In life and business, consistency is essential. The ability to show steadiness with your thoughts gives you leverage in the form of moral authority. One of the main characteristics that leaders share is stability and commitment to their previous thoughts and ideas. Many “lazy” thinkers (sheep) want to follow somebody they can trust, that does not change their mind. In equity investment, not changing your mind can be fatal – for your capital and the capital you manage on behalf of others.

An equity story cannot be a life commitment, neither can you show devotion to them as a religion or your favorite football team. Things change, executives make mistakes, new technologies come, macro scenarios change, and more than anything else, you could realize you were WRONG. That happens as well, and there is nothing wrong with it unless you persist in the error. Many money managers and equity analysts want to avoid admitting mistakes and stay with their thesis. After years, not only do they look stupid, but they also affect their capital and/or the capital they manage.

I made a mistake with ATER. In the last few years, thanks to God, I did not make many, but ATER was one of the worst I made for sure.

When you sell a stock at a loss, you can use that amount to buy another, and if that new investment goes up, you make money back (with less risk sometimes). So, you don’t have to wait until you recover your losses with the same stock when you can redirect that money into a better strategy. I know it’s obvious, but some people get stuck for years in a losing position without realizing or admitting that it was a mistake when they should have shaken it off and move forward.

In the last few months, from October 2020 to February 2021, we have lived a very hectic stock market period where we had no time to sleep, primarily due to momentum stocks going higher every day. During that kind of pre-bubble time, in which it is impossible to cover all those stocks profoundly, you always have a few that you leave more to your team, rely on third parties, or you go over them by yourself but not with the needed level of in-depth analysis.

ATER was one of those companies I quickly looked at and therefore didn’t pay too much attention to some details that I left in my analysts’ hands. I checked up the models but didn’t have the time to dig deeper into the story, which at the moment seemed a straightforward, growth story.

I have come to believe that DCF for growth stories is something that doesn’t make much sense. Most of it has so many assumptions that it becomes a very risky bet. That’s why I usually prefer Sustainable Earnings (EPV) valuation, which allows us to analyze what the company has achieved in recent years and therefore provides a “feet-on-the-ground” idea of what it can deliver in the future.

I like some small growth stories on which I have small positions on my portfolio, between 1% and 2%, which gives me the ability to spend less time studying the stock because of the implied risk for my overall performance. Of course, I spent much more time analyzing the companies where I have more significant positions and still follow and study them closely.

I would have taken more prominent positions. However, time management is an essential skill, especially in high-volatility environments where opportunity cost is outrageous. You must spend more time on the significant convictions of your portfolio rather than trying to make the impossible and cover all the “promising-looking” stories.

The lack of proper due diligence is behind any mistake

Many FinTwit gurus only push the stories and never go into valuation assumptions or perform a proper strategic analysis of the stocks. They overlook the matter by throwing some multiples (usually P/S and EV/S); those multiples are a hazardous way to value a company. Especially in a period of bullish market in which relative multiples are very high and even more when you choose the wrong peer and compare “apples with oranges.” Different companies usually have distinct growth and risk implications, and this can bring two companies of the same space to have unrelated multiples justifiably by their intrinsic and individual characteristics. So, executing a valuation by simply looking at multiples can be extremely harmful because it might lead you to believe that a company is cheap when it is overly expensive.

Revenue Growth is meaningless to value a company unless it is not aimed to produce future free cash flow. Don’t forget that! Most Tech companies, especially SaaS, are based on a subscription model, and most of their revenue can be converted into EBITDA and then eventually free cash flow. When you buy software companies, 80% to 90% of that revenue can be converted into free EBITDA. Once you consider the cost of customer acquisition and the churn rate, most of the income would be cash, so multiples like EV/S may make some sense.

Because of the above argument, some gurus in the FinTwit community take for granted that EV/S is a useful metric for all Tech companies in general when it is bloody not!

Look at the kind of people we need to answer to on Twitter:

Stock pumping on Twitter is creating virtual boiler rooms

Stock pumpers manipulate followers and leverage their lack of knowledge. FinTwit traders have a dangerous behavior that fraudsters can exploit. When you learn about something, understand the terms and have some experience but don’t comprehend the subject deeply, you could be in danger. Because you are at a stage where you think you can handle a conversation, you can put your head around it, so you feel you don’t have to say, “I know nothing about it,” but deep inside, you know you don’t master that topic. That degree of knowledge is dangerous because it is not enough to address the issue accurately and not too little to let you walk away so that you can get played!

Wrong valuation input leads to big mistakes!

