Free thoughts on my wrong investment in ATER

In life and business, consistency is essential. The ability to show steadiness with your thoughts gives you leverage in the form of moral authority. One of the main characteristics that leaders share is stability and commitment to their previous thoughts and ideas. Many “lazy” thinkers (sheep) want to follow somebody they can trust, that does not change their mind. In equity investment, not changing your mind can be fatal – for your capital and the capital you manage on behalf of others.

An equity story cannot be a life commitment, neither can you show devotion to them as a religion or your favorite football team. Things change, executives make mistakes, new technologies come, macro scenarios change, and more than anything else, you could realize you were WRONG. That happens as well, and there is nothing wrong with it unless you persist in the error. Many money managers and equity analysts want to avoid admitting mistakes and stay with their thesis. After years, not only do they look stupid, but they also affect their capital and/or the capital they manage.

I made a mistake with ATER. In the last few years, thanks to God, I did not make many, but ATER was one of the worst I made for sure.

When you sell a stock at a loss, you can use that amount to buy another, and if that new investment goes up, you make money back (with less risk sometimes). So, you don’t have to wait until you recover your losses with the same stock when you can redirect that money into a better strategy. I know it’s obvious, but some people get stuck for years in a losing position without realizing or admitting that it was a mistake when they should have shaken it off and move forward.

In the last few months, from October 2020 to February 2021, we have lived a very hectic stock market period where we had no time to sleep, primarily due to momentum stocks going higher every day. During that kind of pre-bubble time, in which it is impossible to cover all those stocks profoundly, you always have a few that you leave more to your team, rely on third parties, or you go over them by yourself but not with the needed level of in-depth analysis.

ATER was one of those companies I quickly looked at and therefore didn’t pay too much attention to some details that I left in my analysts’ hands. I checked up the models but didn’t have the time to dig deeper into the story, which at the moment seemed a straightforward, growth story.

I have come to believe that DCF for growth stories is something that doesn’t make much sense. Most of it has so many assumptions that it becomes a very risky bet. That’s why I usually prefer Sustainable Earnings (EPV) valuation, which allows us to analyze what the company has achieved in recent years and therefore provides a “feet-on-the-ground” idea of what it can deliver in the future.

I like some small growth stories on which I have small positions on my portfolio, between 1% and 2%, which gives me the ability to spend less time studying the stock because of the implied risk for my overall performance. Of course, I spent much more time analyzing the companies where I have more significant positions and still follow and study them closely.

I would have taken more prominent positions. However, time management is an essential skill, especially in high-volatility environments where opportunity cost is outrageous. You must spend more time on the significant convictions of your portfolio rather than trying to make the impossible and cover all the “promising-looking” stories.

The lack of proper due diligence is behind any mistake

Many FinTwit gurus only push the stories and never go into valuation assumptions or perform a proper strategic analysis of the stocks. They overlook the matter by throwing some multiples (usually P/S and EV/S); those multiples are a hazardous way to value a company. Especially in a period of bullish market in which relative multiples are very high and even more when you choose the wrong peer and compare “apples with oranges.” Different companies usually have distinct growth and risk implications, and this can bring two companies of the same space to have unrelated multiples justifiably by their intrinsic and individual characteristics. So, executing a valuation by simply looking at multiples can be extremely harmful because it might lead you to believe that a company is cheap when it is overly expensive.

Revenue Growth is meaningless to value a company unless it is not aimed to produce future free cash flow. Don’t forget that! Most Tech companies, especially SaaS, are based on a subscription model, and most of their revenue can be converted into EBITDA and then eventually free cash flow. When you buy software companies, 80% to 90% of that revenue can be converted into free EBITDA. Once you consider the cost of customer acquisition and the churn rate, most of the income would be cash, so multiples like EV/S may make some sense.

Because of the above argument, some gurus in the FinTwit community take for granted that EV/S is a useful metric for all Tech companies in general when it is bloody not!

Look at the kind of people we need to answer to on Twitter:

Stock pumping on Twitter is creating virtual boiler rooms

Stock pumpers manipulate followers and leverage their lack of knowledge. FinTwit traders have a dangerous behavior that fraudsters can exploit. When you learn about something, understand the terms and have some experience but don’t comprehend the subject deeply, you could be in danger. Because you are at a stage where you think you can handle a conversation, you can put your head around it, so you feel you don’t have to say, “I know nothing about it,” but deep inside, you know you don’t master that topic. That degree of knowledge is dangerous because it is not enough to address the issue accurately and not too little to let you walk away so that you can get played!

Wrong valuation input leads to big mistakes!

When you do a DCF on a growth story, you rely on multiple extremely difficult assumptions to hit correctly. Terminal growth could be responsible for 60% or more of your final equity value, and the model would be susceptible to the hurdle rate you use and the assumed growth. When you don’t know how value drivers move (Free cash flows either to the equity or to the firm, hurdle rate, and terminal growth), you are not safely investing. For some companies, DCF just doesn’t make sense.

As an example, let’s dig into ATER’s valuation technicals, and let’s try to explain what the issue with ATER is.

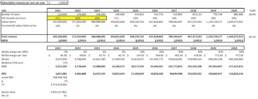

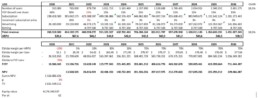

Look at what happens to ATER’s DCF model if you change some of the realities of the company to reflect new evidence:

- Raising Hurdle rate from 14% to 16%

- Reducing terminal growth rate from 3,5% to 1%

- Increasing the share count from 23.2 mil now to 26.2 (however, we could also use 30 to incorporate options and higher strike price warrants, but to avoid critics to this methodology, we use the share count on a weighted average basis)

One could argue that 16% as a discount factor is too high? Well, think about it again: if debt holders are getting 8% on a cash basis with an option to avail warrants, the real cost of debt is north of 12%. Wouldn’t the equity holder be compensated a few extra percentage points of risk premium?

The growth dilemma leads to other big mistakes!

That said, let’s now try tweaking the revenue CAGR growth rate. Growth can slow down if the share prices remain depressed. This is because one of the major investment theses of this company revolved around accretive M&A deals. To remain prudent, here we are assuming that the company’s organic growth does not decline, instead remains stable and grows slowly – which is also a big “if” and risky assumption. We will decode this argument later. If you tried to capture this scenario, valuation again drops significantly.

The fallacy of such a method to value this company is that we are missing the whole point by purely basing the valuation on growth assumptions from now to 10 years ahead. Trying to foresee the growth for a company like this is misleading. Revenue doesn’t mean anything; EBITDA is what matters, or, if we dig deeper, how much EBITDA you can convert into free cash flow. This is especially true when the company is externally buying growth at a high cost of capital.

While I was busy, my team prepared a DCF on ATER; sometimes, busy analysts do that quickly by using consensus and maybe adjusting for a higher hurdle rate if they smell implied growth might be high. By inputting consensus numbers and calculating a reasonable hurdle rate, you most likely will understand what the market thinks about the company.

When the initial model was constructed, the M&A activity of the company was done in an accretive way because the market cap was more than two times what it is today. So it was easy for the company to grow by giving shares in exchange. This narrative has now changed, as ATER is down more than 60% from its ATH, and buying assets in exchange for shares is highly dilutive for ATER. Think about it this way: if you are worth USD 1bln and buy an asset worth USD 40 mln, your share base dilution would be 4%. After a 60% share price drop as in the case of ATER, the same deal would lead to a a 10% share base dilution.

If we look at the products ATER bought, they are pure Chinese garbage. Objectively, they are cheap goods that sell well online. How much the company can grow is NOT the most crucial factor here.

A company can grow its sales CAGR at a factor of infinity. Still, the most crucial element is that whatever they sell makes enough money to pay for the debt and gain a reasonable amount of money. Think about it, plain a simple, they can keep buying all the companies they want and become a 100 billion turnover, but they are buying with a capital that needs to be reimbursed after the debt is paid, and that is the key.

So, the parameter you have to adjust in the DCF model is not only growth, but the most critical part is the EBITDA conversion to Free Cash Flow and EBITDA Margin.

