy, the P/E valuation, as I have written in my precedent articles, will change. Especially for tech companies, we will experience a new paradigm under which the P/E will need to be approached differently, because the growth in the middle of the disruption will be accelerated, so multiple will be higher than what it is in our old paradigm. Don’t forget that P/E makes sense only if it is correlated to growth. At higher growth, we would obviously justify a much higher P/E.

Before talking about a bubble, let’s understand the new paradigm, especially for those disruptive companies that will change the world. Those corrections will be an excellent chance for us in the long-term to accumulate stocks at a discount. Hold tight and enjoy the trip. I hope on Tuesday the sky keeps falling because I need to buy more, and I love sales.

Value Investing Analysis: Park Hotels & Resorts (PK)

Value Investing Analysis: Park Hotels & Resorts (PK)

Many of my friends, employees, and followers ask me how I analyze companies before investing. My answer is usually “that depends on my investment approach for that particular asset”. Park Hotels & Resorts (PK) has been one of my last moves in value investing, so I would like to share with you, in a simplified way, how I analyzed this particular stock at this particular time.

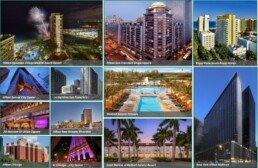

Park Hotels & Resorts is a USA Hotel REIT that initially was a spin-off of Hilton (HLT). Most of its real estate assets are in a public REIT whose portfolio consists of 60 premium-branded hotels and resorts, all currently located in the USA. Their mission is “to be the preeminent lodging REIT, focused on consistently delivering superior, risk-adjusted returns for stockholders through active asset management and a thoughtful external growth strategy while maintaining a strong and flexible balance sheet.”

PK, being among the top 30 in the USA, is a large REIT. It currently has 60 Branded Hotels with 33k+ rooms. A significant acquisition was made in 2019: PK purchased Chesapeake Lodging Trust for $2.5B, diversifying its assets locations and expanding its exposure to Marriot and Hyatt brands. Management has been able to dispose of and acquire Hotels effectively.

Since the spin-off, PK’s management has disposed of 24 hotels and acquired another 18 changing the hotel adjusted EBITDA from $97M to $181M. In 2018 13 hotels were sold for $519M, 10 of them belonged to its international division. In 2019 other 8 hotels were sold for $497M, and they acquired Chesapeake. Finally, in 2020 they sold their last two foreign hotels for $208M getting out of the international market.

Pk's Portfolio

Its geographical distribution is impressive, from the San Francisco Union square to the Hilton New York midtown. More than 85% of PK’s properties are in the luxury or upper-upscale segment.

Insights analysis

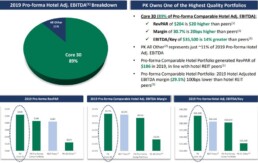

As a Hotel owner and investor, the first thing that pops to my eyes is that almost 90% of PK EBITDA comes from its core 30 Hotels. More importantly, its REVPAR is 20% higher than its peers at $204. EBIDTA/key is roughly $35,500 (pre-COVID19), which was 14% higher when compared to its peers.

REVPAR is the hotel industry metric that indicates the revenue per available room. Higher revenue per room would mean, in the Hotel industry, that there is a moat or client captivity due to the location of the hotels or/and superior management.

As a value investor, I always try to proceed with a proper value investment analysis, Santos/Greenwald’s style. In essence, I would calculate the Asset Value with appropriate adjustment for depreciation, the Earnings Power Value with proper adjustment to the income statement for sustainable earnings, and then compare them.

Once I have found superior management and EV higher than AV, only at that point, I would assess the entry barriers and calculate the franchisee value. However, I don’t want to annoy you with my classical valuation methodology because, in this case, being a REIT, I would value it as an asset play and use different reasoning, mostly objectively focused.

Investment Thesis

My investment thesis is that we are buying superior-location and well-managed big-brand hotels strategically distributed all over the USA for the price to tangible book of around 0.41x.

Price to Tangible Book is a metric that could be useless in some sectors. However, I consider it particularly useful in real estate. This company has been affected dramatically by the COVID19 pandemic, as several PK hotels have been temporarily closed. Nevertheless, my line of argument is that PK strong Balance Sheet and liquidity make PK a winning bet for a quick recovery when the fear of the disease disappears, and the occupancy rate gets back to pre COVID19 levels.

About cash-burning, the management has estimated 73 million, of which 23 million are for corporate expenditures and the remaining 50 million for hotel operating expenses.

Let me give you a quick look at the most recent Balance Sheet

The balance sheet does not hold any Goodwill because it has already been impaired. Also, from the liquidity side, we have some extra good news because all the covenant has been amended.

Amended covenants overview

Exercise of Extension Options:

- revolver maturity extended to December 2021.

