Value Investing Analysis: Park Hotels & Resorts (PK)

Many of my friends, employees, and followers ask me how I analyze companies before investing. My answer is usually “that depends on my investment approach for that particular asset”. Park Hotels & Resorts (PK) has been one of my last moves in value investing, so I would like to share with you, in a simplified way, how I analyzed this particular stock at this particular time.

Park Hotels & Resorts is a USA Hotel REIT that initially was a spin-off of Hilton (HLT). Most of its real estate assets are in a public REIT whose portfolio consists of 60 premium-branded hotels and resorts, all currently located in the USA. Their mission is “to be the preeminent lodging REIT, focused on consistently delivering superior, risk-adjusted returns for stockholders through active asset management and a thoughtful external growth strategy while maintaining a strong and flexible balance sheet.”

PK, being among the top 30 in the USA, is a large REIT. It currently has 60 Branded Hotels with 33k+ rooms. A significant acquisition was made in 2019: PK purchased Chesapeake Lodging Trust for $2.5B, diversifying its assets locations and expanding its exposure to Marriot and Hyatt brands. Management has been able to dispose of and acquire Hotels effectively.

Since the spin-off, PK’s management has disposed of 24 hotels and acquired another 18 changing the hotel adjusted EBITDA from $97M to $181M. In 2018 13 hotels were sold for $519M, 10 of them belonged to its international division. In 2019 other 8 hotels were sold for $497M, and they acquired Chesapeake. Finally, in 2020 they sold their last two foreign hotels for $208M getting out of the international market.

Pk's Portfolio

Its geographical distribution is impressive, from the San Francisco Union square to the Hilton New York midtown. More than 85% of PK’s properties are in the luxury or upper-upscale segment.

Insights analysis

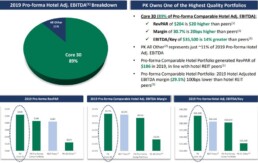

As a Hotel owner and investor, the first thing that pops to my eyes is that almost 90% of PK EBITDA comes from its core 30 Hotels. More importantly, its REVPAR is 20% higher than its peers at $204. EBIDTA/key is roughly $35,500 (pre-COVID19), which was 14% higher when compared to its peers.

REVPAR is the hotel industry metric that indicates the revenue per available room. Higher revenue per room would mean, in the Hotel industry, that there is a moat or client captivity due to the location of the hotels or/and superior management.

As a value investor, I always try to proceed with a proper value investment analysis, Santos/Greenwald’s style. In essence, I would calculate the Asset Value with appropriate adjustment for depreciation, the Earnings Power Value with proper adjustment to the income statement for sustainable earnings, and then compare them.

Once I have found superior management and EV higher than AV, only at that point, I would assess the entry barriers and calculate the franchisee value. However, I don’t want to annoy you with my classical valuation methodology because, in this case, being a REIT, I would value it as an asset play and use different reasoning, mostly objectively focused.

Investment Thesis

My investment thesis is that we are buying superior-location and well-managed big-brand hotels strategically distributed all over the USA for the price to tangible book of around 0.41x.

Price to Tangible Book is a metric that could be useless in some sectors. However, I consider it particularly useful in real estate. This company has been affected dramatically by the COVID19 pandemic, as several PK hotels have been temporarily closed. Nevertheless, my line of argument is that PK strong Balance Sheet and liquidity make PK a winning bet for a quick recovery when the fear of the disease disappears, and the occupancy rate gets back to pre COVID19 levels.

About cash-burning, the management has estimated 73 million, of which 23 million are for corporate expenditures and the remaining 50 million for hotel operating expenses.

Let me give you a quick look at the most recent Balance Sheet

The balance sheet does not hold any Goodwill because it has already been impaired. Also, from the liquidity side, we have some extra good news because all the covenant has been amended.

Amended covenants overview

Exercise of Extension Options:

- revolver maturity extended to December 2021.

- Covenant Waiver.

- Suspend compliance with all existing financial covenants tested through and including 3/31/21.

- Pledge equity in certain subsidiaries to secure the facilities (eight high-quality hotels— a mix of urban, resort, and suburban).

- Adjust levels of particular financial covenants after such a period.

- Minimum liquidity covenant of $200M.

These and other amendments have been set in place to reduce the impact of the current pandemic impact.