Look below:

Getting back to company valuation, the most crucial element to analyze a company is its free cash flow. We all know that valuation is just trying to figure out the future cash flow of a company and bring it back discounted of the hurdle rate to today’s value. Still, some of these genius stock pumpers don’t even know what a hurdle rate is.

When you work on ATER’s model, you take for granted that the EBITDA margin will grow towards 15%, as indicated by the management. Only focusing on the growth will tend to overvalue the company. This is very easy to understand. ATER is buying growth. They are buying companies financing growth north of 12% (8% + warrant), so revenue increase is not an issue that is relatively easy to achieve. It would be best to make sure the company you buy will generate enough money to pay for the debt and remunerate the capital accordingly to satisfy the risk incurred.

Growth is not a helpful metric because ATER is buying it; ROIC is what we have to analyze because if your return on capital is not adequate, you can grow, destroying value. ATER sells stupid cheap Chinese goods, and they have to increase the sales of those products to justify their investment. If they can grow their sales and make a good spread between the money they borrow and what they make, then the business can succeed. However, if these products will go out of favor, or they won’t be able to sell them for a higher price, this company can easily go bankrupt. YES, it can be worth ZERO.

AIMEE is not a competitive advantage

ATER claims AIMEE to be the key to its business model. Well, AIMEE is just a data software that works with data inputs, and it has a code that would analyze data in a certain way. This doesn’t seem to be an advantage or a moat. What should be monitored closely is what kind of advantage AIMEE can offer. In my opinion, it was just one of those gimmicks where a company tried to take up SaaS valuation by selling an investor story involving this tech.

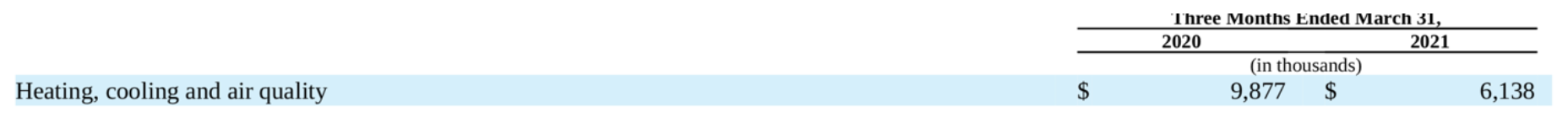

Look at this scary situation, one of the crucial revenue segments is going down dramatically:

Source: 10Q

This is what we need to look for as investors. Can they grow sales of the companies they are acquiring? Their rebuttal was:

Source: 10Q

What happened to AIMEE? They are selling 37% less because of “sell-outs inventory”? So, all this competitive advantage due to AIMEE technology that is supposed to optimize the process does not exist?

A company could hide their organic growth slowing down but keep growing revenue by buying companies at high prices and higher multiples if you don’t have a breakdown of the different companies. These companies could be running a Ponzi scheme, and it would not be easy to spot them if their financials don’t share segment by segment details.

Another FinTwit myth that needs to be clarified: Don’t get fooled by the story that a new high growth story does not have to be profitable. Some companies could not be profitable initially but will be investing heavily in Research and Development (R&D). Think about Amazon, Apple, or any other company that has spent years developing technologies that represent an actual moat. So, if you look at the P&L, you will see hundreds of millions or even billions spent during years to develop a technology.

You will see this cost deducted from the profit. But when the technology is eventually developed, all those R&D will ultimately manifest itself in a growing cash flow stream. In the case of ATER, their R&D is negligible – in 2020, they spend less than 4% of their revenues in R&D.

Conclusions

You should invest in ATER only if you believe that AIMEE provides a substantial competitive advantage. Their organic sales will grow steadily, and their products won’t get out of favor. It would help if you also trusted that they would be able to get better debt conditions. But how would you know that?

Moreover, let’s address two quick issues; in valuation, there are parameters to check for accounting manipulation called Benish Score and Z score. Although the explanation of these tests is beyond this article’s scope, I am not suggesting they are manipulating their books, but the possibility remains.

Nonetheless, a company like this could do this easily because of the setup of the business model. If they don’t show the breakdown of organic growth for each company they buy, they can show a higher EBITDA. Still, we wouldn’t know if EBITDA growth is fueled by a new acquisition (from expensive debt) or was fueled organically. Only the insiders like the CFO know that. ATER, former CFO left after the short report (according to the report, he had previously bankrupted a company).

So, back to the main issue, if the EBITDA growth cannot be assessed accurately, we will never know if it is a company with a stable future. Sometimes you can also define a stock by analyzing who is primarily investing in it. Feel free to go on the Twitter feed and check the kind of people pushing ATER, their financial background, as well as their motives. I was not impressed.

So, if you are a momentum trader and want to ride this, there is nothing wrong with it. If the growth story keeps going up again, ATER could get pumped back to $30 or $40 once again. But remember that price and value remain two different things.

I don’t know, and I don’t care where ATER will go. I don’t want to be seen like somebody who promotes this stock because I don’t feel safe and made a mistake the first time I bought it.

Because I changed my mind about ATER and made some tweets expressing my concerns, I was bullied and even received death threats and all sorts of insults from several Twitter accounts that are bullish on the stock. I have initiated legal procedures, and my lawyer already informed the police that they are constantly monitoring Twitter and taking things very seriously.

This is my last post on ATER, and I don’t want to talk or tweet anymore about it. I am not short yet; I would only take a short position eventually if there is further strong evidence of organic growth slowing and price momentum gaining traction. That said, I will pursue legal actions if I receive insults or threats because of my view and opinions.

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Assessing Menzies risk to go bankrupt after breaching covenants

Many of you have been reaching out to comment and ask about the Multiple-Valuation approach on John Menzies plc (MNZS). Of course, there are some concerns about the cash-burning, and for that reason, here I address that in this short article.

Relying on the Q3 presentation, we know that:

- Available cash resources of over £175m at 31 August 2020

- Underlying operating cash flow ahead of expectations with good debtor collections and upfront support from governmental agencies

- In January, the Company completed the refinance of the Group’s bank facilities that were due to mature in 2021 and replaced them with a US$235m amortizing loan and a £145m revolving credit facility, both due to mature in January 2025.

- The new covenant structure’s critical terms foresee net leverage covenant replaced with a minimum EBITDA covenant tested on a quarterly basis. The Group must keep a minimum of £45m liquidity. The new covenant structure will remain in place until the earlier of June 2022 or whenever the Group’s leverage as measured on a pre-IFRS 16 basis remains below 3.0 times for three consecutive quarters.

Based on the above points, we know the Company has addressed the liquidity issue and has renegotiated covenants. Now the question is whether these measures are enough to support the Company during the pandemic.

Still, from the Q3 presentation, we know that:

- Market conditions will remain challenging through the winter and the early part of next year, but expect a sustainable recovery in activity levels after that, contributing to modest revenue growth in 2021 over 2020

Assuming a liquidity level around GBP 150mln by the end of 2020 and a cash-burning between GBP 7mln and GBP 12mln per month, we believe Menzies might breach the liquidity covenant over the next 9 to 15 months.

Source: Our estimates

Source: Our estimates

What happens in case covenants are breached?

There are three possible scenarios:

- The most likely scenario is that covenants are renegotiated as the banking system proved to be supportive of Menzies.

- Menzies might be forced to look for a share capital increase and/or possible asset disposal to reduce its debt exposure.

- A mix of the above two scenarios

A prolonged lockdown scenario is clearly the major risk we see for Menzies shareholders as it might force Menzies to look for a dilutive share capital increase that might occur at a substantial discount to the current share price (227p as of 19 January 2021).

That said, we share Menzies management view for the long term as we expect “Menzies to emerge as a more efficient, agile and profitable business with a more focused footprint having exited stations that are no longer economically viable.”

Actions to be taken

It is crucial to continue monitoring disclosures on liquidity levels. Suppose we do not see a recovery in the level of activities for Menzies by the late summer period (which also carries a positive seasonality). In that case, we might eventually consider reducing our position as the probability of the events mentioned above increases over time.

