In the fast-paced today’s world of investing, it is always exciting to discover a compelling opportunity that holds favorable upside potential. As a discerning value investor, my relentless pursuit is to uncover opportunities where the market may be overlooking a company’s true worth, leading to an undervaluation. Today, we shift our focus to an intriguing investment occasion: Sphere Entertainment Co. (SPHR); a spin-off from the renowned Madison Square Garden Entertainment Corp. (MSGE).

SPHERE

SPHERE is an innovative entertainment venue under construction in Las Vegas. It promises to be quite a spectacle with a slated opening in September. Although Las Vegas is accustomed to grand entertainment venues, SPHERE is set to redefine expectations.

Located in the heart of the Las Vegas Strip, adjacent to the esteemed Venetian Hotel, the MSG Sphere (as it is also known) has the potential to become a long-standing central attraction for the city. With a seating capacity of approximately 17,000 to 18,000 and a standing capacity of about 20,000, the venue incorporates cutting-edge technology, including a 190,000-resolution screen enveloping the entire building, spanning an impressive 160,000 square feet.

The SPHERE’s sound system will incorporate more than 165,000 speakers, and its 600,000 LED lights promise to create stunning visual experiences. It is designed to host a variety of events, including concerts, boxing, MMA fights, and esports tournaments. SPHERE promises to be one of the most iconic venues and tourist attractions in Las Vegas and will be even seen from flights landing in the city.

Analysis

To understand the calculations, we first need to understand the structure of the company before and after the spinoff. The original company MSG had broadly four types of assets/businesses,

- Maddison Square Garden

- Sphere Construction project

- Maddison Square Garden Networks

- TAO Group.

As a result of the spin-off, Sphere Entertainment Co. (SPHR) is composed of three assets: SPHERE, MSG Networks, and TAO GROUP. As well as a 33% interest in Madison Square Garden Entertainment Corp. (MSGE).

One development worth noting is the sale of TAO Group a post-spinoff where SPHR is expected to receive a net of $300 million.

Given the complexities surrounding the spin-off, an asset valuation presents a buying opportunity: acquiring the Sphere asset (built at a cost of $2.3 billion) for less than $500 million. This might seem improbable, yet market dynamics can occasionally create such scenarios.

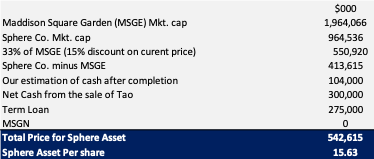

Our calculation methodology takes into account that Sphere holds a 33% stake in MSGE worth north of $636 million at current prices.

To determine the adjusted price of Sphere, we subtract this holding from its overall market capitalization. Additionally, we incorporate a conservative estimate by adding $104 million in cash, considering that approximately $100 million is projected for further construction expenses. Furthermore, we consider the anticipated net cash from the sale of Tao and deduct the outstanding term loan as part of our calculation. We get a price of around $556m which translates into a per share price of $16.02. I must stress the fact that even the initial forecasted cost of sphere was $1.66b provides us with a remarkable discount at current prices.

In the subsequent analysis, we will thoroughly examine the valuation of these assets. It’s essential to remember that an asset’s inherent value is tied to its capacity for generating sustainable earnings and free cash flow. While estimating the revenue potential of a unique asset like SPHERE is a complex task that requires careful consideration of assumptions, even with conservative estimates, the asset’s current valuation suggests an attractive investment proposition.

Advertising

It is important to highlight the uniqueness of Sphere as an asset and its tremendous potential in the advertising sector. The exceptional design of SPHERE grants it a distinct advantage, making it valuable for large corporations seeking branding and naming rights opportunities. Based on media reports, we can see that the Dolan family is actively seeking $50 million in naming rights for Sphere. However, in our analysis, we will adopt a conservative approach and account for only $3 million in potential revenue from naming rights.

SPHERE is not just an entertainment venue but a colossal billboard with 580k square feet of fully programmable LED panels. The magnitude of this structure far surpasses anything currently available. This guarantees superior visibility, making it an unavoidable spectacle for local pedestrians, passers-by on adjacent roads, and passengers in planes flying into Las Vegas.

The advertising strategy revolves around the use of digital billboards, with a display time of 10 seconds. This duration allows for a more conservative approach, ensuring advertisers are comfortable with the length of their ads while maintaining competitive CPM rates. It is worth noting that the 10-second duration aligns closely with the standards set by major billboards in prominent locations like New York City and Los Angeles.

To calculate potential revenue, Sphere Entertainment Co. employs a CPM rate of $8, which is deemed reasonable given the company’s capabilities. With an estimated impression count of 12,500, the daily revenue estimation is around $100,000. Considering 300 days of advertisement in a year we get an annual revenue of $30 million and applying a 45% operating margin, the projected EBIT (earnings before interest and taxes) from the advertising business alone amounts to $13.5 million.