When you do a DCF on a growth story, you rely on multiple extremely difficult assumptions to hit correctly. Terminal growth could be responsible for 60% or more of your final equity value, and the model would be susceptible to the hurdle rate you use and the assumed growth. When you don’t know how value drivers move (Free cash flows either to the equity or to the firm, hurdle rate, and terminal growth), you are not safely investing. For some companies, DCF just doesn’t make sense.

As an example, let’s dig into ATER’s valuation technicals, and let’s try to explain what the issue with ATER is.

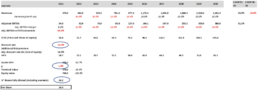

Look at what happens to ATER’s DCF model if you change some of the realities of the company to reflect new evidence:

- Raising Hurdle rate from 14% to 16%

- Reducing terminal growth rate from 3,5% to 1%

- Increasing the share count from 23.2 mil now to 26.2 (however, we could also use 30 to incorporate options and higher strike price warrants, but to avoid critics to this methodology, we use the share count on a weighted average basis)

One could argue that 16% as a discount factor is too high? Well, think about it again: if debt holders are getting 8% on a cash basis with an option to avail warrants, the real cost of debt is north of 12%. Wouldn’t the equity holder be compensated a few extra percentage points of risk premium?

The growth dilemma leads to other big mistakes!

That said, let’s now try tweaking the revenue CAGR growth rate. Growth can slow down if the share prices remain depressed. This is because one of the major investment theses of this company revolved around accretive M&A deals. To remain prudent, here we are assuming that the company’s organic growth does not decline, instead remains stable and grows slowly – which is also a big “if” and risky assumption. We will decode this argument later. If you tried to capture this scenario, valuation again drops significantly.

The fallacy of such a method to value this company is that we are missing the whole point by purely basing the valuation on growth assumptions from now to 10 years ahead. Trying to foresee the growth for a company like this is misleading. Revenue doesn’t mean anything; EBITDA is what matters, or, if we dig deeper, how much EBITDA you can convert into free cash flow. This is especially true when the company is externally buying growth at a high cost of capital.

While I was busy, my team prepared a DCF on ATER; sometimes, busy analysts do that quickly by using consensus and maybe adjusting for a higher hurdle rate if they smell implied growth might be high. By inputting consensus numbers and calculating a reasonable hurdle rate, you most likely will understand what the market thinks about the company.

When the initial model was constructed, the M&A activity of the company was done in an accretive way because the market cap was more than two times what it is today. So it was easy for the company to grow by giving shares in exchange. This narrative has now changed, as ATER is down more than 60% from its ATH, and buying assets in exchange for shares is highly dilutive for ATER. Think about it this way: if you are worth USD 1bln and buy an asset worth USD 40 mln, your share base dilution would be 4%. After a 60% share price drop as in the case of ATER, the same deal would lead to a a 10% share base dilution.

If we look at the products ATER bought, they are pure Chinese garbage. Objectively, they are cheap goods that sell well online. How much the company can grow is NOT the most crucial factor here.

A company can grow its sales CAGR at a factor of infinity. Still, the most crucial element is that whatever they sell makes enough money to pay for the debt and gain a reasonable amount of money. Think about it, plain a simple, they can keep buying all the companies they want and become a 100 billion turnover, but they are buying with a capital that needs to be reimbursed after the debt is paid, and that is the key.

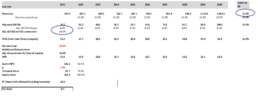

So, the parameter you have to adjust in the DCF model is not only growth, but the most critical part is the EBITDA conversion to Free Cash Flow and EBITDA Margin.

Look below:

Getting back to company valuation, the most crucial element to analyze a company is its free cash flow. We all know that valuation is just trying to figure out the future cash flow of a company and bring it back discounted of the hurdle rate to today’s value. Still, some of these genius stock pumpers don’t even know what a hurdle rate is.

When you work on ATER’s model, you take for granted that the EBITDA margin will grow towards 15%, as indicated by the management. Only focusing on the growth will tend to overvalue the company. This is very easy to understand. ATER is buying growth. They are buying companies financing growth north of 12% (8% + warrant), so revenue increase is not an issue that is relatively easy to achieve. It would be best to make sure the company you buy will generate enough money to pay for the debt and remunerate the capital accordingly to satisfy the risk incurred.

Growth is not a helpful metric because ATER is buying it; ROIC is what we have to analyze because if your return on capital is not adequate, you can grow, destroying value. ATER sells stupid cheap Chinese goods, and they have to increase the sales of those products to justify their investment. If they can grow their sales and make a good spread between the money they borrow and what they make, then the business can succeed. However, if these products will go out of favor, or they won’t be able to sell them for a higher price, this company can easily go bankrupt. YES, it can be worth ZERO.