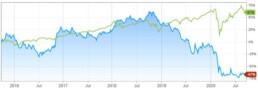

MNZS Chart

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

CURI: The NETFLIX For Documentary Nerds Tilting On Future Growth

Hey guys, here we will go over CuriosityStream. Before getting into it, I recommend you go to my article about approaching subscription companies and review the concepts that we discussed there. Check it out, and then come back here! If you already did, then let’s dig into $CURI.

Summary

- CuriosityStream is a streaming platform that offers thousands of engaging educational documentaries, short films, and series on science, history, nature, travel, adventure, and more.

- Strong management team, insider buying, hypergrowth estimates, and attractive gross margin serve as a bullish sign for CURI.

- Risk-reward based on valuation, trading multiple, potential dilution, and execution risk are unfavorable.

- At the current price, investors aren’t getting growth at a reasonable price as we estimate the fair value to be around $13.73.

What is CuriosityStream (CURI)?

CuriosityStream offers access to thousands of engaging educational documentaries, short films, and series on science, history, nature, travel, adventure, and more. If you relished watching classic Discovery Channel and Animal Planet type of content – this streaming service is similar. The company’s ambition is to address full category service within factual streaming and become what ESPN is to the complete sports category and not just a niche within sports like a golf or tennis channel.

Examples of some of the programs on offer include:

- David Attenborough’s Light on Earth

- Stephen Hawking’s Favorite Places

- Beyond the Spotlight by Leonardo DiCaprio and Stephen David

In August 2020, CuriosityStream underwent a reverse merger with Software Acquisition Group, Inc, a special-purpose acquisition company. Proceeds from this were mainly used to cover production & promotion costs.

Solid Management

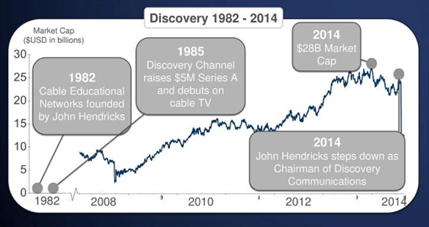

CuriosityStream’s management team is packed with relevant experience in this industry. The company was set up by John Hendricks — the founder of Discovery Communications. Hendricks spent decades building the successful factual cable network, as shown below:

Source: Company Presentation

His track record with Discovery instills trust and confidence that he could do the same with CURI. One valid question that might bother you is why did he left Discovery or not helped them transition towards streaming? According to him, Discovery could not fully take advantage of the ongoing shift in the entertainment industry from cable to streaming due to legacy obligations and restraints; CURI does not have these problems.

In June 2018, Clint Stinchcomb was appointed the CEO of CuriosityStream. He is an industry veteran and served as a CEO and a co-founder of Poker Central. This company ran a subscription streaming service called Poker GO, which was tailored towards the card-playing community.

Jason Eustace, the CFO, was the former head of finance for Bluemercury, Pet360 & Discovery.

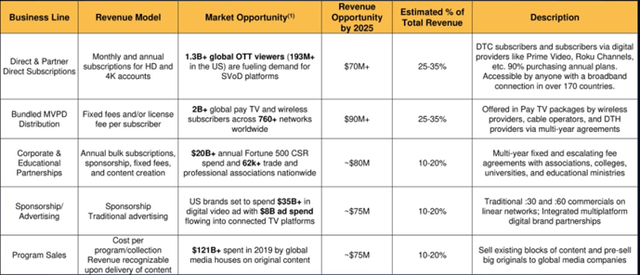

Multiple options to Monetize content

- The company not only acquires and produces content for its direct subscription service; it also sells content via digital providers like ROKU, Prime Video, etc.

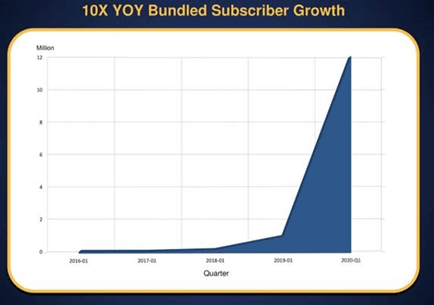

- It also offers bundled subscriptions via cable, satellite, and internet distributors. With a wide range of distribution deals worldwide, featuring Comcast, Altice USA, MultiChoice (Africa), StarHub (Singapore), Totalplay (Mexico), and Millicom (Latin America). This category has seen astonishing growth over the last four years (see below)

Source: Company Presentation

Although this comes with lower ARPU vs.. selling directly to the consumer, according to management, it enables scalability due to its newness compared to major players like NFLX, who achieved this in a decade. ARPU (Average Revenue Per User) is about 15 cents per month, which totals $1.80 per user per year. They receive 8 cents per month from bundled distribution users, which represents a majority of their accounts.

- Corporate partnership – where they target $20BN+ Fortune 500 yearly spending on Corporate Social Responsibility (CSR). Currently, 40 companies have purchased an annual subscription and represent 140K paying subscribers.

- Educational Partnerships -it will also sign multi-year contracts with universities and colleges to build streaming libraries on their behalf. Within their advisory board representation include the president of Georgetown University and a vice provost at Stanford University (among many other universities), there is good reason to believe this may take off.

- Program sales – where they will sell existing content and pre-sell originals to global media companies

Sponsorship and Advertisement – it does sell exclusive sponsorship slots for some of its contents. This is done in the form of 15-second pre-roll ads before the start of a show. For its bundled subscription 30-60 seconds, commercial on linear networks was recently planned.

Breakdown of Revenue TAM and Estimate % of Total Revenue:

Source: Company Presentation

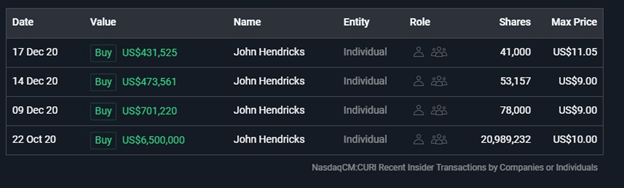

Insider Buying

One of the legend investors, Peter Lynch, once said:

“insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

As corporate executives sometimes have better insights about the firm and its future, this asymmetrical information between companies’ management and investor insider buying is seen as a bullish signal. It can be seen below founder John Hendricks has been galloping some CURI share recently.

Source: Simply Wall St

Astonishing growth and gross margin

- In 2015, when the company was founded, the management hoped to acquire five to seven million subscriptions by 2020. They were able to surpass this, and current subscribers stand at 13M. Management is aiming for a 79M Subscription target by 2023. Due to its track record, there is a high probability they might be able to pull this

- Revs up 83% YOY to $8.7M in last quarter

- >100% Y/Y revenue growth in last three years with 50% CAGR estimated till 2023

- International partnerships, i.e., Tata Sky

- CURI intends to grow from 3100 factual titles today ($1.3B estimated original production value) to around 12k in 2025. Currently, NFLX has 500. When CURI started, it had a library of about 800.

- Gross Margin of >60% due to cheaper average production cost can be sustained long term. For example, it cost $500-600k for a top-end factual documentary to be produced, while scripted shows cost around five to six million.

Risks

- Rapid growth is vital for CURI – at the moment, relying on management, forecasts require a lot of execution.

- Risk of potential share capital dilution, assuming all warrants are converted, the fully diluted share count is estimated to be around 74.3M. An element market has paid less attention to, compared to its potential for profitability and growth.

- The majority of subscriptions came via bundles (12M out of 13M total subs), which have significantly lower ARPU

- Bundle subscription can cannibalize their direct offering as it is cheaper.

- What happens when competition decides they no longer need CURI on their platform or want to compete directly?

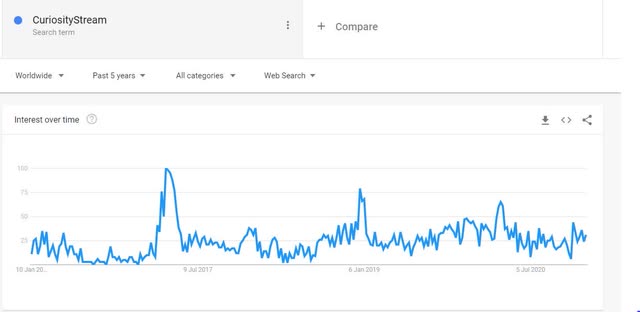

- Recent growth might be there as there were fewer sports in March and people stayed at home more (see google trends below). Can this be sustainable in the long run?

