Approaching subscription companies - Case: FUBOTV INC

Investment summary

- Streaming platform representing a cable-cutting alternative

- Well managed with a clear path to growth on core business

- Opportunities to diversify revenue stream

- Interesting valuation with high potential upside

What is FUBOTV

FUBOTV INC (NYSE: FUBO currently 27.40 $ per share as of December 3, 2020) is a streaming platform focused primarily on live sports. It is a cable-cutting alternative, especially for those who watch various sports channels and don’t want to miss any game, some of them in 4K.

The basic plan, which allows two simultaneous users, includes 100+ channels (more than 24 sports channels), 30 hours of cloud-based DVR for a monthly price of $59.99, and the “Fubo Extra” for $5.99 to add 44 more channels. Like cable TV, they offer several subscription plans, add-ons, and extras. FUBOTV’s interface is friendly but also similar to the cable TV ones. As you would imagine, it can be streamed through smart TVs, mobile, tablets, several devices like AppleTV, Chromecast, Amazon Fire, Roku, Xbox, and on the internet.

The sector is being reshaped

The sector is crowded by cable providers and by a plethora of streaming platforms. But the competitive hedge in the sector is being shifted and competition is not anymore on prices. The focus is now on quality, accessibility, interface, scalability, and contents. Streaming platforms are killing cable tv. At a certain stage we believe streaming platforms will tend to merge to benefit from economies of scale and keep up ARPU. M&A wave might be a major value driver in the sector although its still too early to factor it into current sector multiples. Furthermore, streaming platforms have great opportunities to diversify their revenue stream by increasing advertising (a linear function of the number of users) ecommerce and betting (see recent FUBOTV deal with Balto sports).

Where the upside may lie

FUBOTV is scaling up dimensionally very fast and is expected to keep growing not only on its traditional subscription business but also by expanding into gaming, betting and ecommerce. FUBOTV management is doing the right steps and if FUBOTV’s strategy proves to be effective, there is a substantial upside on this equity story as it is currently trading at 4x P/sales 2021 while it could converge to 8x (peers trading also at 11x) which would be in line with our FCFE model (Ebitda margin stabilized at 70% from 2025 onward, 70% EBTDA to FCFE conversion, 12% cost equity, 3% g).

FUBOTV: the sector and the competitive hedge

The sector is crowded by a plethora of competitors, some of which are not publicly traded for the time being. We believe although that, given current valuation metrics, some might soon considering going public.

DAZN:

English sports streaming service available in the USA, Austria, Brazil, Canada, Germany, Italy, Japan, Spain, and Switzerland. They are expected to go globally for more than 200 countries by December 1st, 2020. We are paying attention to this one because we believe it might be a real threat to FUBOTV.

Hulu:

Streaming service majority-owned by Disney. At the time, it has more than 36 million users. Even though it isn’t primarily focused on sports, it has all the local and national sports channels. For instance, their clients’ value is said to be $6,000, while for FUBOTV, we are being much more conservatives and calculate a customer value of around $550.

YouTube TV:

Features outstanding sports coverage, and like FUBOTV, it is a cable-replacement service. The prices are very similar to the ones of FUBOTV. It also has excellent cloud-based DVR capabilities.

Of course, FUBOTV also competes directly with cable providers. They have been around for a reasonable amount of time and are still important. However, the sector is being reshaped, and they are not competing anymore on prices. The focus is now on quality, accessibility, interface, scalability, and contents.

Opportunities ahead

Besides the regular expectations of more premium paid contents, like important hosted events, we think that there are good opportunities in two major segments:

Advertising

There is room for advertising growth on FUBOTV. As the number of customers grows, the capabilities of selling ads on the platform increase exponentially. Some extra features and metrics like CPC and CPA that online advertisers love must be taken into consideration.

Betting and Ecommerce

FaceBank’s eCommerce and payment system platform allows FUBOTV to penetrate the betting market. The recent acquisition of Balto sports (terms not disclosed) proves that the betting market is another excellent opportunity. Sports and betting go hand to hand very well, and online betting platforms like Draftkings keep growing. FUBOTV’s CEO David Glandler, an expert in the market, declared that they are looking forward to exploiting these opportunities in the future.

Financial overview & some insights

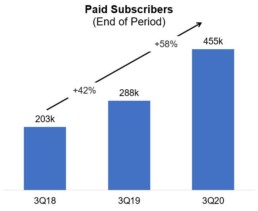

The company has greatly benefited from the COVID-19 situation, reaching an all-time high number of paid-subscribers of 455k+ in Q3 2020, increasing 58% to the same period of last year. The revenues were $61.2mln, an increase of 47% year-over-year. Subscription revenue increased 64% YoY to $53.4 mln, and advertising revenue increased an impressive 153% YoY to $7.5 mln.

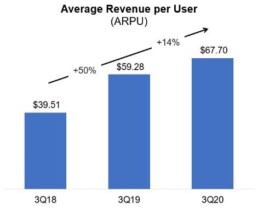

The average revenue per user (ARPU) increased 14% year-over-year, giving an excellent insight into the users’ price sensitivity. The company was able to increase the price and keep its users even though they raised the different plans’ prices.

