Investment summary

- Streaming platform representing a cable-cutting alternative

- Well managed with a clear path to growth on core business

- Opportunities to diversify revenue stream

- Interesting valuation with high potential upside

What is FUBOTV

FUBOTV INC (NYSE: FUBO currently 27.40 $ per share as of December 3, 2020) is a streaming platform focused primarily on live sports. It is a cable-cutting alternative, especially for those who watch various sports channels and don’t want to miss any game, some of them in 4K.

The basic plan, which allows two simultaneous users, includes 100+ channels (more than 24 sports channels), 30 hours of cloud-based DVR for a monthly price of $59.99, and the “Fubo Extra” for $5.99 to add 44 more channels. Like cable TV, they offer several subscription plans, add-ons, and extras. FUBOTV’s interface is friendly but also similar to the cable TV ones. As you would imagine, it can be streamed through smart TVs, mobile, tablets, several devices like AppleTV, Chromecast, Amazon Fire, Roku, Xbox, and on the internet.

The sector is being reshaped

The sector is crowded by cable providers and by a plethora of streaming platforms. But the competitive hedge in the sector is being shifted and competition is not anymore on prices. The focus is now on quality, accessibility, interface, scalability, and contents. Streaming platforms are killing cable tv. At a certain stage we believe streaming platforms will tend to merge to benefit from economies of scale and keep up ARPU. M&A wave might be a major value driver in the sector although its still too early to factor it into current sector multiples. Furthermore, streaming platforms have great opportunities to diversify their revenue stream by increasing advertising (a linear function of the number of users) ecommerce and betting (see recent FUBOTV deal with Balto sports).

Where the upside may lie

FUBOTV is scaling up dimensionally very fast and is expected to keep growing not only on its traditional subscription business but also by expanding into gaming, betting and ecommerce. FUBOTV management is doing the right steps and if FUBOTV’s strategy proves to be effective, there is a substantial upside on this equity story as it is currently trading at 4x P/sales 2021 while it could converge to 8x (peers trading also at 11x) which would be in line with our FCFE model (Ebitda margin stabilized at 70% from 2025 onward, 70% EBTDA to FCFE conversion, 12% cost equity, 3% g).

FUBOTV: the sector and the competitive hedge

The sector is crowded by a plethora of competitors, some of which are not publicly traded for the time being. We believe although that, given current valuation metrics, some might soon considering going public.

DAZN:

English sports streaming service available in the USA, Austria, Brazil, Canada, Germany, Italy, Japan, Spain, and Switzerland. They are expected to go globally for more than 200 countries by December 1st, 2020. We are paying attention to this one because we believe it might be a real threat to FUBOTV.

Hulu:

Streaming service majority-owned by Disney. At the time, it has more than 36 million users. Even though it isn’t primarily focused on sports, it has all the local and national sports channels. For instance, their clients’ value is said to be $6,000, while for FUBOTV, we are being much more conservatives and calculate a customer value of around $550.

YouTube TV:

Features outstanding sports coverage, and like FUBOTV, it is a cable-replacement service. The prices are very similar to the ones of FUBOTV. It also has excellent cloud-based DVR capabilities.

Of course, FUBOTV also competes directly with cable providers. They have been around for a reasonable amount of time and are still important. However, the sector is being reshaped, and they are not competing anymore on prices. The focus is now on quality, accessibility, interface, scalability, and contents.

Opportunities ahead

Besides the regular expectations of more premium paid contents, like important hosted events, we think that there are good opportunities in two major segments:

Advertising

There is room for advertising growth on FUBOTV. As the number of customers grows, the capabilities of selling ads on the platform increase exponentially. Some extra features and metrics like CPC and CPA that online advertisers love must be taken into consideration.

Betting and Ecommerce

FaceBank’s eCommerce and payment system platform allows FUBOTV to penetrate the betting market. The recent acquisition of Balto sports (terms not disclosed) proves that the betting market is another excellent opportunity. Sports and betting go hand to hand very well, and online betting platforms like Draftkings keep growing. FUBOTV’s CEO David Glandler, an expert in the market, declared that they are looking forward to exploiting these opportunities in the future.

Financial overview & some insights

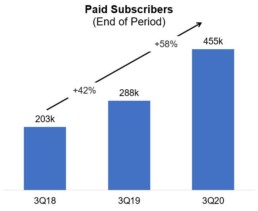

The company has greatly benefited from the COVID-19 situation, reaching an all-time high number of paid-subscribers of 455k+ in Q3 2020, increasing 58% to the same period of last year. The revenues were $61.2mln, an increase of 47% year-over-year. Subscription revenue increased 64% YoY to $53.4 mln, and advertising revenue increased an impressive 153% YoY to $7.5 mln.