PK has Hotel properties for $9,627M (again without Goodwill, which has all been impaired). Its cash position is $1,304M, and total debt would be around $5,095M without considering leasing.

Equity valuation

My valuation delivers an equity value of $3,8bn vs a market cap at the moment of writing of around $2,1bn. (235m shares net of treasures for the price of almost $9).

Normalized earnings

The first consideration is that PK has a REIT status. In the Risk session, we will obviously cover this part. However, the REIT status allows it not to pay any tax. To be more precise, the company has to pay them, but it will be entitled to a refund. Indeed, in the normalized earning analysis, we will take the 2017 and notice that there was a refund for $2,346M.

In order to calculate the sustainable earnings, I have taken the average revenue of $2,704M for the past 20 quarters and calculated the average margin profit of 14.90% for an earning of 403M. The average margin profit is calculated on five years average to adjust for the business cycle.

I have assumed the necessary SGA costs I would incur if I would have to run the hotel and sustain the current earnings. However, I thought that in this case a 25% could be considered as part to grow the business, so I have adjusted the earnings adding back 25% of the average SGA expenses.

Therefore, 25% of SGA costs would be $16.45M. Hence $403M plus $16.45M would be equal to $419.5M that, adding the excessive depreciation I have estimated as being $284M would be $703.5M in total.

In a “typical” non RIET company, I would have subtracted taxes from both earnings and excessive depreciation. However, since we are in a REIT model and we are assuming PK will keep the REIT status, I am not doing so.

PK is now trading at three times normalized earnings. If we consider the interest around $205M, then its TEV/EBIT is equal to $5,906M/$908.5M =6.5 times. The FFO average pre-COVID19 has always been around to $550M.

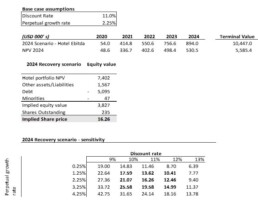

Discounted Cash Flow Analysis

I usually don’t use discount cash flow analysis for value investing strategy. Still, being the current circumstances different, as I described above, I thought that this approach would be useful to have another perspective on PK’s asset value once cash flow is normalized.

I have worked a discounted cash flow analysis considering a minimum perpetual growth and a recovery scenario in 2024.

I’ve assumed a gradual recovery in EBITDA to reach pre-COVID levels in 2024. My underlying assumptions in the DCF model are 11% discount WACC (which looks very conservative as current debt represents around 60% of total sources factoring equity at market value) and 2,25% perpetual growth rate.

Under these assumptions, my conservative target price could be in the region of $16.5 per share leaving above 60% potential upside at current prices. I’ve also made a quick sensitivity to check to which extent the equity value is sensitive to WACC and perpetual growth rate.

To justify the current price, you should either assume inflation minus perpetual growth rate or two digits WACC. Both are not reasonable considering the nature of the business and PK capital structure.

Catalyst

It isn’t necessary to dig deeper into more metrics to explain the value of such assets in the case that COVID19 fades away, and earnings eventually get back to normal. If we take a look from the other side to the pre-COVID19 profit and loss, we will understand the potential of the revenue generation outside the pandemic environment.

I am confident that due to the strength of the Balance Sheet and the available liquidity for over 24 months, that PK is a great card to play. A COVID Vaccine and consequentially a return to traveling will significantly increase the PK valuation rapidly

Risks

Risks are directly connected to the extended COVID situation. The time frame that takes to return to sustainable earnings is what instantly impacts the valuation. I believe that in case of need, the strong balance sheet and the low leverage scenario would allow the company to pull another 1 Billion credit line easily.

Another possible Risk is if the company loses its REIT status, this itself due to tax saving can be worth $6 – $7 per share.

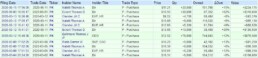

Insiders

It’s useful to add that in recent months, insiders have been purchasing shares at a price on average much higher than today’s price.

I would like to repeat the disclaimer that this is not financial advice. This article is just an analysis of a company that I decided to share because it is an example of how the current situation has affected the stock market and how I analyze firms under a Value Investing approach. You can read my article about “Investing under the new paradigm” if you would like to have a more holistic idea of my investing perspective during and after COVID-19.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.