In the first and second quarter of 2020, the revenues were $51mln and $44.2mln. The YoY increase was 78% for Q1 and 51% for Q2. The management for the last quarter of the year looks forward to a 60% year-over-year increase, which means $80-$85mln in revenues.

|

2020 |

||||||

|

1Q |

YoY % | 2Q | YoY % | 3Q |

YoY % |

|

| Total revenues | $ 51.0 | +78% | $ 44.2 | +53% | $ 61.2 | +47% |

| Subscription | $ 46.4 | +74% | $ 39.5 | +51% | $ 53.4 | +64% |

| Advertising | $ 4.1 | +120% | $ 4.3 | +71% | $ 7.5 | +153% |

Source: Company financial reports

FUBOTV’s number of paid subscribers has also been growing along with the Average Revenue Per User (ARPU). Most of these users are probably migrating from the “old model” of cable TV which is being disrupted.

|

2020 |

||||||

|

1Q |

YoY % | 2Q | YoY % | 3Q |

YoY % |

|

| Paid subscribers | 287,316 | +37% | 286,126 | +47% | 455,000 | +58% |

| ARPU | $54.16 | +25% | $54.79 | +8% | $67.70 | +14% |

| Total content hours | 107.2 million | +120% | 98.6 million | +83% | 133.3 million | +83% |

| MAUs | 120 hours | +52% | 140 hours | +54% | 121 hours | +20% |

Source: Company financial reports

ARPU: Average Revenue Per User

MAUs: Monthly Active User’s average number of consumed content (hours).

Key concepts to approach subscription-based companies

FaceBank and FUBOTV closed a merger agreement that seeks to enhance FUBOTV’s offering by combining FaceBank’s global e-commerce and payment platform and its technology-driven IP in sports, movies, and live performances with FUBOTV’s platform. This merger was a good move for the future possibilities of FUBOTV of getting into the betting market.

This kind of companies should not be compared to “old economy” firms. One of the main characteristics of subscription-based businesses is that it generates recurrent income by its customers as long as they are subscribed. We have to look at this companies as we would do for Netflix, for instance.

We first have to understand that the metrics of the company change accordingly to the company’s stage. The most successful the company is in acquiring new customers, the biggest will be the losses at the beginning. However, the customer acquisition cost (CAC) will generate revenue that will be kept for a certain length of time.

The happier the customer, the longer it will stay subscribed, and therefore it will be more valuable for the firm. So, having satisfied clients is translated into having a better customer lifetime value (CLV).

Once clear that traditional metrics to value a company are not taken into consideration when it comes to subscription-based firms we have to rely on some basic concepts:

Customer Churn Rate (CCR):

Churn rate is calculated by dividing the number of users at the beginning of a period less the number of users at the end of the same period by the number of users the beginning of the period. So, it is the rate that calculates how many users abandon the service in a certain period.

Customer Lifetime Value (CLV):

It is the Average Revenue Per User (ARPU) by the Customer Churn Rate (CCR). It measures how long the client stays with the service and how much revenue it provides.

Customer Acquisition Cost (CAC):

It measures the cost to acquire a user. CAC is equal to the total sales and marketing expenses divided by the number of new customers added. The expenses must be just the ones used to attract new clients, and promotions for current users must be excluded.

CLV:CAC ratio:

The relationship between the Customer Lifetime Value and the Customer Acquisition Cost is usually referred to as the “CLV:CAC ratio.” This is one of the most important metrics for subscription-based companies when it comes to profitability.

At the beginning, like all growth companies, we need to be very careful when looking at the Research and Development costs because they will be placed in the GAAP accounting. However, those intangibles will be capitalized over time. For FUBOTV, FaceBank, and Balto Sports are actually future drivers of value and contribute to the acquisition, retention, and monetization of users.

The concept of unit economics commonly englobes these indicators and others related to them. It looks directly at the revenues and costs associated with the firm’s business model. The concept is used for the projections of the company’s profitability. In subscription-based companies, the basic units are the subscribers.

ECLV ratio:

As you could imagine, to value FUBOTV, we will also need to calculate the expected customer lifetime value or “ECLV.” Under the assumption that the ARPU will be constant, we can say that the ECLV is the average return per user multiplied by the customer lifetime. ECLV = ARPU * CL

On the other hand, if we assume that the churn rate remains equal over time, the ECVL could be equal to the ARPU divided by the CCR. ECVL = ARPU / CCR

How could the valuation be approached?

I think that one way to get a fair valuation would be by calculating the users’ present value. So we first need the Cash Flow Per User (CFPU) and a discount rate (r).

To calculate the present value of future users, we can use:

Notice that we will need to subtract the cost of acquiring those clients at the end of the equation. Then to calculate the present value of current users, we would use the same without that last part:

We are going to apply these concepts in our approach to the valuation in a later stage.

Given the current stage of FUBOTV, we are unable to fully assess its churn rate. We first need to understand if the company could have a real moat. We do believe that strategic mergers and partnerships could increase the revenue of the firm. Nevertheless, until a competitive advantage is developed, their business model is under high risk as they might fail to grow, and the valuation would collapse.

Our valuation approach to FUBOTV

Our goal is to find the Present value of each FUBOTV client. The valuation would probably be the present value of the existing customers and future clients’ cash flow. Therefore, the concept of CAC (customer acquisition cost) and Churn Rate are essential to define, and they will have an impact on the company’s final valuation.

At this stage of the company’s life, attention needs to be put on the ability to retain the clients and keeping them because they can later switch to other platforms and therefore create tremendous damage to the valuation of the company. It all comes down to the moat.

It is extremely difficult to have a reliable quantitative model because Retention Rate and CAC will most likely depend on the competition. We believe indeed that the company’s effort would be to create a fantastic customer experience through acquisition. Still, if they fail to make a tremendous value experience for the clients, their business can be in danger.