Source: Google Trends

Our Valuation case

Basic assumptions underlying the valuation model

- The perpetual growth rate of 2%

- 5 Year Average of 10 Year UST is 2%

- 2% is also the average of US GDP growth in recent years

- A discount rate of 15%

- Cost of Equity for NFLX us 7.4% based on Market Risk Premium of 6%, Beta of 1.06, and Risk-Free rate of 1%

- Additional to NFLX’s cost of equity, we added a Small-Cap risk premium of 7.7%. Why?

- Professor Damodaran estimated the stock premium of small-cap between 1926 and 2015 to be 3.82% on average. (You can find the study here). He also noticed the premium had a standard deviation of about 1.91%. To become 95% confident in our small-cap premium estimate, we took 7.6% as our premium (2 standard deviations from the mean).

- Liquidity Risk

- Price Volatility causing risk aversion for investors

- No previous price history, we cant estimate the cost of equity using CAPM

- Information uncertainty/asymmetry as it’s a new company

- Revenue Growth Rate – CAGR 40% divided into two stages

- Till 2025 we used management estimates Y/Y as given in its company presentation

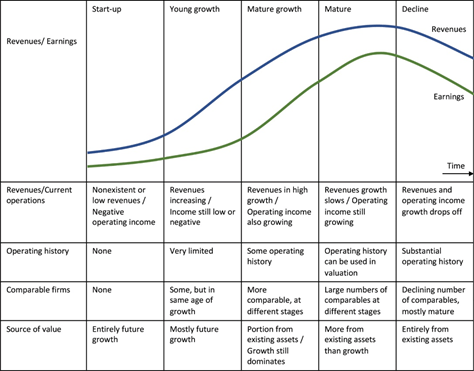

- From 2025-2030 we took the average revenue growth rate of NFLX and Discovery channel as they entered from high growth to mature growth stage of the company’s life cycle

Company Life Cycle Framework

Source: Damodaran (2010)

- Gross Margin –Two Stages

- 2020-2025 – company guidance around 60%

- 2025-2030 – 60% Long term margin akin to Discovery and other streaming companies

- SG&A increases by 10% Y/Y

- Since CURI is not capital intensive

- Operating income to FCFE conversion ratio of 60%

- To remain conservative in our valuation

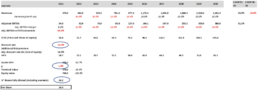

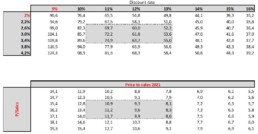

Fair value based on our valuation model

Source: MOAT Investing

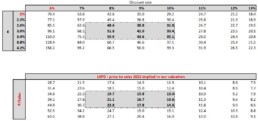

Sensitivity analysis on key value drivers (discount rate and g)

Source: MOAT Investing

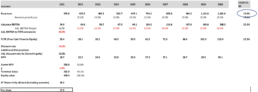

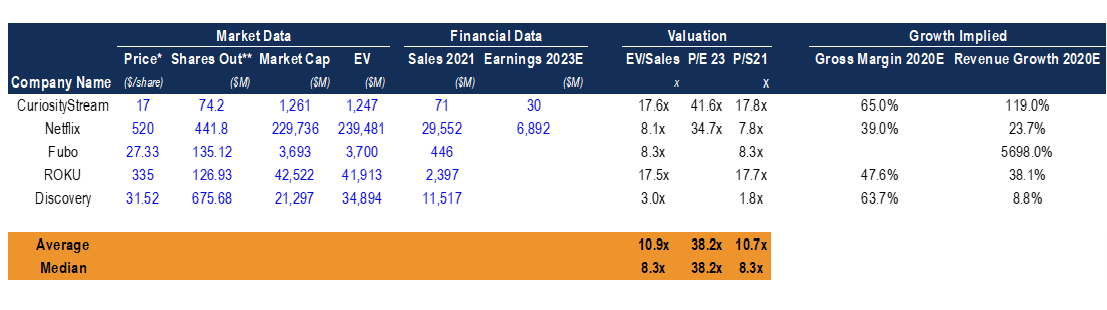

Multiple analysis VS peers.

As shown in the table below, CURI is trading at higher multiples relative to its peers. The market has already priced in the growth story for this stock. Implied growth priced in is higher compared to that of FuboTV, which has a similar business model. Additionally, it’s trading at a slight premium compared to Roku, which can be argued, addresses a significantly larger TAM market relative to CURI.

Price as of 5th Jan*

Fubo and CURI share outstanding assumes potential dilution**

Source: MOAT Investing.

Conclusion

We believe that CURI is a hold at the current price (USD 16,33 p/sh as of January 8, 2021). Market consensus has aggressively priced in rapid growth. Although it offers an elevated level of growth at present, its niche business model limits its TAM. Despite management having a demonstrable track record, there is an inherent risk of executing their aggressive growth promise. That said, we will monitor this stock to see whether the company can hit its forecast (or surpass it). If they do so, it can tilt its way to becoming NETFLIX for documentary nerds, and we would eventually revise our stance on the stock!

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Multiple Valuation Models - John Menzies plc (LSE: MNZS)

Lately, we have been focused on growth stories. One of the last value stocks that we covered was Park Hotels & Resorts, which valuation has more than doubled since the article was released. I have been looking at MNZS for some time now but haven’t had the time to dig deeper into it. However, I knew from the beginning that this was the perfect story to be approached by different valuation models, especially Value Investing.

Brief description

John Menzies plc (LSE: MNZS) is the holding company of Menzies Aviation, which provides aviation services in more than 30 countries. John Menzies plc was founded in 1833 and is based in Edinburgh (UK). The company offers several solutions to airports, airlines, and other clients and partners in the sector around the world.

- Fuel services: Fuelling more than 9,500 planes per day at around 80 locations, they claim to be the world’s largest independent provider of into-plane fuelling services and fuel farm management for oil companies, airports, and airlines.

- Ground services: Menzies Aviation handles 1.2 million aircrafts every year. This includes ramp and baggage handling, de-icing planes, passenger services (from check-in to boarding), and cabin cleaning.

- Air Cargo: They manage about 1.5 million tons per year, including logistics, special cargo, and human resources outsourcing.

- Offline services: With more than 20 years of experience, Menzies provides all the services needed, from the maintenance of ground support equipment to baggage tracing and customer relations.

- Executive services: They have a VIP lounge network providing a tailored experience to executive passengers. In 2019 they welcomed 1.5 million guests.

COVID-19 impact on MNZS

The pandemic drastically impacted the valuation of MNZS, opening a unique buying opportunity. The company is now looking to reduce costs and focus on the core business to cope with the industry’s new metrics (lower traffic volumes).

This company has a history of acquiring other companies with the aim to consolidate the sector as economies of scale matter. We think that this is an intelligent move of the management to enter into new markets. Just in December of this year, the company acquired 51% of Royal Airports Services in Pakistan. It also partnered with Lift in South Africa, reinforcing its presence in Africa and the Middle East.

In 2017, Menzies acquired ASIG Holdings for $202 million. For the year ended December 31, 2015, ASIG reported revenues of $415.8m and pre-tax profits of $17.9m.

Because of the COVID-19 situation, the ASIG integration into Menzies industrial plan did not deploy as expected. This is a critical issue that we have factored into our analysis. There is a potential value creation that has been stopped for the time being because of the pandemic crisis.

Investment Thesis

Clearly, the pandemic is the catalyst here and the leading cause of the drastically decreased market valuation. We think that due to the current price of the stock and the COVID-19 foreseeable future, this firm is a candidate for a Value Investing approach.

We will also cover other models and discuss several points of view to undercover the company’s complexity from different angles in these uncertain times. We will check a DCF analysis and its sensitivity chart and review the most used metric in this sector, the EV/EBITDA Ratio.