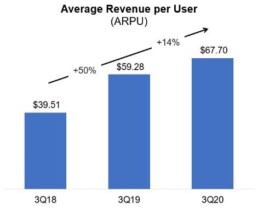

The average revenue per user (ARPU) increased 14% year-over-year, giving an excellent insight into the users’ price sensitivity. The company was able to increase the price and keep its users even though they raised the different plans’ prices.

In the first and second quarter of 2020, the revenues were $51mln and $44.2mln. The YoY increase was 78% for Q1 and 51% for Q2. The management for the last quarter of the year looks forward to a 60% year-over-year increase, which means $80-$85mln in revenues.

|

2020 |

||||||

|

1Q |

YoY % | 2Q | YoY % | 3Q |

YoY % |

|

| Total revenues | $ 51.0 | +78% | $ 44.2 | +53% | $ 61.2 | +47% |

| Subscription | $ 46.4 | +74% | $ 39.5 | +51% | $ 53.4 | +64% |

| Advertising | $ 4.1 | +120% | $ 4.3 | +71% | $ 7.5 | +153% |

Source: Company financial reports

FUBOTV’s number of paid subscribers has also been growing along with the Average Revenue Per User (ARPU). Most of these users are probably migrating from the “old model” of cable TV which is being disrupted.

|

2020 |

||||||

|

1Q |

YoY % | 2Q | YoY % | 3Q |

YoY % |

|

| Paid subscribers | 287,316 | +37% | 286,126 | +47% | 455,000 | +58% |

| ARPU | $54.16 | +25% | $54.79 | +8% | $67.70 | +14% |

| Total content hours | 107.2 million | +120% | 98.6 million | +83% | 133.3 million | +83% |

| MAUs | 120 hours | +52% | 140 hours | +54% | 121 hours | +20% |

Source: Company financial reports

ARPU: Average Revenue Per User

MAUs: Monthly Active User’s average number of consumed content (hours).

Key concepts to approach subscription-based companies

FaceBank and FUBOTV closed a merger agreement that seeks to enhance FUBOTV’s offering by combining FaceBank’s global e-commerce and payment platform and its technology-driven IP in sports, movies, and live performances with FUBOTV’s platform. This merger was a good move for the future possibilities of FUBOTV of getting into the betting market.

This kind of companies should not be compared to “old economy” firms. One of the main characteristics of subscription-based businesses is that it generates recurrent income by its customers as long as they are subscribed. We have to look at this companies as we would do for Netflix, for instance.

We first have to understand that the metrics of the company change accordingly to the company’s stage. The most successful the company is in acquiring new customers, the biggest will be the losses at the beginning. However, the customer acquisition cost (CAC) will generate revenue that will be kept for a certain length of time.

The happier the customer, the longer it will stay subscribed, and therefore it will be more valuable for the firm. So, having satisfied clients is translated into having a better customer lifetime value (CLV).

Once clear that traditional metrics to value a company are not taken into consideration when it comes to subscription-based firms we have to rely on some basic concepts:

Customer Churn Rate (CCR):

Churn rate is calculated by dividing the number of users at the beginning of a period less the number of users at the end of the same period by the number of users the beginning of the period. So, it is the rate that calculates how many users abandon the service in a certain period.

Customer Lifetime Value (CLV):

It is the Average Revenue Per User (ARPU) by the Customer Churn Rate (CCR). It measures how long the client stays with the service and how much revenue it provides.

Customer Acquisition Cost (CAC):

It measures the cost to acquire a user. CAC is equal to the total sales and marketing expenses divided by the number of new customers added. The expenses must be just the ones used to attract new clients, and promotions for current users must be excluded.

CLV:CAC ratio:

The relationship between the Customer Lifetime Value and the Customer Acquisition Cost is usually referred to as the “CLV:CAC ratio.” This is one of the most important metrics for subscription-based companies when it comes to profitability.

At the beginning, like all growth companies, we need to be very careful when looking at the Research and Development costs because they will be placed in the GAAP accounting. However, those intangibles will be capitalized over time. For FUBOTV, FaceBank, and Balto Sports are actually future drivers of value and contribute to the acquisition, retention, and monetization of users.

The concept of unit economics commonly englobes these indicators and others related to them. It looks directly at the revenues and costs associated with the firm’s business model. The concept is used for the projections of the company’s profitability. In subscription-based companies, the basic units are the subscribers.

