Lately, we have been focused on growth stories. One of the last value stocks that we covered was Park Hotels & Resorts, which valuation has more than doubled since the article was released. I have been looking at MNZS for some time now but haven’t had the time to dig deeper into it. However, I knew from the beginning that this was the perfect story to be approached by different valuation models, especially Value Investing.

Brief description

John Menzies plc (LSE: MNZS) is the holding company of Menzies Aviation, which provides aviation services in more than 30 countries. John Menzies plc was founded in 1833 and is based in Edinburgh (UK). The company offers several solutions to airports, airlines, and other clients and partners in the sector around the world.

- Fuel services: Fuelling more than 9,500 planes per day at around 80 locations, they claim to be the world’s largest independent provider of into-plane fuelling services and fuel farm management for oil companies, airports, and airlines.

- Ground services: Menzies Aviation handles 1.2 million aircrafts every year. This includes ramp and baggage handling, de-icing planes, passenger services (from check-in to boarding), and cabin cleaning.

- Air Cargo: They manage about 1.5 million tons per year, including logistics, special cargo, and human resources outsourcing.

- Offline services: With more than 20 years of experience, Menzies provides all the services needed, from the maintenance of ground support equipment to baggage tracing and customer relations.

- Executive services: They have a VIP lounge network providing a tailored experience to executive passengers. In 2019 they welcomed 1.5 million guests.

COVID-19 impact on MNZS

The pandemic drastically impacted the valuation of MNZS, opening a unique buying opportunity. The company is now looking to reduce costs and focus on the core business to cope with the industry’s new metrics (lower traffic volumes).

This company has a history of acquiring other companies with the aim to consolidate the sector as economies of scale matter. We think that this is an intelligent move of the management to enter into new markets. Just in December of this year, the company acquired 51% of Royal Airports Services in Pakistan. It also partnered with Lift in South Africa, reinforcing its presence in Africa and the Middle East.

In 2017, Menzies acquired ASIG Holdings for $202 million. For the year ended December 31, 2015, ASIG reported revenues of $415.8m and pre-tax profits of $17.9m.

Because of the COVID-19 situation, the ASIG integration into Menzies industrial plan did not deploy as expected. This is a critical issue that we have factored into our analysis. There is a potential value creation that has been stopped for the time being because of the pandemic crisis.

Investment Thesis

Clearly, the pandemic is the catalyst here and the leading cause of the drastically decreased market valuation. We think that due to the current price of the stock and the COVID-19 foreseeable future, this firm is a candidate for a Value Investing approach.

We will also cover other models and discuss several points of view to undercover the company’s complexity from different angles in these uncertain times. We will check a DCF analysis and its sensitivity chart and review the most used metric in this sector, the EV/EBITDA Ratio.

We will then check if the three approaches will eventually converge towards a similar valuation.

Value investment approach

So how we make the value investment approach? There are a few ways in which we can decide to buy a company from a value perspective, but we will focus on one to assess MNZS.

First of all, we calculate the Asset Value of the company. So we start by looking at the company’s balance sheet and perform some adjustments to make sure that we find a fair value for the company’s assets.

Secondly, we go to the income statement and calculate the Earning Power Value. This is a way of knowing what the sustainable earnings of the company are. So we smooth out the normalized earnings with an average that takes out the peaks in our efforts to assess that.

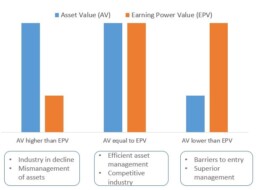

We then compare Asset Value (AV) to the Earnings Power Value (EPV) because we need to understand the relationship between them to make some value investment assumptions.

When the AV and the EPV have a similar value, we assume that the company is in a competitive environment and has efficient management. When the AV is higher than EPV, it would mean that the company is mismanaged or the company/industry is declining. If the AV is lower than the EPV, it means that the company has superior management and might enjoy entry barriers.

In the latter, which is not the case with this stock, value investors would be in general willing to pay an extra franchisee value for the moat, so a more significant valuation could be justified.

Asset Value of MNZS

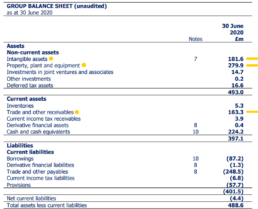

The first thing we do is to calculate the actual asset value of the firm. Below you will find the last reported balance sheet, and we are going to change the value of the elements that we think need some adjustment.

- The intangible assets comprise goodwill of 135.5m. These assets have been reduced by 75% to 46.6m to be more conservative about this amount because of potential future impairment.

- Because of the company Property, plant, and equipment leasing model, we have reduced this amount by 50% to 139.9m.

- A further adjustment of about 40% has been made to the Trade and other receivables as we predict Menzies’ clients are under much pressure and distress because of the pandemic. For instance, the Uk airline Flybe declared bankruptcy due to the demand drop because of the pandemic. Flybe was a client of Menzies, and there were rumors that a third of Menzies’ employees at Glasgow Airport were at risk of losing their jobs. As we do not know how the industry situation could affect the receivables, we adjusted the amount to 93.3m.

- As a consequence of the above adjustments, total assets are being adjusted from 890.1m to 495.5m.

Earning Power Value

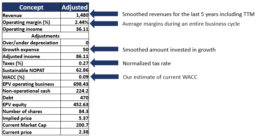

As we discussed above, here we are trying to calculate the company’s sustainable earnings. In the case of Menzies, we had to average and smooth some numbers. However, for the most critical adjustment, we had to understand how much of the operating expenses were for growth to add it back.