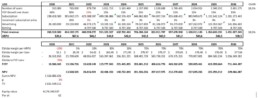

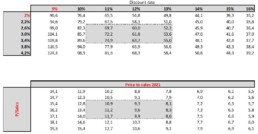

The spreadsheet below is based on a client’s subsection that will have an annual compound growth rate. Initially, around 50% and then eventually will go down approximately 15%, which is very conservative. The same thing can be said about inflation. We have assumed a 3% price increase, which is again low as we consider that new competitors might lower prices or offer a better proposition trying to “steal” clients.

We have considered an EBITDA margin which starts negative and stabilizes in 2025 at 70%. This means that from 2025 onward 70% of ARPU is transformed into EBITDA. Some other subscription platforms can rely on higher margins. However, we believe 70% EBITDA margin at regimen is a very reasonable measure.

The other key assumption we have made is that 70% of the Ebitda is converted into FCFE (Free cash flow to equity, residual to shareholders) which can finally be discounted at an appropriate cost of equity to figure out the equity value.

We have used a 12% cost of equity and 3% perpetual growth rate. We could have done a more in-depth analysis of the beta and rely on a capital asset pricing model (CAPM). However, we believe it would not make much sense at this stage because the CAPM fails to deliver a reasonable cost of equity in cases like FUBOTV where basically the correlation to the index is limited as the company was recently listed.

So, we decided to rely on a sensitivity analysis which calculates the price per share by changing the cost of equity and the perpetual growth rate (g). Assuming a discount rate between 11% and 13% and a perpetual growth rate between of 2.6% to 3.4%, the average price could be between 55 and 69 $ per share. We would be confident in assessing a target price around $60 per share (current share price around $ 27 per share).

We have also checked the 2021 P/sales ratio implied by our sensitivity. In other words, in table 2 we show for each equity value (or price per share) which is the implied 2021 P/sales.

Currently FUBOTV is trading around 4x P/Sales 2021, very far from ROKU which is trading at a P/sales 2021around 12x.

In table 3, we show that at a P/Sales around 10x in any given year from 2021 to 2030, we come out with a market cap which, discounted to present at 12% cost of equity, delivers around $60 target price.

We are aware that our valuation relies on FUBOTV being able to scale up dimensionally vary fast. We are also aware that we have not set a timeframe to reach our valuation. We believe it is not the case because of the nature of the business and the stage of the company.

However, we believe there is evidence enough to consider FUBOTV as a growth company with an interesting potential upside which could find room in a portfolio of any smart investor focused on growth. We will update the valuation according to the news flow. STAY TUNED!

Spreadsheets

Table 1: DCF model

Source: Antonio Velardo personal elaboration

Table 2: Sensitivity analysis and 2021 implied P/E sales

Source: Antonio Velardo personal elaboration

Table 3: P/E sales implied by our FCFF DCF model

Source: Antonio Velardo personal elaboration

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Allocation under modern portfolio theory and some value investing lessons to apply

Allocation under modern portfolio theory and some value investing lessons to apply

Underlying the basics of the modern portfolio theory risk is perceived as the standard deviation of the asset’s price in the market. However, this is entirely different when saw from the value investing perspective. A value investor considers risk as a permanent loss of capital while, under the modern portfolio approach, the assumption is that investors are risk-averse and therefore need to be compensated with a reasonable premium for each extra unit of risk they take.

Let’s say an asset has a 10% mean return; nonetheless, the stream of return is not constant because it varies from month to month and fluctuates with a standard deviation of 5%. A modern portfolio approach would try to optimize or, to say better, judge performance relative to risk. This means that if you have a return of 10% but a 5% standard deviation, your risk/return ratio would be 2. Consequently, the modern approach is basically a mathematical model that defines risk as to the standard deviation and judges the stock from how it fits the portfolio and its risk/reward ratio.

A value investor does not approach risk in the same matter. In value investing, risk is defined by the health of the balance sheet, not from the beta of the stock. For instance, a value stock, which is usually a depressed one, has a potential theoretical drawdown of 50%. There is no intention from a value investing perspective in trying to time a better entrance on the stock. A value approach would analyze the stock making a single bet in a concentration of a few stocks without studying the impact of the volatility of the single bet on its own overall basket of stocks.

The latter is impossible for a modern portfolio theory trader or fund manager. They need to understand the risk/reward ratio of the stock and how it would impact the portfolio. Therefore, decisions are not taken on the stock’s quality only but on how it affects the overall position. So you could end up adding assets to your portfolio, not because you believe in the potential of appreciation but for the sole reason that the investment could have a negative covariance on the portfolio and stabilize the overall position. Or maybe because it could reduce the volatility of the portfolio without affecting the expected returns, which should indeed be the purpose of optimal asset allocation.

So buying a stock can have different meanings and purposes depending on your approach style.

If we would be robots, we could theoretically adsorb a drawdown of 50% without even blinking and adding a position to average down cheaper stocks. I try to do that, and I am among a few who are able to absorb such pressure without panicking.

The majority of investors cannot do it that way, they panic and sell when stock prices decrease to reduce what they call risk, and they try to cash momentum buying higher when the portfolio is green. I never buy on a good day or sell on a bad one. I try to do the opposite. Investors are moved by fear. When they experience significant drawdown, they illogically tend to sell at a lower price.

The only way you have to avoid that is to be confident about the stocks you own. Behind that confidence, there should be knowledge and conviction of your investments. A deep understanding of what you own is the only energy that can help you beat stupidity and indefinitely hold a “falling” asset.