We will then check if the three approaches will eventually converge towards a similar valuation.

Value investment approach

So how we make the value investment approach? There are a few ways in which we can decide to buy a company from a value perspective, but we will focus on one to assess MNZS.

First of all, we calculate the Asset Value of the company. So we start by looking at the company’s balance sheet and perform some adjustments to make sure that we find a fair value for the company’s assets.

Secondly, we go to the income statement and calculate the Earning Power Value. This is a way of knowing what the sustainable earnings of the company are. So we smooth out the normalized earnings with an average that takes out the peaks in our efforts to assess that.

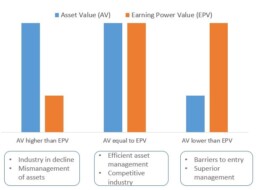

We then compare Asset Value (AV) to the Earnings Power Value (EPV) because we need to understand the relationship between them to make some value investment assumptions.

When the AV and the EPV have a similar value, we assume that the company is in a competitive environment and has efficient management. When the AV is higher than EPV, it would mean that the company is mismanaged or the company/industry is declining. If the AV is lower than the EPV, it means that the company has superior management and might enjoy entry barriers.

In the latter, which is not the case with this stock, value investors would be in general willing to pay an extra franchisee value for the moat, so a more significant valuation could be justified.

Asset Value of MNZS

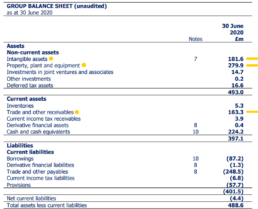

The first thing we do is to calculate the actual asset value of the firm. Below you will find the last reported balance sheet, and we are going to change the value of the elements that we think need some adjustment.

- The intangible assets comprise goodwill of 135.5m. These assets have been reduced by 75% to 46.6m to be more conservative about this amount because of potential future impairment.

- Because of the company Property, plant, and equipment leasing model, we have reduced this amount by 50% to 139.9m.

- A further adjustment of about 40% has been made to the Trade and other receivables as we predict Menzies’ clients are under much pressure and distress because of the pandemic. For instance, the Uk airline Flybe declared bankruptcy due to the demand drop because of the pandemic. Flybe was a client of Menzies, and there were rumors that a third of Menzies’ employees at Glasgow Airport were at risk of losing their jobs. As we do not know how the industry situation could affect the receivables, we adjusted the amount to 93.3m.

- As a consequence of the above adjustments, total assets are being adjusted from 890.1m to 495.5m.

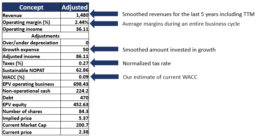

Earning Power Value

As we discussed above, here we are trying to calculate the company’s sustainable earnings. In the case of Menzies, we had to average and smooth some numbers. However, for the most critical adjustment, we had to understand how much of the operating expenses were for growth to add it back.

First, we smoothed out the company revenue for the last five years, 1.4 billion. We then calculated the firm’s average operating margin (2.44%) to figure the Operating Income to 36.11 million. Then we added back the money spent on growth. Breaking down the general expenses, we tried to figure out how much we had to add back. It was a bit tricky, but through the calculations of the acquisitions and other aspects, we could come up with a conservative number of 50 million.

We calculated the normalized tax rate to 27% and estimated the WACC to 9%. The Weighted Average Cost of Capital (WACC) is the company’s proportionally weighted cost of capital, considering all sources of funding.

We then calculated the Earning Power Value of the operating business (698.43 million). To that, we add the non-operational cash and subtract the debt for EPV equity of 452.63 million, which would be the implied market cap. According to this model, there is a 126% upside potential.

AV, EPV & Margin of Safety

After we applied the adjustments, we still find a reasonable margin of safety, so we think there is significant upside potential. There is a potential 126% upside is according to this approach.

DCF Model

In our Discount Cash Flow model, the central assumption was EBIT growth. An aggressive 50% in 2023, followed by 20% from 2024 to 2026, then 10% in 2020 to a stabilized 5% up to 2030. The discount rate used is 10%, and the terminal growth would be 2%.

At first glance, the growth might seem optimistic. However, the pre-COVID19 guidance for 2021 was 98 million. This year, we are around 62 million; when the pandemic situation is over, at least Menzies should be able to catch up near the previous trend.

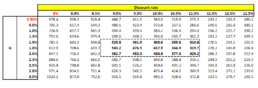

Sensitivity Analysis

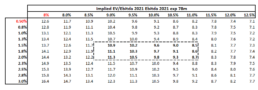

You can check the fair price according to the discount rate and the terminal growth you would like to pick in the table below. Depending on the used discount rate, you can see the value at 1.8%, and 2% terminal growth can vary between 319.7 million and 543.2 million.

Indeed a fair mean value could be 430 at a 2% and 10% discount rate. However, we would pick a central value of 4.18 for this analysis as we will compare all our valuations at the end of this article.

EV/EBITDA Ratio

Before getting into the EV/EBITDA ratio calculation, we would like to discuss why this ratio is one of the most used and essential metrics to approach companies in this sector. You will also understand why do we think that Menzies is an excellent acquisition target in the industry.

One of the global’s Ground Handling leaders, Swissport, expressed their willingness to acquire new companies to enhance their market position a few months before the pandemic started. They have already made some crucial acquisitions like the Heathrow Cargo Handling in February 2019 and the Apron and Aerocare acquisitions in 2018. For the last, they paid a multiple of 10x EBITDA.

Worldwide Flight Services is another potential buyer. In 2018 they were bought by Cerberus Capital Management for a multiple of about 12.5x

Back in July 2015, the Chinese conglomerate HNA Group acquired Swissport with a price of 11.5x EBITDA. PAI Partners, the former owner of Swissport, acquired it at 11x EBITDA in 2011.

We already mentioned the acquisition of ASIG by Menzies. The EV/EBITDA multiple of that transaction was 9.9x

Menzies is a small-cap company with a good track record and promising opportunities for the future. One of the industry’s big players on the private equity side could purchase the company as it is an excellent acquisition target.

As we see, the EV/EBITA Ratio is one of the most used metrics to approach companies in this sector. WE would say that a ratio between 8 to 10 is considered adequate as transactions for this type of firm’s acquisitions have been historically made at an EV/EBITDA multiple between 8 and 12.

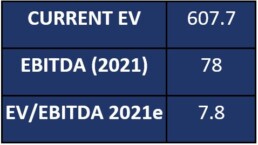

Menzies Enterprise Value is 607.7m, and the adjusted expected EBITDA for 2021 is 78m. As no updated guidance is available for 2021 EBITDA, we considered the last 98m consensus and adapted it to 78m because of the pandemic’s future effects.

This is a sensitivity analysis considering the implied EV/EBITDA 2021 with Ebitda 2021e at 78m.

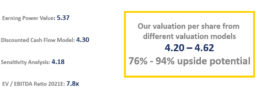

Valuations converge

As we have seen, the valuations of the different models for MNZS converge. We have taken the Earning Power Value, Discount cash Flow with its Sensitivity Analysis, and the EV/EBITDA ratio in the industry to conservatively approach the valuation.

We came up with a target price of 4.20 – 4.62 pounds per share with an upside potential of 76% – 94%.

Dividends

In 2017 MNZS reported an EBITDA of 110 million, an EBIT of 78 million, and a Free Cash Flow per share of 9.7. The dividend yield for that year was 4.5%. The following year 2018, their EBITDA was 83 million, their EBIT was 55 million, and the Free Cash Flow per share was 13.7. The dividend yield for the year was again at 4.5%.

The free cash flow per share may be less in the future because of the higher current debt which served to finance recent acquisitions. The company might eventually decide not ti distribute a dividend. This, should not be considered a major concern as the investment thesis here is not the future stream of dividends. The value driver here is the recovery in air traffic and a return of Menzies to higher operating margins.