- Covenant Waiver.

- Suspend compliance with all existing financial covenants tested through and including 3/31/21.

- Pledge equity in certain subsidiaries to secure the facilities (eight high-quality hotels— a mix of urban, resort, and suburban).

- Adjust levels of particular financial covenants after such a period.

- Minimum liquidity covenant of $200M.

These and other amendments have been set in place to reduce the impact of the current pandemic impact.

PK has Hotel properties for $9,627M (again without Goodwill, which has all been impaired). Its cash position is $1,304M, and total debt would be around $5,095M without considering leasing.

Equity valuation

My valuation delivers an equity value of $3,8bn vs a market cap at the moment of writing of around $2,1bn. (235m shares net of treasures for the price of almost $9).

Normalized earnings

The first consideration is that PK has a REIT status. In the Risk session, we will obviously cover this part. However, the REIT status allows it not to pay any tax. To be more precise, the company has to pay them, but it will be entitled to a refund. Indeed, in the normalized earning analysis, we will take the 2017 and notice that there was a refund for $2,346M.

In order to calculate the sustainable earnings, I have taken the average revenue of $2,704M for the past 20 quarters and calculated the average margin profit of 14.90% for an earning of 403M. The average margin profit is calculated on five years average to adjust for the business cycle.

I have assumed the necessary SGA costs I would incur if I would have to run the hotel and sustain the current earnings. However, I thought that in this case a 25% could be considered as part to grow the business, so I have adjusted the earnings adding back 25% of the average SGA expenses.

Therefore, 25% of SGA costs would be $16.45M. Hence $403M plus $16.45M would be equal to $419.5M that, adding the excessive depreciation I have estimated as being $284M would be $703.5M in total.

In a “typical” non RIET company, I would have subtracted taxes from both earnings and excessive depreciation. However, since we are in a REIT model and we are assuming PK will keep the REIT status, I am not doing so.

PK is now trading at three times normalized earnings. If we consider the interest around $205M, then its TEV/EBIT is equal to $5,906M/$908.5M =6.5 times. The FFO average pre-COVID19 has always been around to $550M.

Discounted Cash Flow Analysis

I usually don’t use discount cash flow analysis for value investing strategy. Still, being the current circumstances different, as I described above, I thought that this approach would be useful to have another perspective on PK’s asset value once cash flow is normalized.

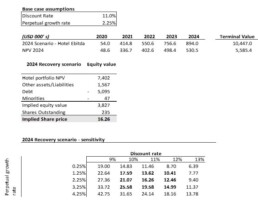

I have worked a discounted cash flow analysis considering a minimum perpetual growth and a recovery scenario in 2024.

I’ve assumed a gradual recovery in EBITDA to reach pre-COVID levels in 2024. My underlying assumptions in the DCF model are 11% discount WACC (which looks very conservative as current debt represents around 60% of total sources factoring equity at market value) and 2,25% perpetual growth rate.

Under these assumptions, my conservative target price could be in the region of $16.5 per share leaving above 60% potential upside at current prices. I’ve also made a quick sensitivity to check to which extent the equity value is sensitive to WACC and perpetual growth rate.

To justify the current price, you should either assume inflation minus perpetual growth rate or two digits WACC. Both are not reasonable considering the nature of the business and PK capital structure.

Catalyst

It isn’t necessary to dig deeper into more metrics to explain the value of such assets in the case that COVID19 fades away, and earnings eventually get back to normal. If we take a look from the other side to the pre-COVID19 profit and loss, we will understand the potential of the revenue generation outside the pandemic environment.

I am confident that due to the strength of the Balance Sheet and the available liquidity for over 24 months, that PK is a great card to play. A COVID Vaccine and consequentially a return to traveling will significantly increase the PK valuation rapidly

Risks

Risks are directly connected to the extended COVID situation. The time frame that takes to return to sustainable earnings is what instantly impacts the valuation. I believe that in case of need, the strong balance sheet and the low leverage scenario would allow the company to pull another 1 Billion credit line easily.

Another possible Risk is if the company loses its REIT status, this itself due to tax saving can be worth $6 – $7 per share.

Insiders

It’s useful to add that in recent months, insiders have been purchasing shares at a price on average much higher than today’s price.

I would like to repeat the disclaimer that this is not financial advice. This article is just an analysis of a company that I decided to share because it is an example of how the current situation has affected the stock market and how I analyze firms under a Value Investing approach. You can read my article about “Investing under the new paradigm” if you would like to have a more holistic idea of my investing perspective during and after COVID-19.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Interview with Dominican Economist Jordan De Los Santos

In this interview, we talk about the Dominican Market’s opportunities for investment growth, some hotel industry insights, and Real Capital Caribe’s competitive advantage.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

May 21, 2019