When applying modern portfolio theory, hedging would help an anxious investor to navigate through volatile times. I had seen many investors breaking down in volatile times, even when they did swear to hold. I saw them literally in tears quickly selling because they were afraid to lose it all. Selling when stock presents less risk (because it is cheaper) due to the general market condition is silly. But it does happen every day, not only to amateurs but to professionals.

Before choosing your investment style, try to think about what is adequate for your stomach. The stomach is what you need in a difficult moment to adopt a particular investment style and being successful at it. To have the stomach is more important than technical knowledge, but technical expertise gives you the stomach to handle those difficult times.

As you build your portfolio, you must know your risk sensibility and, of course, your concept of risk before anything else. A simple approach to portfolio construction thought for weak stomach investors is the “All Wheatear Portfolio,” made famous by Ray Dalio. I love Ray Dalio, I love his philosophy, and I like him as a person. I believe he is honest, and I learned a lot from him on macroeconomics and how the economy works. But the All Wheater Portfolio is for people who want to have peace fo mind, even though I don’t think it did very well under the recent crises.

The “All Weather Portfolio” could work for me when I get to my 70’s. It assumes that you don’t know what is going to happen, and you have a portfolio that could perform or preserve your wealth in all scenarios: deflation, inflation, recessions, and so on. Another issue with Dalio’s approach is that Bond, which was used as a negative covariance to balance the risk of stocks, now would have a different meaning under the current monetary policy.

What Dalio does is to mix all the assets trying to move the weights of such investments in a way that fits its biases towards a particular macroeconomic view. Then if it is not right, it does not take a big hit. Still, if he is correct, then it makes money but not with the impact that it would make if he would go all-in on a particular asset.

Lets’ be clear and pragmatic; this means that you can do 7% to 8% a year if your biases are centered because your view would allow an asset allocation to favor a particular scenario. Or to make 4% to 5% when your preferences are wrong, but you will never experience a drawdown.

This is great for Mama and Papa or anybody that does not have enough stomach. I prefer to get richer or die trying, but I can stomach the drawdown. I want to deeply study the market, generate a firm conviction towards a macroenvironment or stocks, and chase my 100-million dream. I am not that far away anyway, and I would not embrace mediocrity for the sake of fear, don’t do the same, but I am this way.

I don’t invest what is needed to live but to make me jump to another level. I am searching for greatness, so I need to make something spectacular out of my portfolio. I will do what it takes and digest the drawdown as I have done until now because I am pretty sure the results will follow. I don’t believe in being cautions in periods of monetary loss policy unless the risk of systemic fall of the system and crack of the US dollar as reserve currency materialize.

The tail risk can be hedged not only by crypto but with assets allocated in emerging markets and alternative superpowers like China. The best hedge you can have is the ability to deeply understand what you own and keep studying your equity every day.

Value Investing is dead and is not worth pursuing, but some of its lessons are extremely valuable. We can take things from value investing, which would help us to understand the real meaning of risk and the foulness of selling your asset under the market’s pressure—the importance of a long-term perspective.

From the other side, trying to buy as a value investor does is foolish. To find a top-class business with a strong moat for a low price, based on its sustainable earnings and get free growth. Growth is that thing that makes it foolish and useless for any P/E calculation; price-earnings means nothing versus growth. If you grow exponentially, then what the point of price-earnings is?

In order to understand a company to insert it into your portfolio, you need to apply two elemental principles. The first is to understand that particular business, its potential, scalability, competition, and moats deeply. The second one is to know yourself.

Before you choose what kind of investor you are, understand what stomach you have towards volatility and if you can learn how to manage it with the knowledge of the assets you own. If you don’t have the stomach and the time, then embrace peace with a neutral All Wheater Portfolio. But don’t try to mix assets randomly without a proper plan, because that indeed can be the receipt for catastrophe. Know yourself and know your assets, have a plan before start playing.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

A real gem in the trash bond market of Europe

A real gem in the trash bond market of Europe

These days, I’ve been looking for high-yield bonds to diversify the overall exposure of my portfolio and also reduce the correlation to the US equity market. I’ve my own screening tools, which returned a bunch of bonds with over 20% YTM. Most of them were really junk, and the Yield To Maturity (YTM) is a real function of the implied risk.

I was intrigued by 300 mln KME bond ISIN XS1756722069 expiring on February 2023, 6.75% interest, and currently trading at around 67. It was trading at 35 during the pick of the COVID19 crisis. Wow, what’s behind this company? I did my research, and I figured out that KME is a pan-European industrial group and a global market leader in copper and copper alloy products. This sounded very interesting to me!

KME is profitable and a market leader in its segment. So why its bond is considered junk? Well, it is because of its outstanding debt (237 mln as of December 2019). I found out that KME 2019 EBITDA is around 86 mln, which means its net debt/EBITDA is approximately 3x, which doesn’t look so stretched to me. But Moody’s is currently rating this stock junk because it trades at over 7x net debt/EBITDA. What on Earth is Moody’s looking at? They are looking at the Staff Severance Reserve (SSR) around 218 mln and including it in the net financial position. But is that correct? I think it is not because SSR isn’t debt!

Eventually, they expect KME to collapse next year. How is it possible with copper price at its five years high? Frankly, I don’t know what Moody’s is looking at and, more important, I’m not interested in. I feel like a guy who found a rare gem! KME bond could deliver me more than 20% return per year over the next two years and a half! This is what matters to me!

What makes me even more confident is that the bond is guaranteed by KME plants in Germany and Italy, and it is callable at a modest par premium on February 21. Seriously, this is music to my hears!