First, we smoothed out the company revenue for the last five years, 1.4 billion. We then calculated the firm’s average operating margin (2.44%) to figure the Operating Income to 36.11 million. Then we added back the money spent on growth. Breaking down the general expenses, we tried to figure out how much we had to add back. It was a bit tricky, but through the calculations of the acquisitions and other aspects, we could come up with a conservative number of 50 million.

We calculated the normalized tax rate to 27% and estimated the WACC to 9%. The Weighted Average Cost of Capital (WACC) is the company’s proportionally weighted cost of capital, considering all sources of funding.

We then calculated the Earning Power Value of the operating business (698.43 million). To that, we add the non-operational cash and subtract the debt for EPV equity of 452.63 million, which would be the implied market cap. According to this model, there is a 126% upside potential.

AV, EPV & Margin of Safety

After we applied the adjustments, we still find a reasonable margin of safety, so we think there is significant upside potential. There is a potential 126% upside is according to this approach.

DCF Model

In our Discount Cash Flow model, the central assumption was EBIT growth. An aggressive 50% in 2023, followed by 20% from 2024 to 2026, then 10% in 2020 to a stabilized 5% up to 2030. The discount rate used is 10%, and the terminal growth would be 2%.

At first glance, the growth might seem optimistic. However, the pre-COVID19 guidance for 2021 was 98 million. This year, we are around 62 million; when the pandemic situation is over, at least Menzies should be able to catch up near the previous trend.

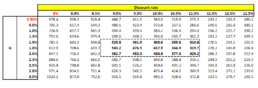

Sensitivity Analysis

You can check the fair price according to the discount rate and the terminal growth you would like to pick in the table below. Depending on the used discount rate, you can see the value at 1.8%, and 2% terminal growth can vary between 319.7 million and 543.2 million.

Indeed a fair mean value could be 430 at a 2% and 10% discount rate. However, we would pick a central value of 4.18 for this analysis as we will compare all our valuations at the end of this article.

EV/EBITDA Ratio

Before getting into the EV/EBITDA ratio calculation, we would like to discuss why this ratio is one of the most used and essential metrics to approach companies in this sector. You will also understand why do we think that Menzies is an excellent acquisition target in the industry.

One of the global’s Ground Handling leaders, Swissport, expressed their willingness to acquire new companies to enhance their market position a few months before the pandemic started. They have already made some crucial acquisitions like the Heathrow Cargo Handling in February 2019 and the Apron and Aerocare acquisitions in 2018. For the last, they paid a multiple of 10x EBITDA.

Worldwide Flight Services is another potential buyer. In 2018 they were bought by Cerberus Capital Management for a multiple of about 12.5x

Back in July 2015, the Chinese conglomerate HNA Group acquired Swissport with a price of 11.5x EBITDA. PAI Partners, the former owner of Swissport, acquired it at 11x EBITDA in 2011.

We already mentioned the acquisition of ASIG by Menzies. The EV/EBITDA multiple of that transaction was 9.9x

Menzies is a small-cap company with a good track record and promising opportunities for the future. One of the industry’s big players on the private equity side could purchase the company as it is an excellent acquisition target.

As we see, the EV/EBITA Ratio is one of the most used metrics to approach companies in this sector. WE would say that a ratio between 8 to 10 is considered adequate as transactions for this type of firm’s acquisitions have been historically made at an EV/EBITDA multiple between 8 and 12.

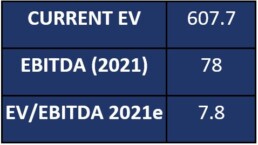

Menzies Enterprise Value is 607.7m, and the adjusted expected EBITDA for 2021 is 78m. As no updated guidance is available for 2021 EBITDA, we considered the last 98m consensus and adapted it to 78m because of the pandemic’s future effects.

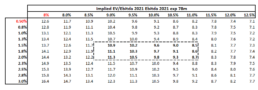

This is a sensitivity analysis considering the implied EV/EBITDA 2021 with Ebitda 2021e at 78m.

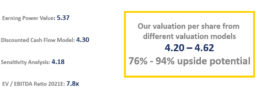

Valuations converge

As we have seen, the valuations of the different models for MNZS converge. We have taken the Earning Power Value, Discount cash Flow with its Sensitivity Analysis, and the EV/EBITDA ratio in the industry to conservatively approach the valuation.

We came up with a target price of 4.20 – 4.62 pounds per share with an upside potential of 76% – 94%.

Dividends

In 2017 MNZS reported an EBITDA of 110 million, an EBIT of 78 million, and a Free Cash Flow per share of 9.7. The dividend yield for that year was 4.5%. The following year 2018, their EBITDA was 83 million, their EBIT was 55 million, and the Free Cash Flow per share was 13.7. The dividend yield for the year was again at 4.5%.

The free cash flow per share may be less in the future because of the higher current debt which served to finance recent acquisitions. The company might eventually decide not ti distribute a dividend. This, should not be considered a major concern as the investment thesis here is not the future stream of dividends. The value driver here is the recovery in air traffic and a return of Menzies to higher operating margins.

Risks

One of the most discussed risks that we see is in the industry itself. Some say that the travel sector could suffer permanent changes because of the COVID-19 pandemic. There are risks of disruption in corporate travels as remote working could be seen as a more productive and cost-efficient way of doing business. Still, leisure travel could also pick in the following months after the pandemic as the people are willing to visit relatives and explore the world after the long confinement.

Another risk lies in the stretched financial situation of the group. Although covenants on debt have been recently renegotiated, if the air traffic does not recover the company might face the challenge to pay back the debt. It could be forced to rely on a share capital increase (implying potential share capital dilution).

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.