ECLV ratio:

As you could imagine, to value FUBOTV, we will also need to calculate the expected customer lifetime value or “ECLV.” Under the assumption that the ARPU will be constant, we can say that the ECLV is the average return per user multiplied by the customer lifetime. ECLV = ARPU * CL

On the other hand, if we assume that the churn rate remains equal over time, the ECVL could be equal to the ARPU divided by the CCR. ECVL = ARPU / CCR

How could the valuation be approached?

I think that one way to get a fair valuation would be by calculating the users’ present value. So we first need the Cash Flow Per User (CFPU) and a discount rate (r).

To calculate the present value of future users, we can use:

Notice that we will need to subtract the cost of acquiring those clients at the end of the equation. Then to calculate the present value of current users, we would use the same without that last part:

We are going to apply these concepts in our approach to the valuation in a later stage.

Given the current stage of FUBOTV, we are unable to fully assess its churn rate. We first need to understand if the company could have a real moat. We do believe that strategic mergers and partnerships could increase the revenue of the firm. Nevertheless, until a competitive advantage is developed, their business model is under high risk as they might fail to grow, and the valuation would collapse.

Our valuation approach to FUBOTV

Our goal is to find the Present value of each FUBOTV client. The valuation would probably be the present value of the existing customers and future clients’ cash flow. Therefore, the concept of CAC (customer acquisition cost) and Churn Rate are essential to define, and they will have an impact on the company’s final valuation.

At this stage of the company’s life, attention needs to be put on the ability to retain the clients and keeping them because they can later switch to other platforms and therefore create tremendous damage to the valuation of the company. It all comes down to the moat.

It is extremely difficult to have a reliable quantitative model because Retention Rate and CAC will most likely depend on the competition. We believe indeed that the company’s effort would be to create a fantastic customer experience through acquisition. Still, if they fail to make a tremendous value experience for the clients, their business can be in danger.

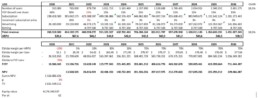

The spreadsheet below is based on a client’s subsection that will have an annual compound growth rate. Initially, around 50% and then eventually will go down approximately 15%, which is very conservative. The same thing can be said about inflation. We have assumed a 3% price increase, which is again low as we consider that new competitors might lower prices or offer a better proposition trying to “steal” clients.

We have considered an EBITDA margin which starts negative and stabilizes in 2025 at 70%. This means that from 2025 onward 70% of ARPU is transformed into EBITDA. Some other subscription platforms can rely on higher margins. However, we believe 70% EBITDA margin at regimen is a very reasonable measure.

The other key assumption we have made is that 70% of the Ebitda is converted into FCFE (Free cash flow to equity, residual to shareholders) which can finally be discounted at an appropriate cost of equity to figure out the equity value.

We have used a 12% cost of equity and 3% perpetual growth rate. We could have done a more in-depth analysis of the beta and rely on a capital asset pricing model (CAPM). However, we believe it would not make much sense at this stage because the CAPM fails to deliver a reasonable cost of equity in cases like FUBOTV where basically the correlation to the index is limited as the company was recently listed.

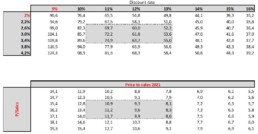

So, we decided to rely on a sensitivity analysis which calculates the price per share by changing the cost of equity and the perpetual growth rate (g). Assuming a discount rate between 11% and 13% and a perpetual growth rate between of 2.6% to 3.4%, the average price could be between 55 and 69 $ per share. We would be confident in assessing a target price around $60 per share (current share price around $ 27 per share).

We have also checked the 2021 P/sales ratio implied by our sensitivity. In other words, in table 2 we show for each equity value (or price per share) which is the implied 2021 P/sales.

Currently FUBOTV is trading around 4x P/Sales 2021, very far from ROKU which is trading at a P/sales 2021around 12x.

In table 3, we show that at a P/Sales around 10x in any given year from 2021 to 2030, we come out with a market cap which, discounted to present at 12% cost of equity, delivers around $60 target price.

We are aware that our valuation relies on FUBOTV being able to scale up dimensionally vary fast. We are also aware that we have not set a timeframe to reach our valuation. We believe it is not the case because of the nature of the business and the stage of the company.

However, we believe there is evidence enough to consider FUBOTV as a growth company with an interesting potential upside which could find room in a portfolio of any smart investor focused on growth. We will update the valuation according to the news flow. STAY TUNED!

Spreadsheets

Table 1: DCF model

Source: Antonio Velardo personal elaboration

Table 2: Sensitivity analysis and 2021 implied P/E sales

Source: Antonio Velardo personal elaboration

Table 3: P/E sales implied by our FCFF DCF model

Source: Antonio Velardo personal elaboration

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.