Going deeply into my research, I also found out that KME is fully controlled by Intek, a holding company listed on the Italian stock market. I figured out that almost 90% of Intek NAV is represented by KME. Intek market cap is around 112 mln, which means that either KME is worth some 100 mln (but Intek balance sheet factors in 489mln value for KME) or that Intek company is trading at some 70% discount to NAV! I would bet on the second option.

Furthermore, Intek is an outstanding bond whose YTM is lower than the KME one. How is this possible if KME is Intek’s trophy asset pledged to guarantee the KME bond?

So, why not also buy Intek shares? Because these shares are not covered by any analyst, and there is no consensus. I’ve seen many stories like this one in the Italian market. These kinds of companies are managed by entrepreneurs (in this case, two entrepreneurs representing the Gotha of Italian capitalism) who think the sun shines just out of their asses and are willing to screw minorities. They know that Intek is mispriced and KME as well, but they don’t care about it as long as they continue doing their business.

To make a long story short, I believe I found out a mispriced asset where its owners are aware of such mispricing, which, for certain reasons, is also functional to their business.

I’m not interested in whether this mispricing would disappear at a certain point in time because I’m not buying Intek shares. I’m just interested in the fact that they will continue absolving their obligations on the KME bond. I believe they will because KME assets pledged to guarantee the KME bond are the pillars of their castle!

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Value Investing Analysis: Park Hotels & Resorts (PK)

Value Investing Analysis: Park Hotels & Resorts (PK)

Many of my friends, employees, and followers ask me how I analyze companies before investing. My answer is usually “that depends on my investment approach for that particular asset”. Park Hotels & Resorts (PK) has been one of my last moves in value investing, so I would like to share with you, in a simplified way, how I analyzed this particular stock at this particular time.

Park Hotels & Resorts is a USA Hotel REIT that initially was a spin-off of Hilton (HLT). Most of its real estate assets are in a public REIT whose portfolio consists of 60 premium-branded hotels and resorts, all currently located in the USA. Their mission is “to be the preeminent lodging REIT, focused on consistently delivering superior, risk-adjusted returns for stockholders through active asset management and a thoughtful external growth strategy while maintaining a strong and flexible balance sheet.”

PK, being among the top 30 in the USA, is a large REIT. It currently has 60 Branded Hotels with 33k+ rooms. A significant acquisition was made in 2019: PK purchased Chesapeake Lodging Trust for $2.5B, diversifying its assets locations and expanding its exposure to Marriot and Hyatt brands. Management has been able to dispose of and acquire Hotels effectively.

Since the spin-off, PK’s management has disposed of 24 hotels and acquired another 18 changing the hotel adjusted EBITDA from $97M to $181M. In 2018 13 hotels were sold for $519M, 10 of them belonged to its international division. In 2019 other 8 hotels were sold for $497M, and they acquired Chesapeake. Finally, in 2020 they sold their last two foreign hotels for $208M getting out of the international market.

Pk's Portfolio

Its geographical distribution is impressive, from the San Francisco Union square to the Hilton New York midtown. More than 85% of PK’s properties are in the luxury or upper-upscale segment.

Insights analysis

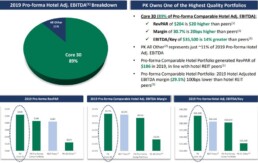

As a Hotel owner and investor, the first thing that pops to my eyes is that almost 90% of PK EBITDA comes from its core 30 Hotels. More importantly, its REVPAR is 20% higher than its peers at $204. EBIDTA/key is roughly $35,500 (pre-COVID19), which was 14% higher when compared to its peers.

REVPAR is the hotel industry metric that indicates the revenue per available room. Higher revenue per room would mean, in the Hotel industry, that there is a moat or client captivity due to the location of the hotels or/and superior management.

As a value investor, I always try to proceed with a proper value investment analysis, Santos/Greenwald’s style. In essence, I would calculate the Asset Value with appropriate adjustment for depreciation, the Earnings Power Value with proper adjustment to the income statement for sustainable earnings, and then compare them.

Once I have found superior management and EV higher than AV, only at that point, I would assess the entry barriers and calculate the franchisee value. However, I don’t want to annoy you with my classical valuation methodology because, in this case, being a REIT, I would value it as an asset play and use different reasoning, mostly objectively focused.

Investment Thesis

My investment thesis is that we are buying superior-location and well-managed big-brand hotels strategically distributed all over the USA for the price to tangible book of around 0.41x.

Price to Tangible Book is a metric that could be useless in some sectors. However, I consider it particularly useful in real estate. This company has been affected dramatically by the COVID19 pandemic, as several PK hotels have been temporarily closed. Nevertheless, my line of argument is that PK strong Balance Sheet and liquidity make PK a winning bet for a quick recovery when the fear of the disease disappears, and the occupancy rate gets back to pre COVID19 levels.

About cash-burning, the management has estimated 73 million, of which 23 million are for corporate expenditures and the remaining 50 million for hotel operating expenses.

Let me give you a quick look at the most recent Balance Sheet

The balance sheet does not hold any Goodwill because it has already been impaired. Also, from the liquidity side, we have some extra good news because all the covenant has been amended.

Amended covenants overview

Exercise of Extension Options:

- revolver maturity extended to December 2021.

- Covenant Waiver.

- Suspend compliance with all existing financial covenants tested through and including 3/31/21.

- Pledge equity in certain subsidiaries to secure the facilities (eight high-quality hotels— a mix of urban, resort, and suburban).

- Adjust levels of particular financial covenants after such a period.

- Minimum liquidity covenant of $200M.

These and other amendments have been set in place to reduce the impact of the current pandemic impact.