Risks

One of the most discussed risks that we see is in the industry itself. Some say that the travel sector could suffer permanent changes because of the COVID-19 pandemic. There are risks of disruption in corporate travels as remote working could be seen as a more productive and cost-efficient way of doing business. Still, leisure travel could also pick in the following months after the pandemic as the people are willing to visit relatives and explore the world after the long confinement.

Another risk lies in the stretched financial situation of the group. Although covenants on debt have been recently renegotiated, if the air traffic does not recover the company might face the challenge to pay back the debt. It could be forced to rely on a share capital increase (implying potential share capital dilution).

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

A closer look at lightspeed POS

A company to keep into the radar although valuation looks stretched

BRIEF

- LSPD is a platform offering front-end consumer experience, back-end operations management, and a payment system.

- COVID-19 has dramatically increased the demand for the service as retailers rush to integrate online sales channels and payment systems.

- Well managed with a clear path to grow by scaling up dimensionally via M&A piggyback strategy.

- Valuation looks stretched for the time being but it’s worth looking at this company as its addressable market is huge. We would reconsider the story should the price fall back below $40 per share.

What is Lightspeed?

Lightspeed POS (TSE: LPSD / NYSE: LSPD) provides cloud-based point-of-sale and e-commerce software to restaurants, hospitality businesses, and retailers in over 100 countries. The platform’s three main pillars are the front-end consumer experience, back-end operations management, and the payment system. The company offers different services (SaaS) and hardware to run its software. They provide products for retailers like Point of sale, e-commerce, payment system, loyalty system, analytics, accounting, hardware (cashiers, scanners, printers, etc.), and other integrations.

Why did we look at the stock?

There have been certain movements related to this company. AMI Partners estimates that there are approximately 226 million small and medium-sized businesses (SMBs) around the world generating around $59 trillion of revenue in 2018. Lightspeed’s addressable market is huge and the firm is trying to consolidate the market by acquiring small operators and their client base.

Why do we believe it is overvalued?

LSPD valuation looks unsustainable under whatever metric we have tried to use. The stock is trading at around 35x P/Sales 2021E and 24x P/Sales 2022E. We understand that covid-19 has accelerated the digital transition for SMEs dramatically but, at current prices, we see more risks than upside on the story even if LSPD would continue to consolidate its market. Furthermore, we should factor in the potential dilution on equity (more likely at current prices as many growth companies are taking advantage to raise fresh money) on top of the difficulties in integrating targets being acquired. We would be keen to look at this interesting equity story once the price would fall below $40 per share.

Increased demand for services is an LPSD catalyst

It is hard for small and medium businesses to keep up with new developments in customer engagement, operation and channel management, and online payments. These kinds of retailers tend to look for modular services to keep updating their systems without incurring many complications. Lightspeed is also promising for data-driven solutions that are becoming critical for the businesses they serve. These services, as well as current and future artificial intelligence and other developments, are easy to integrate as new modules, driving further incremental revenue.

The demand for the service has dramatically increased due to the COVID-19 pandemic as retailers rush to integrate online sales channels and payment systems. However, Lightspeed’s churn rate has also increased because businesses like restaurants are suffering losses, and many have closed due to COVID-19’s impact on the real economy.

The company seems to be moving in the right direction when it comes to partnerships and acquisitions. Last February, they partnered with Stripe to add a payment module to Lightspeed’s services. This so far has represented a great strategy and a new revenue driver to the platform. Furthermore, in November, Dax Dasilva, Lightspeed’s CEO and founder announced the acquisition of ShoopKeep, a similar platform with more than 20,000 small and medium retailers in the USA. On December 1st, the company announced the acquisition of Upserve, a restaurant management cloud-software company that focuses on high-end restaurants, fast-casual, and bars.

Competitive position

The Point of Sales market is an old one and was once disrupted by offline software companies and now is being disrupted by internet-based companies.

Some Lightspeed competitors are:

- Square POS

- PayPal POS

- Heartland Retail

- Vend

- Clover

- Shopify POS

- QuickBooks POS

- Oracle Retail Xstore POS

The retail market is huge. There are approximately 226 million small and medium-sized businesses (SMBs) worldwide, generating around $59 trillion of revenue in 2018.

It is worth considering that there are a few limitations when it comes to small businesses. For instance, the price sensitivity for core software and equipment is something that the sector has to keep in mind to be able to compete. Lightspeed has very reasonable plans from just $69 to $259 per month for retailers and a starting package of $59 to $98 for restaurants. For that reason, the payment system was a good move as they entered the percentage game with much better outcomes possibilities for revenue.

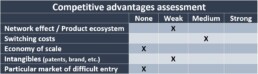

Nevertheless, we are still searching for substantial competitive advantages as only a significant moat could assure the permanence and sustained growth of Lightspeed in the market in the long run. So far, we estimate that the switching costs could represent a medium barrier to entry to competitors.

Similar to what happens with legacy cashier systems (which are being disrupted by these internet companies), changing the software with which retailers manage their clients, operations, and payments could be more challenging and complicated than it seems.

The network effect and product ecosystem could play a role when it comes to multiple-store businesses but still weak in terms of a real barrier to entry. Notice that the company could enjoy an economy of scale advantage in the hardware segment. However, as it represents a small part of the company’s revenues and is not the core product, we do not think such a moat could be achieved soon. The same goes for the intangibles, it is a remote possibility, but the firm isn’t close to it yet.

Lastly, as we already know, the market is not particularly difficult for new players to enter. Virtually anyone could enter the market as the software and development of such services aren’t rocket science anymore, especially for banks and payments platforms.

Financials and business insights

We believe that the company is currently trading far above its fair price as the current valuation is overestimating the future increases in demand for their services due to the pandemic.

However, as we have said before, this pandemic was a catalyst for technology adoption. Still, the world was already moving in that direction, and it probably won’t go back when the COVID-19 is over. It doesn’t mean, though, that the company will keep its position for a long time. That will depend on other factors, particularly on the company’s ability to develop and maintain competitive advantages.

Lightspeed is a subscription-based company. We already discussed different ways to approach these firms in the report on FUBOTV that you can find on the blog. The difference with Lightspeed is that they tend to have more long-term subscriptions because of the LSPD business’s nature.

We have to look at unit economics when it comes to Lightspeed. Remember, the trick lies in obtaining the user, maintaining it, and monetizing it in different ways. Lightspeed has great potential in this last respect. For instance, the inclusion of the payment system mentioned before was a clear signal. In recent events, they have clarified some ideas about the future in this matter. Data-driven services are the management promise for future modules to be included in the list of services. With artificial intelligence and big-data development, we think that they are right-minded to state that.

Retailers, restaurants, and hotels greatly benefit from these technologies, and there is much more to come. They also have multiple-store customers’ added side effect, meaning that one customer could have separate accounts/users (one per store). It serves in both ways because the Customer Acquisition Cost for this kind of customer is divided by the number of its users/stores.

Suppose the management is able to strengthen its platform by including new modular services and that they can keep their clients happy, so the churn rate is controlled. In that case, the ARPU could keep growing in time. This could improve the Customer Lifetime Value and Customer Acquisition Cost Ratio, increasing Lightspeed’s profitability in the long term.

Before getting deeper into the company’s numbers, we have to state that to get clients in this market, you have to get new starting clients, disrupt existing retailers that use legacy systems, or steal them from competitors. None of these options are easy.

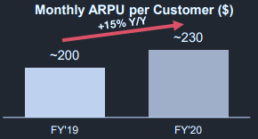

The number of users (or customer locations as they call them) has been systematically growing in the last years. The company currently has more than 80,000 users to be reported in the second quarter of 2021. A Year-To-Year growth of +40%, respecting in the same quarter of 2020.

The annual Average Revenue Per User increased by 15%, which is also a good indicator and helps with our theory of a medium barrier to entry regarding switching costs. Moreover, it also speaks about Lightspeed’s capacity to increase the revenue by selling new services to existing users.

The primary revenue sources are the software (subscriptions to the different services) and the payment system (they charge 2.30% + 10/20/30 cents depending on the case). They also receive revenue from the hardware segment.