AIMEE is not a competitive advantage

ATER claims AIMEE to be the key to its business model. Well, AIMEE is just a data software that works with data inputs, and it has a code that would analyze data in a certain way. This doesn’t seem to be an advantage or a moat. What should be monitored closely is what kind of advantage AIMEE can offer. In my opinion, it was just one of those gimmicks where a company tried to take up SaaS valuation by selling an investor story involving this tech.

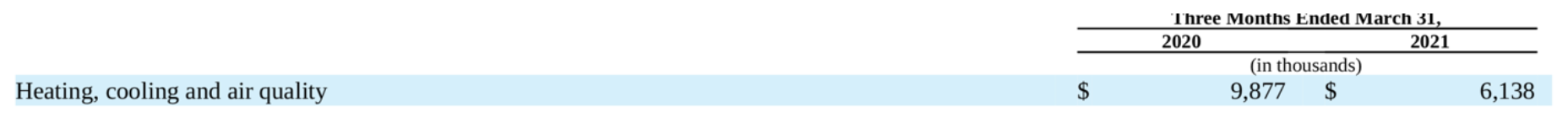

Look at this scary situation, one of the crucial revenue segments is going down dramatically:

Source: 10Q

This is what we need to look for as investors. Can they grow sales of the companies they are acquiring? Their rebuttal was:

Source: 10Q

What happened to AIMEE? They are selling 37% less because of “sell-outs inventory”? So, all this competitive advantage due to AIMEE technology that is supposed to optimize the process does not exist?

A company could hide their organic growth slowing down but keep growing revenue by buying companies at high prices and higher multiples if you don’t have a breakdown of the different companies. These companies could be running a Ponzi scheme, and it would not be easy to spot them if their financials don’t share segment by segment details.

Another FinTwit myth that needs to be clarified: Don’t get fooled by the story that a new high growth story does not have to be profitable. Some companies could not be profitable initially but will be investing heavily in Research and Development (R&D). Think about Amazon, Apple, or any other company that has spent years developing technologies that represent an actual moat. So, if you look at the P&L, you will see hundreds of millions or even billions spent during years to develop a technology.

You will see this cost deducted from the profit. But when the technology is eventually developed, all those R&D will ultimately manifest itself in a growing cash flow stream. In the case of ATER, their R&D is negligible – in 2020, they spend less than 4% of their revenues in R&D.

Conclusions

You should invest in ATER only if you believe that AIMEE provides a substantial competitive advantage. Their organic sales will grow steadily, and their products won’t get out of favor. It would help if you also trusted that they would be able to get better debt conditions. But how would you know that?

Moreover, let’s address two quick issues; in valuation, there are parameters to check for accounting manipulation called Benish Score and Z score. Although the explanation of these tests is beyond this article’s scope, I am not suggesting they are manipulating their books, but the possibility remains.

Nonetheless, a company like this could do this easily because of the setup of the business model. If they don’t show the breakdown of organic growth for each company they buy, they can show a higher EBITDA. Still, we wouldn’t know if EBITDA growth is fueled by a new acquisition (from expensive debt) or was fueled organically. Only the insiders like the CFO know that. ATER, former CFO left after the short report (according to the report, he had previously bankrupted a company).

So, back to the main issue, if the EBITDA growth cannot be assessed accurately, we will never know if it is a company with a stable future. Sometimes you can also define a stock by analyzing who is primarily investing in it. Feel free to go on the Twitter feed and check the kind of people pushing ATER, their financial background, as well as their motives. I was not impressed.

So, if you are a momentum trader and want to ride this, there is nothing wrong with it. If the growth story keeps going up again, ATER could get pumped back to $30 or $40 once again. But remember that price and value remain two different things.

I don’t know, and I don’t care where ATER will go. I don’t want to be seen like somebody who promotes this stock because I don’t feel safe and made a mistake the first time I bought it.

Because I changed my mind about ATER and made some tweets expressing my concerns, I was bullied and even received death threats and all sorts of insults from several Twitter accounts that are bullish on the stock. I have initiated legal procedures, and my lawyer already informed the police that they are constantly monitoring Twitter and taking things very seriously.

This is my last post on ATER, and I don’t want to talk or tweet anymore about it. I am not short yet; I would only take a short position eventually if there is further strong evidence of organic growth slowing and price momentum gaining traction. That said, I will pursue legal actions if I receive insults or threats because of my view and opinions.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Thanks for the detailed analysis

Great content! Keep up the good work!