PK has Hotel properties for $9,627M (again without Goodwill, which has all been impaired). Its cash position is $1,304M, and total debt would be around $5,095M without considering leasing.

Equity valuation

My valuation delivers an equity value of $3,8bn vs a market cap at the moment of writing of around $2,1bn. (235m shares net of treasures for the price of almost $9).

Normalized earnings

The first consideration is that PK has a REIT status. In the Risk session, we will obviously cover this part. However, the REIT status allows it not to pay any tax. To be more precise, the company has to pay them, but it will be entitled to a refund. Indeed, in the normalized earning analysis, we will take the 2017 and notice that there was a refund for $2,346M.

In order to calculate the sustainable earnings, I have taken the average revenue of $2,704M for the past 20 quarters and calculated the average margin profit of 14.90% for an earning of 403M. The average margin profit is calculated on five years average to adjust for the business cycle.

I have assumed the necessary SGA costs I would incur if I would have to run the hotel and sustain the current earnings. However, I thought that in this case a 25% could be considered as part to grow the business, so I have adjusted the earnings adding back 25% of the average SGA expenses.

Therefore, 25% of SGA costs would be $16.45M. Hence $403M plus $16.45M would be equal to $419.5M that, adding the excessive depreciation I have estimated as being $284M would be $703.5M in total.

In a “typical” non RIET company, I would have subtracted taxes from both earnings and excessive depreciation. However, since we are in a REIT model and we are assuming PK will keep the REIT status, I am not doing so.

PK is now trading at three times normalized earnings. If we consider the interest around $205M, then its TEV/EBIT is equal to $5,906M/$908.5M =6.5 times. The FFO average pre-COVID19 has always been around to $550M.

Discounted Cash Flow Analysis

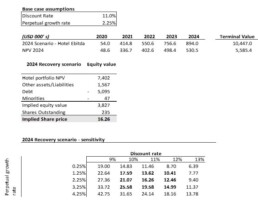

I usually don’t use discount cash flow analysis for value investing strategy. Still, being the current circumstances different, as I described above, I thought that this approach would be useful to have another perspective on PK’s asset value once cash flow is normalized.

I have worked a discounted cash flow analysis considering a minimum perpetual growth and a recovery scenario in 2024.

I’ve assumed a gradual recovery in EBITDA to reach pre-COVID levels in 2024. My underlying assumptions in the DCF model are 11% discount WACC (which looks very conservative as current debt represents around 60% of total sources factoring equity at market value) and 2,25% perpetual growth rate.

Under these assumptions, my conservative target price could be in the region of $16.5 per share leaving above 60% potential upside at current prices. I’ve also made a quick sensitivity to check to which extent the equity value is sensitive to WACC and perpetual growth rate.

To justify the current price, you should either assume inflation minus perpetual growth rate or two digits WACC. Both are not reasonable considering the nature of the business and PK capital structure.

Catalyst

It isn’t necessary to dig deeper into more metrics to explain the value of such assets in the case that COVID19 fades away, and earnings eventually get back to normal. If we take a look from the other side to the pre-COVID19 profit and loss, we will understand the potential of the revenue generation outside the pandemic environment.

I am confident that due to the strength of the Balance Sheet and the available liquidity for over 24 months, that PK is a great card to play. A COVID Vaccine and consequentially a return to traveling will significantly increase the PK valuation rapidly

Risks

Risks are directly connected to the extended COVID situation. The time frame that takes to return to sustainable earnings is what instantly impacts the valuation. I believe that in case of need, the strong balance sheet and the low leverage scenario would allow the company to pull another 1 Billion credit line easily.

Another possible Risk is if the company loses its REIT status, this itself due to tax saving can be worth $6 – $7 per share.

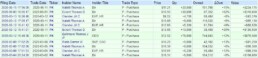

Insiders

It’s useful to add that in recent months, insiders have been purchasing shares at a price on average much higher than today’s price.

I would like to repeat the disclaimer that this is not financial advice. This article is just an analysis of a company that I decided to share because it is an example of how the current situation has affected the stock market and how I analyze firms under a Value Investing approach. You can read my article about “Investing under the new paradigm” if you would like to have a more holistic idea of my investing perspective during and after COVID-19.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Investing under the new paradigm

Investing under the new paradigm

Why are you so scared and worried about the budget deficit?

How many trillions of budget deficit can the government sustain? An infinite number of trillions if we speak about the USA government and the dollar. However, not without consequences, but let’s go by order and understand how to take advantage of the new paradigm we are living under.

If the government spends $100 into the economy, and it taxes $30, then the remaining 70 dollars are on someone else’s book and pocket. The deficit is always good for someone, that is for the people that did not have money, and it’s, on the other side, terrible for the savers in that currency.

A great investor in today’s paradigm is someone that finds an opportunity to short the dollar. Your real job today as an active investor is to follow the Fed wind, check where it goes, and take advantage of their policy. How you do that? You short the dollar. You find all possible ways to trade a fiat currency with asset or medium of exchange that would produce future cash flow or will be recognized as a better store of wealth.

Businesses producing future cash flow most likely means that inflation will be dealt with. In 20 years, the new iPhone would, for sure, cost more numerically speaking that the one today. Businesses are a way to short the dollar because their cash flow will adjust for inflation. Gold, from the other end, is just perceived as a better store of value than the worthless dollars, but gold will not produce cash flow.

What did we say above? The deficit for the government is just money in someone else’s pocket. So, why don’t you take advantage of that extra money in the economy? It will go somewhere, and they will be spending so to produce more cash flow, increase sales, and promote innovation.