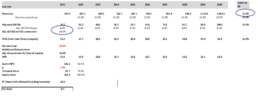

Our Valuation

We are basically repeating what we have done with FUBOTV equity story. Our goal is to find the Present value of each LSPD client. The valuation would probably be the present value of the existing and future clients’ cash flows.

For growth companies like LSPD, we continue repeating a basic concept: it is extremely difficult to have a reliable quantitative model because churn, inflation in service prices will most likely depend on the competition and on the company’s ability to scale up dimensionally.

The spreadsheet below is based on a client’s subscription base expected to grow at 26%CAGR over the 2021-30 period. We have assumed a 3% price increase, which we believe is reasonable given clients’ switching costs.

We have considered an EBITDA margin that turns positive in 2023 and stabilizes in 2030 at 50%. This means that from 2030 onward 50% of ARPU is transformed into EBITDA. This is a more than fair assumption as the business is low margin and furthermore, LSPD might incur additional costs related to the acquisitions it has done and it will do in the future.

The other key assumption we have made is that 70% of the Ebitda is converted into FCFE (Free cash flow to equity, residual to shareholders) which can finally be discounted at an appropriate cost of equity to figure out the equity value.

We have used a 9% cost of equity and a 3% perpetual growth rate. We could have done a more in-depth analysis of the beta and rely on a capital asset pricing model (CAPM). However, we believe it would not make much sense at this stage because the CAPM fails to deliver a reasonable cost of equity in cases like LSPD where basically the correlation to the index is limited as the company was listed last April.

So, in table 2 we have decided to rely on a sensitivity analysis which calculates the price per share by changing the cost of equity and the perpetual growth rate (g). Assuming a discount rate between 8% and 10% and a perpetual growth rate between 2.6% to 3.4%, the average price could be between $32 and $56 per share. The downside here is around 20%!

We have also checked the 2022 P/sales ratio implied by our sensitivity. In other words, still in table 2, we show for each equity value (or price per share) which is the implied 2022 P/sales. At current prices LSPD is trading around 35x P/Sales 2021E and 24x P/Sales 2022E. Our fair value range between $32 and $56 per share implies between 13x and 22.8x P/Sales 2022E.

In our view, there is evidence enough to consider LSPD overvalued: low margin business, low entry barrier, potential dilution on equity are all factors we have to take into consideration. If we were not in a pandemic scenario that is accelerating the digital transition, our valuation would have been even more conservative.

Spreadsheets

Table 1: DCF model

Table 2: Sensitivity analysis and 2022 implied P/E sales

About Antonio Velardo

Antonio Velardo is an experienced Italian Venture Capitalist and options trader. He is an early Bitcoin and Ethereum adopter and evangelist who has grown his passion and knowledge after pursuing the Blockchain Strategy Programme at Oxford University and a Master’s degree in Digital Currency at Nicosia University.

Velardo manages an 8-figure portfolio of his investment company with a team of analysts; he is a sort of FinTweet mentor, people interact with him online, and he has more than 40,000 followers after his tweets. He has built a fortune in the great tech years and put together a tail strategy during the pandemic that allowed him to take advantage of the market drop. “I did not time the market, and I did not think this was even a black sworn,” he says.

On the side of the financial markets, Velardo has a unique combination. He was a real estate entrepreneur that developed several projects in Tunisia, Miami, Italy, the UK, and many other countries and cities. But he has always been passionate about options trading. Still, contrary to the volatility player and quant trading, he always had a value investing touch in his blood. Antonio studied Value Investing at Buffet’s famous business school at Columbia University. Even though the central concepts of value investing are antagonists to the venture capital pillars, Antonio’s approach tries to bridge elements of both worlds in order to seek alpha. Velardo has learned the importance of spotting pure growth stories and taking advantage of their S-Curve position. This is an essential element of Velardo’s approach as he looks forward to embracing great tech stories at the right time of the adoption cycle. This applies to stocks but also to blockchain projects.

Approaching subscription companies - Case: FUBOTV INC

Investment summary

- Streaming platform representing a cable-cutting alternative

- Well managed with a clear path to growth on core business

- Opportunities to diversify revenue stream

- Interesting valuation with high potential upside

What is FUBOTV

FUBOTV INC (NYSE: FUBO currently 27.40 $ per share as of December 3, 2020) is a streaming platform focused primarily on live sports. It is a cable-cutting alternative, especially for those who watch various sports channels and don’t want to miss any game, some of them in 4K.

The basic plan, which allows two simultaneous users, includes 100+ channels (more than 24 sports channels), 30 hours of cloud-based DVR for a monthly price of $59.99, and the “Fubo Extra” for $5.99 to add 44 more channels. Like cable TV, they offer several subscription plans, add-ons, and extras. FUBOTV’s interface is friendly but also similar to the cable TV ones. As you would imagine, it can be streamed through smart TVs, mobile, tablets, several devices like AppleTV, Chromecast, Amazon Fire, Roku, Xbox, and on the internet.

The sector is being reshaped

The sector is crowded by cable providers and by a plethora of streaming platforms. But the competitive hedge in the sector is being shifted and competition is not anymore on prices. The focus is now on quality, accessibility, interface, scalability, and contents. Streaming platforms are killing cable tv. At a certain stage we believe streaming platforms will tend to merge to benefit from economies of scale and keep up ARPU. M&A wave might be a major value driver in the sector although its still too early to factor it into current sector multiples. Furthermore, streaming platforms have great opportunities to diversify their revenue stream by increasing advertising (a linear function of the number of users) ecommerce and betting (see recent FUBOTV deal with Balto sports).

Where the upside may lie

FUBOTV is scaling up dimensionally very fast and is expected to keep growing not only on its traditional subscription business but also by expanding into gaming, betting and ecommerce. FUBOTV management is doing the right steps and if FUBOTV’s strategy proves to be effective, there is a substantial upside on this equity story as it is currently trading at 4x P/sales 2021 while it could converge to 8x (peers trading also at 11x) which would be in line with our FCFE model (Ebitda margin stabilized at 70% from 2025 onward, 70% EBTDA to FCFE conversion, 12% cost equity, 3% g).

FUBOTV: the sector and the competitive hedge

The sector is crowded by a plethora of competitors, some of which are not publicly traded for the time being. We believe although that, given current valuation metrics, some might soon considering going public.

DAZN:

English sports streaming service available in the USA, Austria, Brazil, Canada, Germany, Italy, Japan, Spain, and Switzerland. They are expected to go globally for more than 200 countries by December 1st, 2020. We are paying attention to this one because we believe it might be a real threat to FUBOTV.

Hulu:

Streaming service majority-owned by Disney. At the time, it has more than 36 million users. Even though it isn’t primarily focused on sports, it has all the local and national sports channels. For instance, their clients’ value is said to be $6,000, while for FUBOTV, we are being much more conservatives and calculate a customer value of around $550.

YouTube TV:

Features outstanding sports coverage, and like FUBOTV, it is a cable-replacement service. The prices are very similar to the ones of FUBOTV. It also has excellent cloud-based DVR capabilities.

Of course, FUBOTV also competes directly with cable providers. They have been around for a reasonable amount of time and are still important. However, the sector is being reshaped, and they are not competing anymore on prices. The focus is now on quality, accessibility, interface, scalability, and contents.

Opportunities ahead

Besides the regular expectations of more premium paid contents, like important hosted events, we think that there are good opportunities in two major segments:

Advertising

There is room for advertising growth on FUBOTV. As the number of customers grows, the capabilities of selling ads on the platform increase exponentially. Some extra features and metrics like CPC and CPA that online advertisers love must be taken into consideration.

Betting and Ecommerce

FaceBank’s eCommerce and payment system platform allows FUBOTV to penetrate the betting market. The recent acquisition of Balto sports (terms not disclosed) proves that the betting market is another excellent opportunity. Sports and betting go hand to hand very well, and online betting platforms like Draftkings keep growing. FUBOTV’s CEO David Glandler, an expert in the market, declared that they are looking forward to exploiting these opportunities in the future.