When combined, the estimated EBIT from the total advertising business, including naming rights, amounts to $16.5 million.

Events

Let’s move on to ticketing revenue from concerts, shows, and movies. We could postulate numerous assumptions, but we will maintain a conservative approach to both ticket prices and occupancy rates. An average price of $140 for a concert, considering the anticipated high-profile acts and the Sphere’s unique experience, seems reasonable. Assuming 40 concerts per year and a 60% occupancy rate for the 17,000 seats, and a profit margin of 10%, we could calculate the gross revenue as follows:

The gross revenue for one event: 10,200 seats (17,000*60%) * $140 per seat = $ 1,428,000

Gross revenue for 40 events: 40 events * $1,428,000 per event = $57,120,000

Finally, applying the 10% profit margin: $57,120,000 * 10% = $5,712,000 EBIT.

Sphere will also be hosting Movie screenings. The company’s plan includes organizing 400-500 screenings per year, with a potential ticket price of $50 per screening.

Conservatively if we assume only 350 screenings in a year with a price of just $35 per seat, an occupancy of just 35%, and a margin of 22.5%, we can calculate the EBIT as shown below:

Gross revenue for one screening: 5,950 seats (17,000*35%) * $35 per seat = 208,250

Gross annual revenue for total screenings: 208,250 * 350 = 72,887,500

10% Profit Margin: 22.5% * 72,887,500 = 16,399,688.

From the Sphere managed events we get an estimated total EBIT of $22,111,688.

Third-party events

The Sphere is also set to host an assortment of third-party events, from concerts to award ceremonies, corporate product launches, and combat sports events. The success and attractiveness of these events depend on the Sphere’s performance and its ability to garner external interest. If we consider an annual rate of 10 events with a venue licensing fee of $200,000 and an assumed profit margin of 60%, we can calculate the potential revenue:

Total Revenue: 10 events * $200,000/event = $2,000,000

EBIT: $2,000,000 * 60% = $1,200,000

As explained in the above calculation, we could estimate that third-party-hosted events would generate at least $1,200,000.

Food & Beverages

Regarding food and beverage revenue, we should consider a conservative assumption. Let’s assume that 74% of attendees (approximately 7,548 out of 10,200) will purchase food and beverages at each event, with an average spend of $39.50 per person, and a total of 50 events annually:

Per Event F&B Revenue: 7,548 attendees * $39.50 = $298,142

Total Annual F&B Revenue: $298,142 * 50 events = $14,907,100

EBIT: $14,907,100 * 50% = $7,453,550

Revenue breakdown and EBIT estimations

Below is the breakdown of our revenue and EBIT estimations for different sources of revenue.

- Sphere-Hosted Events:

- Revenue: $130million

- EBIT: $22.11million

- Third-Party Events:

- Revenue: $2million

- EBIT: $1.2million

- Food & Beverage Sales:

- Revenue: $14.91million

- EBIT: $7.45 million

- Advertising:

- Revenue: $30 million

- EBIT: $16.5million

Total Revenue: $130 million (Sphere-hosted events) + $2 million (third-party events) + $14.91 million (F&B sales) + $ 30 million (advertising rights) = $176.91 million

Total EBIT: $22.11 million (Sphere-hosted events) + $1.2 million (third-party events) + $7.45 million (F&B sales) + $16.5 million (advertising) = $47.26 million

So, with these estimates, the Sphere’s total annual revenue would be approximately $176.91 million and its total EBIT would be approximately $47.26 million.

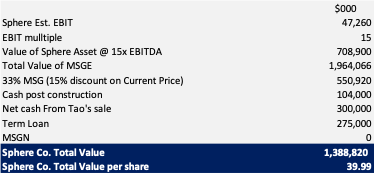

In this case, the value of Sphere could be $47mil EBIT x 15 multiple equal to $709 million.

Indeed, the initial EBIT assumption of $47 million might seem rather conservative, especially when considering the scale and potential of the Sphere project. Given the Sphere’s substantial initial budget of $1.66 billion, one would expect a target yield of at least 5 to 6% to justify such an investment, which translates to an EBIT in the ballpark of $83 to $99 million.

Therefore, estimating an EBIT of $75 million appears more realistic and aligns more closely with the expected return on investment. At a multiple of 15x EBIT, this would suggest a valuation for the Sphere alone of $1.125 billion, translating into a share price of $51.68..