Investors fail to understand the nature of the deficit budget, its consequences on the economy, and how to take advantage of it regarding your asset allocation. MMT clarify that, in a simple sentence, “USA Government does not have financial constrain, it can print as much as it wants, and should just replace its artificial constrains, with a real constrain which is inflation.”

Can printing go too far?

Absolutely, to the point of creating real inflation, but the Fed “should not monitor the inflation.” At least according to their expectation inflation model (that frankly is not even a proper model), but through a full-employment policy. To be fair to the MMT people, the Fed does not have an appropriate model of working of inflation, and fiscal policy could monitor inflation by draining money supply with taxes or setting a new system in place to avoid bubbles in particular sectors.

Even if the government “disagrees” with the MMT policy or ideas, the Fed agenda and the government fiscal stimulus are effectively following them. What else could they do? I don’t disagree with that. I don’t blame the Fed, I just follow the wind and short the fiat currency in the smartest way possible. I invest by keeping in mind that my first objective is shorting the dollar. The consequences of money printing will be two, weaker dollars and money flying in the pocket of the smarter and younger, who will spend in technology and luxury products.

Investing in companies providing such services will guarantee that the future cash flow will be considering inflation. Let’s look at diversification and the world economy. Where geographically allocate my wealth? While USD is a reserve currency, the USA can manage to print trillions to crate stimulus, and eventually later manage the inflation efficiently. That is not possible for other countries in emerging markets and particularly South America.

Hyperinflation based on inflation expectation, contrary to the USA, is highly possible in South America. Most countries there tend to fight economic depression with money printing. Those are hard spots that I would consider shorting at any chance I have. Because, unless they don’t find political leadership able to guide through the crisis, they will be in trouble for many many years.

If you, as a country, have debt in a foreign currency and do not have the means to produce and sell products that attract dollars, you will be in serious trouble.

Investment thesis

My investment thesis for the next years is:

- Invest in USA equity, in particular, tech companies.

- Take debt in USD and Euro to finance businesses and Real estate. Fiat currency will be cheaper and will create, with time, a significant spread between its cash flow that will adapt to inflation. Its intrinsic value will be lower every year.

- Not hold bonds in my portfolio. Those will not be a hedge anymore versus my equity. I would only own junk bonds that I genuinely believe will not face bankruptcy and will be recovering.

- Have a small amount of crypto and very little gold.

If you would like to go deeper into this and have a broader view, I recommend one of my last articles called “What does Bear not understand about the market’s current situation?”

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

What does Bear not understand about the market's current situation?

What does Bear not understand about the market's current situation?

The economy seems to be in a deep recession, and the market is almost back where it was a few months ago pre-COVID. Some people are still scratching their heads about it, but I’m not. Actually, I profited from this crisis. My performance and equity line have skyrocketed. Let me explain why it wasn’t that hard to predict the direction of the market and take advantage of it, by limiting the risk with OTM options.

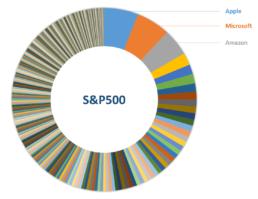

The S&P500 is our reference index in the market, and how the index is currently weighted, big Tech companies are an essential part of its portfolio. Amazon, which is now one of the most significant components of the S&P500, is up almost 50% as I am writing this.

COVID has accelerated the progress of digital society. Cloud firms, digital communication enterprises, and all the companies for which mass adoption of technology would probably have taken many more years have now reached impressive levels due to people staying home during the pandemic.

Technology is sticky; great tech companies have historically had a low churn rate. Still, when people discover and use these technologies, they get attached to them because they fall in love with the benefits. Adoption is the key to the valuation of tech companies. Its compound effect on the network is the hidden secret of those that apparently have a lousy multiple but know that once on a growing path, it can go far.

What does increased adoption mean for the network? Exponential or at least logarithmic growth. If all the assets are “just” a matter of calculating the Net Present Value (well, “just” is a euphemism), then even if there is an apparent disruption of earnings for a couple of quarters, the valuation of the company will be higher.

What else can you have if higher earnings are at the horizon due to adoption increase, and the hurdle rate is going virtually to zero? What else would you expect? Your Net Present Value now will be a result of a more significant number on top and much lower denominator for a higher valuation.

Forget about all that negativity and moaning of the street economy from your friend’s bakery or your cousin’s restaurant. The bankrupt has little or nothing to do with those tech giants with market caps of trillions of dollars that are benefiting from the digital life and their moat in this arena.

Your poor bankrupted friend who lost his job or small business, he has no access to the capital market or the Fed Power, he could probably be in deep trouble, but that has nothing to little to do, at least for now, with the best and most powerful market in the world.

Many of us were fortunate enough to profit from the last crisis in 2009. I made 20 times my money and became wealthier by using the Fed’s Quantitative Easing paradigm to invest in assets that, at the time, nobody wanted. However, a few years later, thanks to the expansive monetary policy, my real estate was available to be bought from the same bankrupted people that could not keep up before because of their credit. The same people that lost their single-family homes ten years ago, which I paid 70k for, are buying back the same property from me at 300k with the bank’s money again.

Equity, and in particular Tech, did even better. Look at Apple, Facebook, and Amazon’s stock price a few years ago and compare it to the current rate. I have some friends who kept gold and were preaching against money printing, evoking inflation and the Financial Armageddon. Gold is now returning at a price similar to that of ten years ago, while my Tech’s stock value is ten times what it was. Those friends that used to hang out with me are now not much better off than a decade ago.