Financial overview & some insights

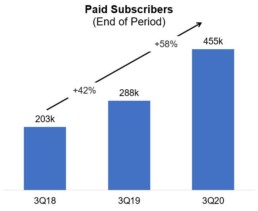

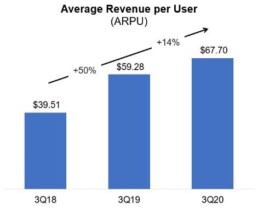

The company has greatly benefited from the COVID-19 situation, reaching an all-time high number of paid-subscribers of 455k+ in Q3 2020, increasing 58% to the same period of last year. The revenues were $61.2mln, an increase of 47% year-over-year. Subscription revenue increased 64% YoY to $53.4 mln, and advertising revenue increased an impressive 153% YoY to $7.5 mln.

The average revenue per user (ARPU) increased 14% year-over-year, giving an excellent insight into the users’ price sensitivity. The company was able to increase the price and keep its users even though they raised the different plans’ prices.

In the first and second quarter of 2020, the revenues were $51mln and $44.2mln. The YoY increase was 78% for Q1 and 51% for Q2. The management for the last quarter of the year looks forward to a 60% year-over-year increase, which means $80-$85mln in revenues.

|

2020 |

||||||

|

1Q |

YoY % | 2Q | YoY % | 3Q |

YoY % |

|

| Total revenues | $ 51.0 | +78% | $ 44.2 | +53% | $ 61.2 | +47% |

| Subscription | $ 46.4 | +74% | $ 39.5 | +51% | $ 53.4 | +64% |

| Advertising | $ 4.1 | +120% | $ 4.3 | +71% | $ 7.5 | +153% |

Source: Company financial reports

FUBOTV’s number of paid subscribers has also been growing along with the Average Revenue Per User (ARPU). Most of these users are probably migrating from the “old model” of cable TV which is being disrupted.

|

2020 |

||||||

|

1Q |

YoY % | 2Q | YoY % | 3Q |

YoY % |

|

| Paid subscribers | 287,316 | +37% | 286,126 | +47% | 455,000 | +58% |

| ARPU | $54.16 | +25% | $54.79 | +8% | $67.70 | +14% |

| Total content hours | 107.2 million | +120% | 98.6 million | +83% | 133.3 million | +83% |

| MAUs | 120 hours | +52% | 140 hours | +54% | 121 hours | +20% |

Source: Company financial reports

ARPU: Average Revenue Per User

MAUs: Monthly Active User’s average number of consumed content (hours).

Key concepts to approach subscription-based companies

FaceBank and FUBOTV closed a merger agreement that seeks to enhance FUBOTV’s offering by combining FaceBank’s global e-commerce and payment platform and its technology-driven IP in sports, movies, and live performances with FUBOTV’s platform. This merger was a good move for the future possibilities of FUBOTV of getting into the betting market.

This kind of companies should not be compared to “old economy” firms. One of the main characteristics of subscription-based businesses is that it generates recurrent income by its customers as long as they are subscribed. We have to look at this companies as we would do for Netflix, for instance.

We first have to understand that the metrics of the company change accordingly to the company’s stage. The most successful the company is in acquiring new customers, the biggest will be the losses at the beginning. However, the customer acquisition cost (CAC) will generate revenue that will be kept for a certain length of time.

The happier the customer, the longer it will stay subscribed, and therefore it will be more valuable for the firm. So, having satisfied clients is translated into having a better customer lifetime value (CLV).

Once clear that traditional metrics to value a company are not taken into consideration when it comes to subscription-based firms we have to rely on some basic concepts:

Customer Churn Rate (CCR):

Churn rate is calculated by dividing the number of users at the beginning of a period less the number of users at the end of the same period by the number of users the beginning of the period. So, it is the rate that calculates how many users abandon the service in a certain period.

Customer Lifetime Value (CLV):

It is the Average Revenue Per User (ARPU) by the Customer Churn Rate (CCR). It measures how long the client stays with the service and how much revenue it provides.

Customer Acquisition Cost (CAC):

It measures the cost to acquire a user. CAC is equal to the total sales and marketing expenses divided by the number of new customers added. The expenses must be just the ones used to attract new clients, and promotions for current users must be excluded.

CLV:CAC ratio:

The relationship between the Customer Lifetime Value and the Customer Acquisition Cost is usually referred to as the “CLV:CAC ratio.” This is one of the most important metrics for subscription-based companies when it comes to profitability.

At the beginning, like all growth companies, we need to be very careful when looking at the Research and Development costs because they will be placed in the GAAP accounting. However, those intangibles will be capitalized over time. For FUBOTV, FaceBank, and Balto Sports are actually future drivers of value and contribute to the acquisition, retention, and monetization of users.

The concept of unit economics commonly englobes these indicators and others related to them. It looks directly at the revenues and costs associated with the firm’s business model. The concept is used for the projections of the company’s profitability. In subscription-based companies, the basic units are the subscribers.

ECLV ratio:

As you could imagine, to value FUBOTV, we will also need to calculate the expected customer lifetime value or “ECLV.” Under the assumption that the ARPU will be constant, we can say that the ECLV is the average return per user multiplied by the customer lifetime. ECLV = ARPU * CL

On the other hand, if we assume that the churn rate remains equal over time, the ECVL could be equal to the ARPU divided by the CCR. ECVL = ARPU / CCR

How could the valuation be approached?

I think that one way to get a fair valuation would be by calculating the users’ present value. So we first need the Cash Flow Per User (CFPU) and a discount rate (r).

To calculate the present value of future users, we can use:

Notice that we will need to subtract the cost of acquiring those clients at the end of the equation. Then to calculate the present value of current users, we would use the same without that last part:

We are going to apply these concepts in our approach to the valuation in a later stage.

Given the current stage of FUBOTV, we are unable to fully assess its churn rate. We first need to understand if the company could have a real moat. We do believe that strategic mergers and partnerships could increase the revenue of the firm. Nevertheless, until a competitive advantage is developed, their business model is under high risk as they might fail to grow, and the valuation would collapse.

Our valuation approach to FUBOTV

Our goal is to find the Present value of each FUBOTV client. The valuation would probably be the present value of the existing customers and future clients’ cash flow. Therefore, the concept of CAC (customer acquisition cost) and Churn Rate are essential to define, and they will have an impact on the company’s final valuation.

At this stage of the company’s life, attention needs to be put on the ability to retain the clients and keeping them because they can later switch to other platforms and therefore create tremendous damage to the valuation of the company. It all comes down to the moat.

It is extremely difficult to have a reliable quantitative model because Retention Rate and CAC will most likely depend on the competition. We believe indeed that the company’s effort would be to create a fantastic customer experience through acquisition. Still, if they fail to make a tremendous value experience for the clients, their business can be in danger.

The spreadsheet below is based on a client’s subsection that will have an annual compound growth rate. Initially, around 50% and then eventually will go down approximately 15%, which is very conservative. The same thing can be said about inflation. We have assumed a 3% price increase, which is again low as we consider that new competitors might lower prices or offer a better proposition trying to “steal” clients.

We have considered an EBITDA margin which starts negative and stabilizes in 2025 at 70%. This means that from 2025 onward 70% of ARPU is transformed into EBITDA. Some other subscription platforms can rely on higher margins. However, we believe 70% EBITDA margin at regimen is a very reasonable measure.

The other key assumption we have made is that 70% of the Ebitda is converted into FCFE (Free cash flow to equity, residual to shareholders) which can finally be discounted at an appropriate cost of equity to figure out the equity value.

We have used a 12% cost of equity and 3% perpetual growth rate. We could have done a more in-depth analysis of the beta and rely on a capital asset pricing model (CAPM). However, we believe it would not make much sense at this stage because the CAPM fails to deliver a reasonable cost of equity in cases like FUBOTV where basically the correlation to the index is limited as the company was recently listed.

So, we decided to rely on a sensitivity analysis which calculates the price per share by changing the cost of equity and the perpetual growth rate (g). Assuming a discount rate between 11% and 13% and a perpetual growth rate between of 2.6% to 3.4%, the average price could be between 55 and 69 $ per share. We would be confident in assessing a target price around $60 per share (current share price around $ 27 per share).