This analysis, of course, rests on the assumptions that the SPHR will be able to generate such an EBIT, that a 15x EBIT multiple is appropriate, and that market conditions will be conducive for such performance. It also depends on the successful completion and operation of the Sphere. Remember, while we strive to be as precise as possible in our projections, the actual outcome may differ due to unforeseen market factors and operational challenges.

However, it’s worth noting that even at a valuation of $1.125 billion, SPHR is significantly undervalued compared to its initial forecasted cost of $1.66 billion. The discount becomes even more pronounced when considering the revised construction cost of $2.3 billion. These discrepancies underline the potential value opportunity at hand, given successful execution and favorable market conditions.

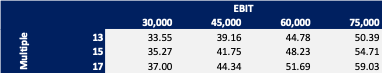

Sensitivity Analysis

The table below highlights the valuation of SPHR at different EBIT assumptions.

Considering the above a value of $50 to $55 should be indicated for the stock.

Identified Risks & Conclusion

Understanding the forces at play behind the scenes requires an examination of the Dolan family and MSGE. The Dolans have long held controlling interests in numerous companies, including MSGE, which owns iconic properties such as Madison Square Garden. Family patriarch Charles Dolan founded Cablevision, which was later sold to Altice, as well as HBO. His son, James Dolan, has played a significant role in managing Cablevision, MSGE, and sports franchises such as the New York Knicks and the New York Rangers

For us, one of the potential risks associated with investing in SPHR relates to the ownership and management of the Dolan family. The Dolan family has demonstrated a historical tendency to prioritize their own interests over those of minority shareholders.

Recently, the Dolan family reached a settlement amounting to $85 million for a case dating back to 2021 involving the merger of MSG with MSGN. The lawsuit accused the family of orchestrating the merger, overpaying for MSGN, diluting the value of MSGE’s public stockholders, and advancing their own interests by enhancing their voting rights.

In fiscal year 2019, Dolan received a total compensation of $54.1 million, earning him the highest CEO salary in the media sector for that year, according to an analysis conducted by S&P Global Market Intelligence. The majority of his compensation was comprised of stock and option awards totaling $49.9 million. In March 2019, a lawsuit was filed in the Delaware Court of Chancery, alleging that the MSG board had violated their fiduciary duties to stockholders by approving Dolan’s compensation.

In June 2020, the company reached a settlement with a shareholder, and Dolan agreed to relinquish additional one-time stock awards in MSG Sports and MSG Entertainment.

Another aspect to consider is Sphere Entertainment Co. anticipated project in London. As value investors, we prioritize the return of capital to shareholders through means such as buybacks and dividends, which is one of the reasons we favor $OXY. However, with this company, there is a risk that the cash flow generated from the Vegas project may be allocated toward the development of SPHERE in London. Not only is this an inherently risky capital allocation decision for growth purposes, but it is also, in our view, an unfavorable business decision due to the vast cultural differences between London and Las Vegas.

London serves as a prominent global business hub with a distinct professional atmosphere, where evenings tend to be quieter. Concerns have already been raised by British individuals regarding the potential night-time illumination of SPHERE. Consequently, we firmly believe that utilizing cash flow to pursue the development of SPHERE in London poses a significant risk.

Moreover, given the Dolan family’s past actions, we consider it highly likely that they may repeat a similar pattern in the present circumstances. It is worth noting that the Dolan family faced lawsuits in the past when they merged MSGN, with allegations suggesting that the merger was driven by the need to fund their Sphere project. These legal disputes further reinforce our concern regarding their potential utilization of cash flow for the development of SPHERE in London.

Another risk to consider is the situation concerning MSGN. It is important to note that the loan associated with MSGN is non-recourse, which is the primary reason why we have assigned a conservative valuation of zero to it. Our concern lies in the possibility that the Dolan family may be reluctant to relinquish control of MSGN, even if the company encounters difficulties in repaying its loan. Their actions might not align with the best interests of the overall group if it comes to safeguarding the legacy network company.

It is also important to highlight the significant increase in SPHERE’s construction costs, which currently surpassed $2.3 billion, exceeding the initial forecast of $1.66 billion. It remains uncertain as to how much further the costs for this construction project might escalate, and whether the newly scheduled opening in September can be adhered to, or if it will need to be postponed again, as has occurred in the past.

However, when evaluating the risk-reward profile associated with investing in SPHR, we find it to be generally aligned with our risk appetite. That being said, considering the theoretical nature of the EBIT calculation, the lack of a sustained earnings history, the risks associated with the Dolan family, and the potential long-term operations, we would limit our exposure to no more than 3% of the total portfolio. This precautionary approach provides a balanced way to participate in Sphere’s potential upside while mitigating downside risk.

In conclusion, it is important to reiterate that this investment is primarily focused on the potential value of the underlying asset, with uncertain earnings at present.