This time it has been even easier to make money. It was not difficult to understand which paradigm we were under and what would happen with such a strong and motivated Fed. Trump and Powell (the Chairman of the Federal Reserve) were the certainties that the USA would do anything to bring the market up. They and their language, speech, and willingness to take care of the market were the assurance that the cheap option premium, which was indeed very cheap, would produce amazing results. OTM option premium in March and April on Tech did 7x to 10x.

It’s funny when people find an excuse not to invest because they worry about the Fed’s balance sheet. I don’t get what they think, like if having cash would help them, what damaging fear can be to even the smartest!

Cash is trash, Ray Dalio mentioned recently. The worse place you can be when there is such accommodating monetary policy is cash. Assets, in particular stocks, are the most efficient protection you can have for inflation. Intuitively people think about gold and real estate. But, the best place to be is quality equity, low debt, big moat, and resiliency to the pandemic. In other words, top tech companies.

On the flip side, I’m not worried about the debasement of the currency, and after keeping Bitcoin for so many years, I believe it currently isn’t an alternative to the dollar, and probably won’t be for the next few years. In another article, I will explain my view of Bitcoin which is, for the short term, at least, only a function of the liquidity on the market.

The US will find a way to deal with inflation, and when it happens, which I am quite sure will be in a few years, taxes will increase and drain the extra inflation away. However, I will be offshore and won’t be touched by it. Bonds and cash will be a dead beat, and your fear will become your worst enemy. If you have some savings, a medium two-to-four year horizon and plan to retire, buy stocks with leaps option, quality stock, or index if you are able to spot the right one. And buy your residency in an incredible lovely tax paradise, I am sure it will work just fine.

All this generosity by the Fed will eventually finish when the dollar is threatened as a reserve currency. Right now, they are doing all it takes to keep the economy up, but fiscal and monetary policy will drain the money away from the economy in the near future.

The wealth gap will be huge, much bigger than now. All of us that have benefited from the asset bubble towards which we are flying will be 100 times richer than those with no savings. And will, eventually, live another paradigm in which the wealthy would ultimately be hit. However, my retirement will be offshore, and my money safe from taxes.

Now please be careful, I am only advocating to go long on the top class companies in the USA. Your hedge should be being short on the countries and companies that don’t have the benefit of having a reserve currency.

I think you can be an Alpha creator if you can pick not only the winners but also the losers of the market. This market created an enormous differentiation, and now it hasn’t been effective in discriminating, so here it comes the new strategy to hedge your position.

To be more precise, the current crisis is different than the boom and bust cycle that usually leads to a financial crisis. In a typical economic cycle, the interest gets pushed up when things are going great to avoid inflation. Economic contraction starts to happen, the debt crisis will show up, and then again, monetary policy will start the expansion period to accommodate the economy.

The normal debt cycle, the way we know it, will result in credit falling, monetary policy tightening, and only after, the income will be hit before a new accommodating monetary policy kick in. However, because of the virus, we had income falling before, in a scenario where the interest rate was already zero. Credit expansion now cannot be exercised by merely cutting interest rates, so the Fed needs to adopt other policies to be effective.

Once that happens, the way out has been Quantitative Easing, but that weapon has also been used. So now the Fed is moving to something that has never happened before. More and more economies are embracing Modern Monetary Theory or MMT.

MMT has different layers and approaches, but basically it is the idea that a country could and should always run at a constant deficit. Instead of going deeper into theory, let’s focus on the paradigm’s consequences and how to structure your strategy.

Economies that have reserve currencies like the USD will be able to “print their way out” without creating hyperinflation, at least for the next few years. But all those countries that don’t have that ability will face more significant issues and a hyperinflation scenario.

Fiscal policy will be used in combination with monetary policy to send money to support the economy. Now “support the economy” does not mean the market goes up, it means that the Fed will do all it takes to promote full employment, and that is their mandate.

At a certain point, all those companies affected by COVID will eventually be picked up, to generate jobs. I would not be surprised if, in the next few months, the affected sectors receive an extra stimulus. At the end of the day, the Fed knows that the only way to reach full employment is to send money and support the old economy businesses. To incentivize jobs to the less skilled people, who are the ones suffering, that necessarily needs to be done with fiscal stimulus.

The difference between the countries without this ability, like the emerging markets in Latin America and the USA or Europe, will be enormous. The gap will increase with time, and if not dealt with, conflicts and riots will be a daily issue in those countries. Shorting Latin America, their banks, and debts would be your hedge while long on the USA market.

What will happen in the long term? Well, I recall a lesson at university in which when studying MMT, my professor was speaking about the colonies, and how they were operating their monetary policy.

Dutch colonies; for example, were printing to pay their local workers (the slaves). Printing paper currency and plenty of it, with the queen or king’s head on it, to pay to the slaves. Where was this leading? You would be thinking “inflation,” well, those colonies were obligated to pay a lot of taxes. And do you know what the Dutch army was doing with it? They were burning piles of money to drain the inflation. That was a way to get the useless paper out of the system and, at the same time, to make it less worthless.

So, we are moving into a scenario in which we will see asset pricing inflating. Those who have access to credit and assets will become more prosperous, while others will be much poorer. One day, far in the future, this large gap will have a repercussion in politics. Taxes will be the way for the poor to take back some wealth, and it will be the only way for the governments to avoid the debasement of the whole system.

If the strategy is not clear: long USA equity and short emerging markets, especially South America. Look for assets and businesses that target the rich, not the poor. Start to look for a place to run to when taxes hit hard, escaping from taxes could be an issue if you don’t prepare for it, and take all your money back. Becoming wealthy will be that easy.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Antonio manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.